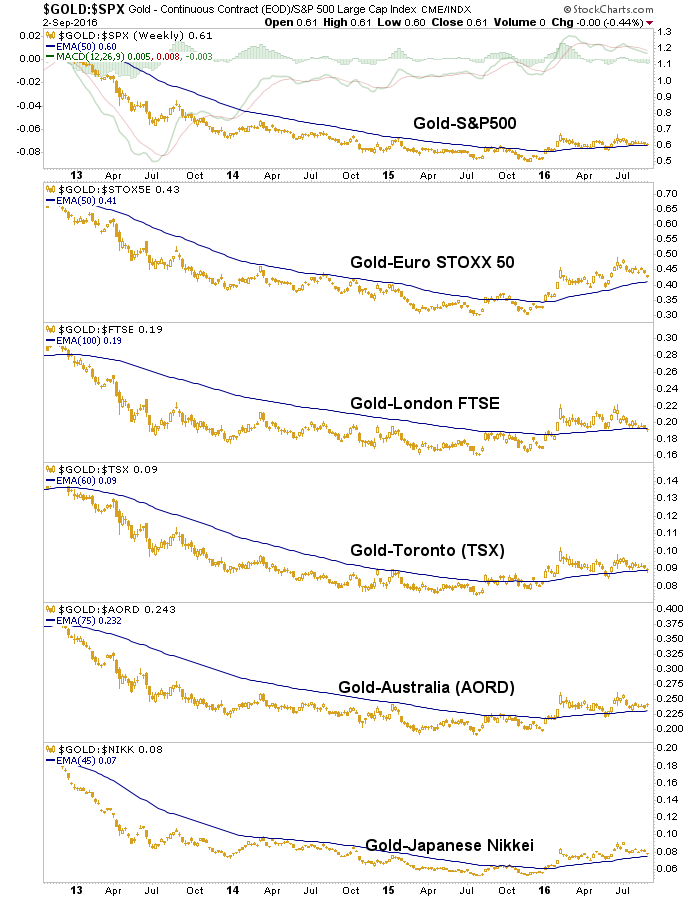

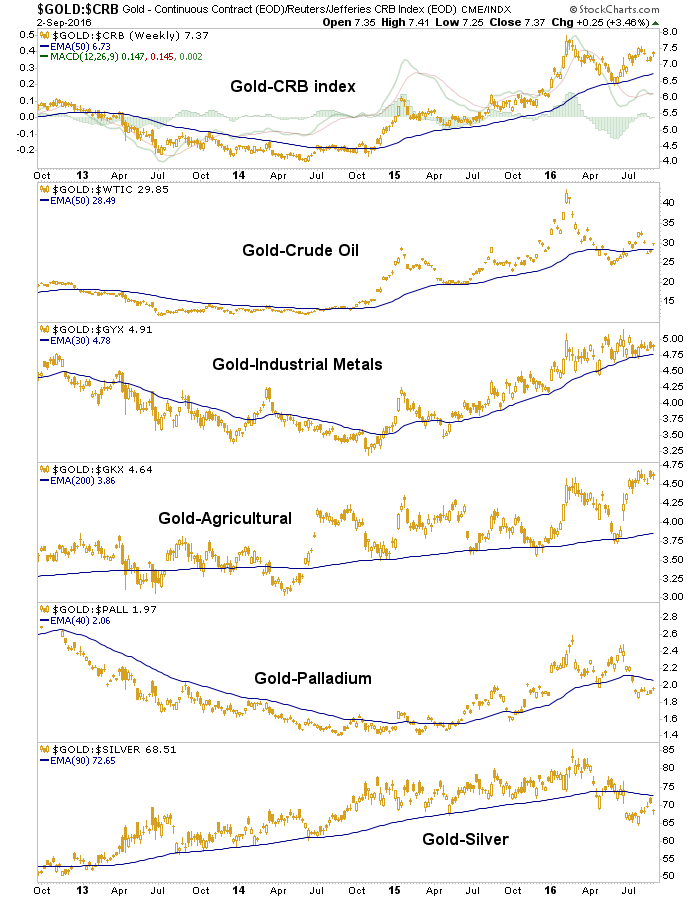

Using Technical Analysis for a Fundamental View: https://nftrh.com/2016/09/03/gold-the-good-and-the-not-yet-good/

Using Technical Analysis for a Fundamental View: https://nftrh.com/2016/09/03/gold-the-good-and-the-not-yet-good/

The Trend is not your friend

There’s an old saying in the financial markets that the trend is your friend, meaning that you will do well as long as you position your trades in line with the current price trend. This sounds good. The only problem is that you can never know what the current trend is; you can only know what the trend was during some prior period. How is it possible for something you can never know to be your friend?

Market ‘technicians’ often make comments such as “the trend for Market X is up” and “Market Y is in a downward trend” as if they were stating facts. They are not stating facts, they are stating assumptions that have as much chance of being wrong as being right.

A statement such as “Market X’s trend is up” would more correctly be worded as “I’m going to assume that Market X’s trend is up unless proven otherwise”. The proving otherwise will generally involve the price moving above or below a certain level, but the selection of this level is yet another assumption and the price moving above/below any particular level will provide no factual information about the current trend.

More http://tsi-blog.com/2016/09/sorry-the-trend-is-not-your-friend/

Mea Culpa: sequoia-may-2016-transcript Not much to glean.

However, a question for you: Is it better to buy franchises or net/nets?

If you could choose between a fair coin that was gold or a rusty tin coin that each paid off 4 to 1 on choosing heads or tails, which one would you prefer?

In October those near Philly Microcap Conference http://microcapconf.com/conferences/philadelphia-2016/

HAVE A GOOD WEEKEND!

7 responses to “Using Technical Analysis Fundamentally; Mea Culpa”