An Interesting Juncture for Gold Stocks (A good read with links)

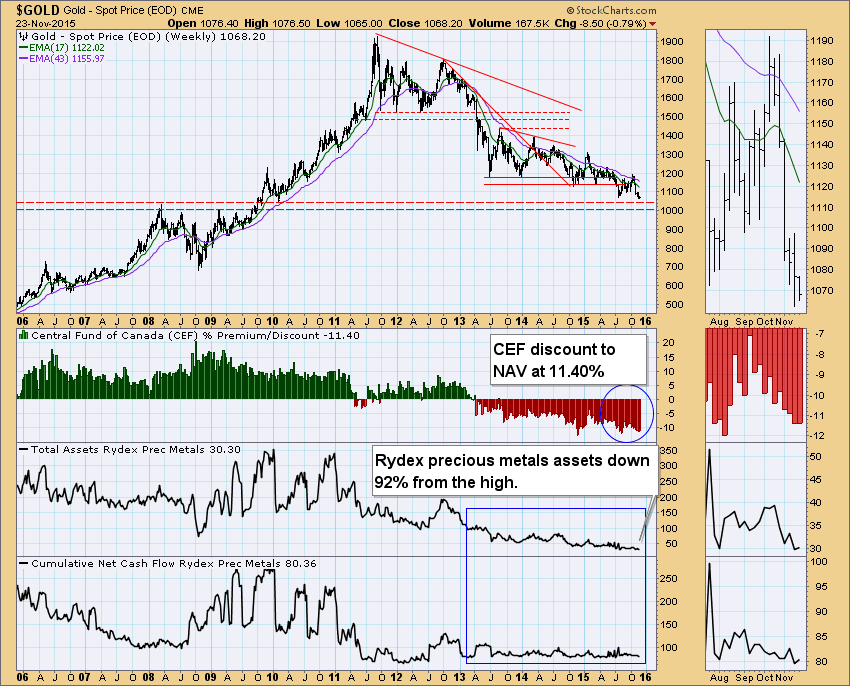

Note that CEF in the above chart trades at an 11% discount to its 60%/40% holding of gold and silver bullion after a four year down-trend–note that this is either hyper-bearishness or massive extrapolation of trend-following. Apple’s cash hoard could buy the entire public mining sector. Gold stocks are cheap for a reason: poor capital allocation, poor cost control, and dilution of shareholders revealed in the five-year long bust from an epic boom from 2001 to 2011 caused investors to flee. Since then many managements have gained religion on cost control and capital discipline (Note Barrick, ABX). All cycles turn, but when? If we knew, then no opportunity.

I always hear investors or analysts ask, “So what is the catalyst?” If the market is at all efficient–and I would say that it is except at major inflection points–then if we knew the catalyst, then the opportunity would be arbitraged away. How about the law of low prices or the law of supply and demand.

Ironically, as gold has declined in US dollar terms, it has risen in real terms versus commodities showing its mettle in a credit contraction. TSI BLOG

The HUI, a gold stock index, is showing relative strength versus gold. However, certain gold stocks like Novagold (NG), Sabina Gold (SGSVF) or Agnico-Eagle (AEM) are in incipient uptrends or, at least, vastly outperforming their indexes such as GDX or GDXJ. You must diversify amongst the highest quality producers, developers, and explorers.

The HUI, a gold stock index, is showing relative strength versus gold. However, certain gold stocks like Novagold (NG), Sabina Gold (SGSVF) or Agnico-Eagle (AEM) are in incipient uptrends or, at least, vastly outperforming their indexes such as GDX or GDXJ. You must diversify amongst the highest quality producers, developers, and explorers.

This post is not a recommendation but a historical reference point for a hated asset class. I see much less RISK in a terrible industry such as gold mining than wonderful businesses such as Amazon, CRM, or GE.

7 responses to “Gold Stocks: No One Left to Kill?”