What multiples and metrics to use for different industries?

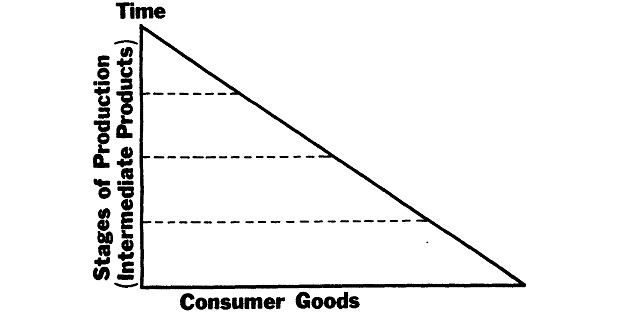

A reader struggles with how to value cyclical industries. First you have to understand the particular industry. How to do that–read the reports and financials of dozens of companies in that industry, then note what is important to value such a business. Take several months. If you are looking at highly-cyclical businesses, then you should read : Skousen-Structure-production.pdf.

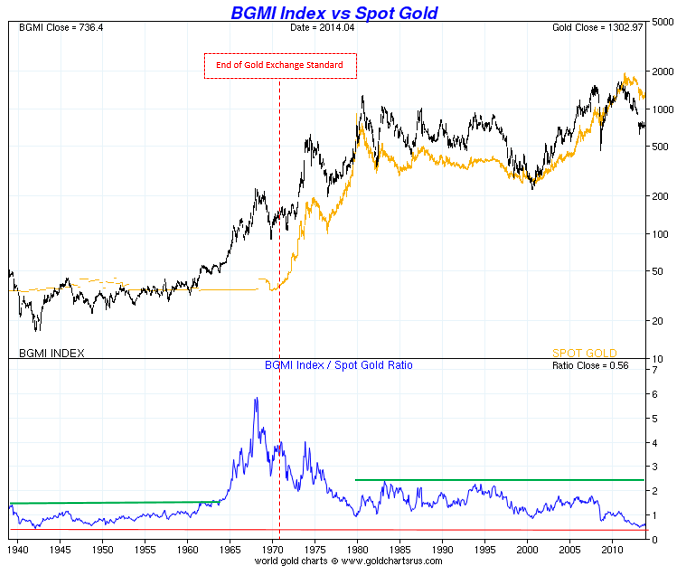

Note how long the cycles are in the gold mining industry. A mine may take a year or two to close or years to open. From discovery of the deposit until extraction may take a decade or more. A gold miner is valued on production, reserves, cost to extract, etc.

Now if you have access to a Bloomberg (expensive!) or go to a library and look at Value-Line, Moody’s Manuals, or industry articles of the industry. You can scrub around the Internet, but you have to grind through company reports to get a feel. Obviously, “heavy industries” require analysis of tangible book, replacement value, capital costs, industry capacity and utilization–note what happened in the airline industry when capacity was taken off-line. Go to search box and read my post on CRR, Carbo-ceramics–below TBV and replacement value, for example.

If I seem abrupt with your questions, here is the reason why.

2 responses to “Reader’s Question: Cyclicals”