An ode to the end of a con

How long can deception go on?

When prices are set By banks printing debt

All trust in the “markets” is gone!

There is no stand-alone Narrative regarding gold today (June 2013), as there was in 1895. Today gold is understood from a Common Knowledge perspective only as a shadow or reflection of a powerful stand-alone Narrative regarding central banks, particularly the Fed … what I will call the Narrative of Central Banker Omnipotence. Like all effective Narratives it’s simple: central bank policy WILL determine market outcomes. There is no political or fundamental economic issue impacting markets that cannot be addressed by central banks. Not only are central banks the ultimate back-stop for market stability (although that is an entirely separate Narrative), but also they are the immediate arbiters of market outcomes. Whether the market goes up or down depends on whether central bank policy is positive or negative for markets. The Narrative of Central Banker Omnipotence does NOT imply that the market will always go up or that central bank policy will always support the market. It connotes that whatever the central bank policy might be, it will drive a market outcome; whatever the market outcome, it was driven by a central bank policy.

The stronger the Narrative of Central Banker Omnipotence, the more likely it is that the price of gold goes down. The weaker the Narrative – the less established the Common Knowledge that central bank policy determines market outcomes – the more likely it is that the price of gold will go up. In other words, it’s not central bank policy per se that makes the price of gold go up or down, it’s Common Knowledge regarding the ability of central banks to control economic outcomes that makes the price of gold go up or down.

Instead, the focus of the mainstream Narrative effort moved almost entirely towards what open-ended QE signaled for the Fed’s ability and resolve to create a self-sustaining economic recovery in the US. And it won’t surprise you to learn that this Narrative effort was overwhelmingly supportive of the notion that the Fed could and would succeed in this effort, that the Fed’s policies had proven their effectiveness at lifting the stock market and would now prove their effectiveness at repairing the labor market. Huzzah for the Fed!

See 6_30_13-HOW-GOLD-LOST-ITS-LUSTER-THE-ALL-WEATHER-FUND-GOT-WET-AND-OTHER-JUST-SO-STORIES and A Negative Narrative on Gold

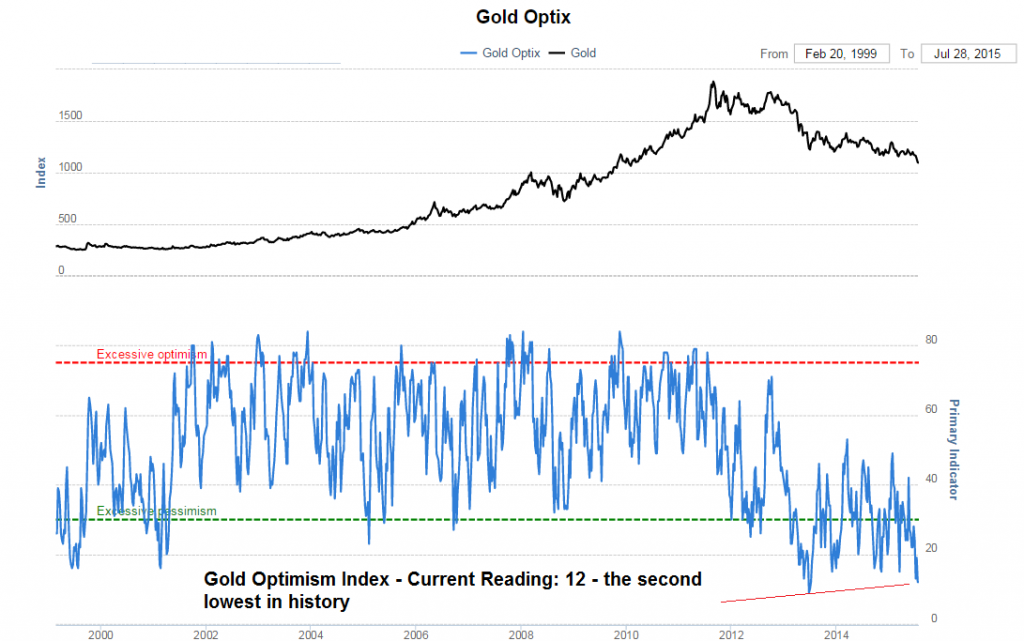

Negative News Tends to Cluster at MAJOR bottoms:

