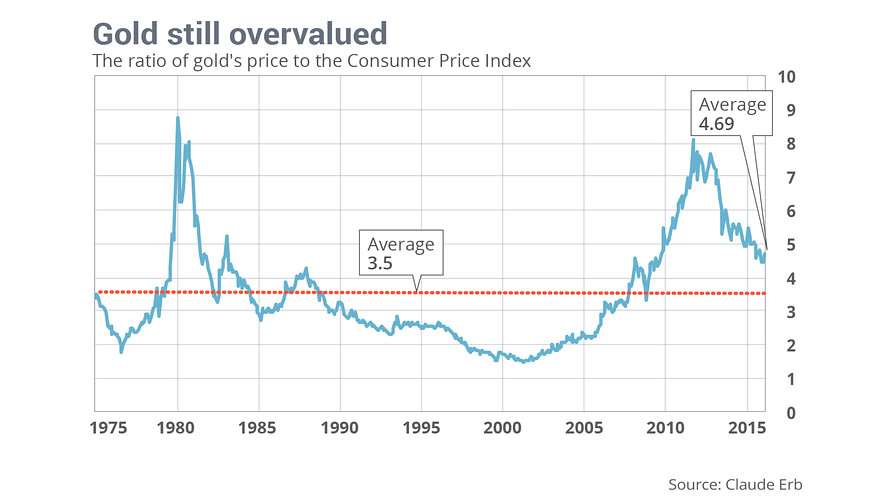

You just got promoted to advise Ackman; he is keen to improve returns. He slaps that chart on your desk and then asks if shorting gold would be a good idea? Why or why not based on this brilliant analysis? In fact, with “Deflation” fears rampant, Ackman feels gold could drop to $650.

Also, you read: The Golden Dilemma where two PhDs project a $350 price target. If experts such as these predict lower prices, then should you join the pack?

Also, you find a chart that supports what your boss thinks. Yahoo!

Unfortunately, some nut-job sends you this link: The Positive theory of gold and the The ultimate extinguisher of debt

You have until this afternoon to report back. This tests common sense and critical thinking skills. Good luck!

A prize to be awarded.

10 responses to “Analyst Quiz is Gold Overvalued Based on CPI–Go SHORT?”