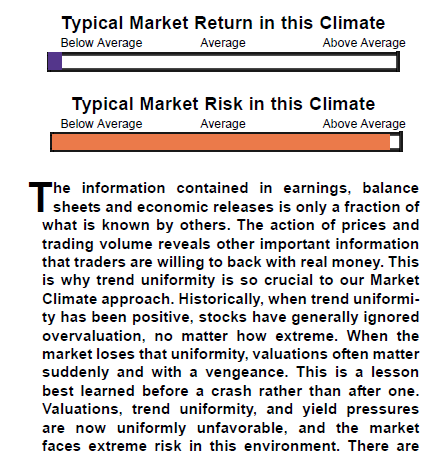

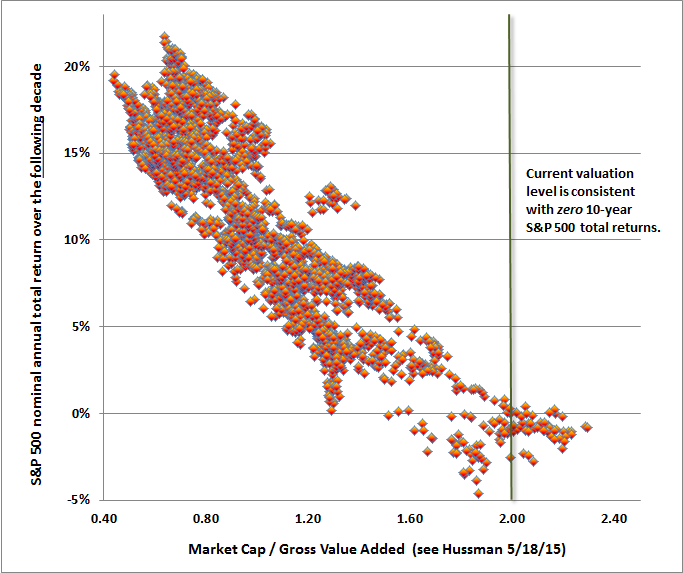

http://hussmanfunds.com/wmc/wmc150615.htm Never in market history has the MEDIAN stock been so highly priced relative to valuation metrics.

—-

Buy the Accused, Sell the Acclaimed

Going back to behavioral finance and what causes cheapness: Blaming Management and Human Sacrifice

Buying Distress and Falling Knives or the “No Hope” Portfolio.

| Symbol | Company | Price | Shares | Amount | Comm. | Total | Date |

| CLD | Cloud Peak Energy | 4.66 | 1071 | $ 4,991 | 8 | $ 4,999 | 6/14/2015 |

| BTU | Peabody Energy | 2.47 | 2020 | $ 4,989 | 8 | $ 4,997 | 6/14/2015 |

| CNX | Consol Energy | 25.51 | 196 | $5,000 | 8 | $ 5,008 | 6/14/2015 |

| Completed 1:14 EST | $15,004.00 | 6/14/2015 |

I am buying a basket of coal miners today with different characteristics. CNX is not a pure coal company. Peabody is more of a stub stock since its market cap is about 1/10th its debt–scary! I will add on a further 25% decline. Holding period: five years. I recommend that anyone reading this NOT follow me. Do your own thinking or mis-thinking as the case may be.

We also don’t want to confuse low nominal prices or declining prices with “cheapness.” There are plenty of junior resource stocks trading for pennies that are worth $0. Microcap_stock_fraud

Lot’s of hope:http://www.fool.com/investing/general/2011/06/20/the-hottest-sector-you-still-refuse-to-watch.aspx.

2 responses to “Blame Management and Human Sacrifice”