My Jaw Dropped: Long gold, short US stocks, Short US Dollar

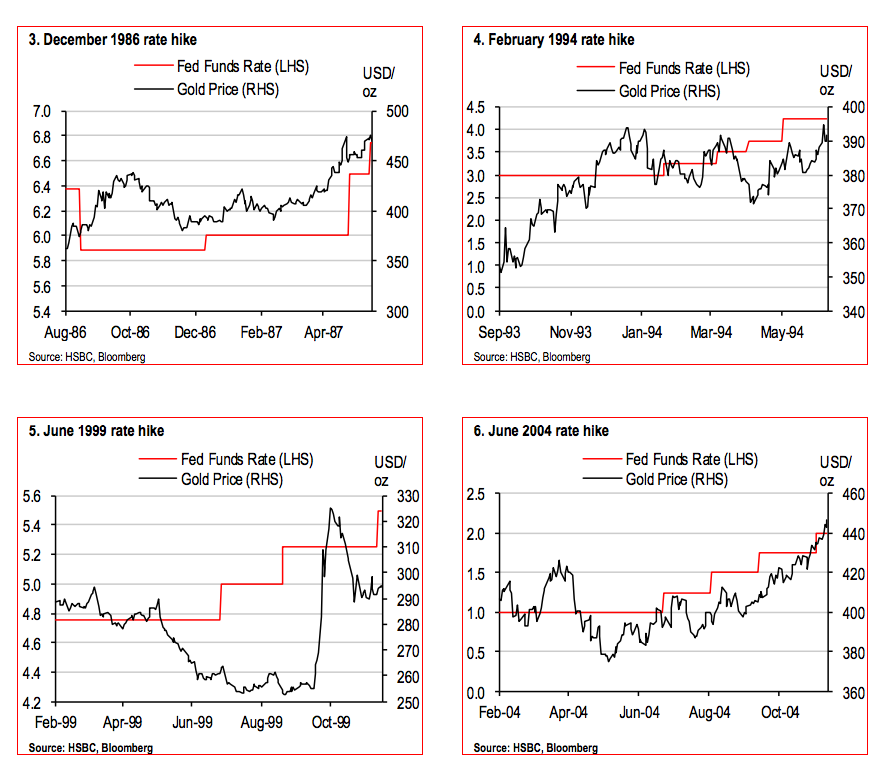

Will the US Dollar Continue its Rampage Higher? 272660136-Raoul-Pal-GMI-July2015-Monthly Rate hikes are “bad” for gold?

Rate hikes are “bad” for gold?

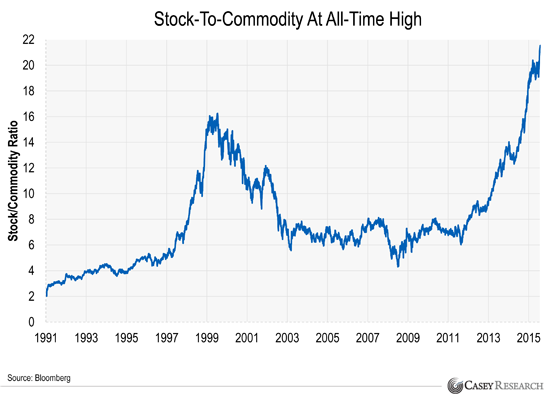

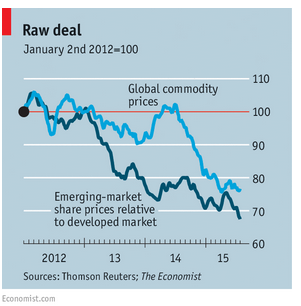

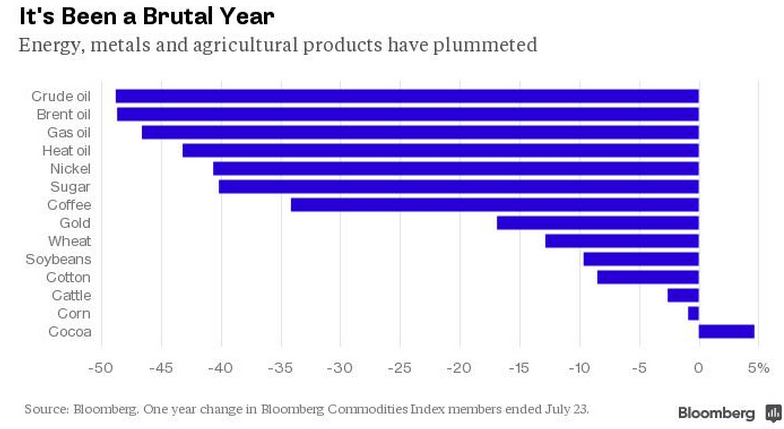

Investors above flee tangible assets for financial assets. Taken to an extreme, input costs for companies will go to zero and profit margins to infinity. Reality?

Investors above flee tangible assets for financial assets. Taken to an extreme, input costs for companies will go to zero and profit margins to infinity. Reality?

9 responses to “Perpetual Capitulation”