An unbiased appreciation of uncertainty is a conerstone of rationality–but it is not what people and organizations want. Extreme uncertainty is paralyzing under dangerous circumstances, and the admission that one is merely guessing is especially unacceptable when the stakes are high. Acting on pretended knowledge is often the preferred solution.” –Daniel Kahneman

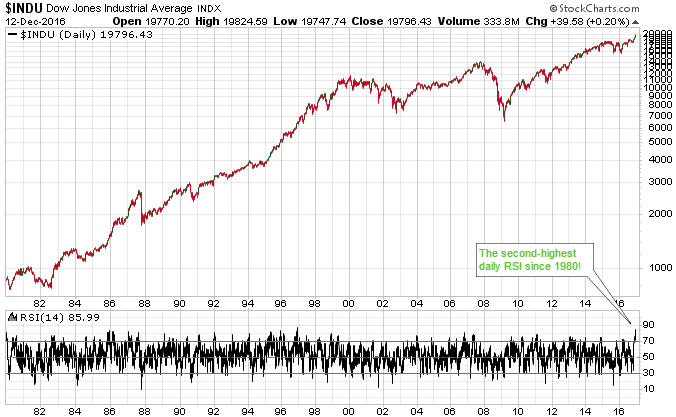

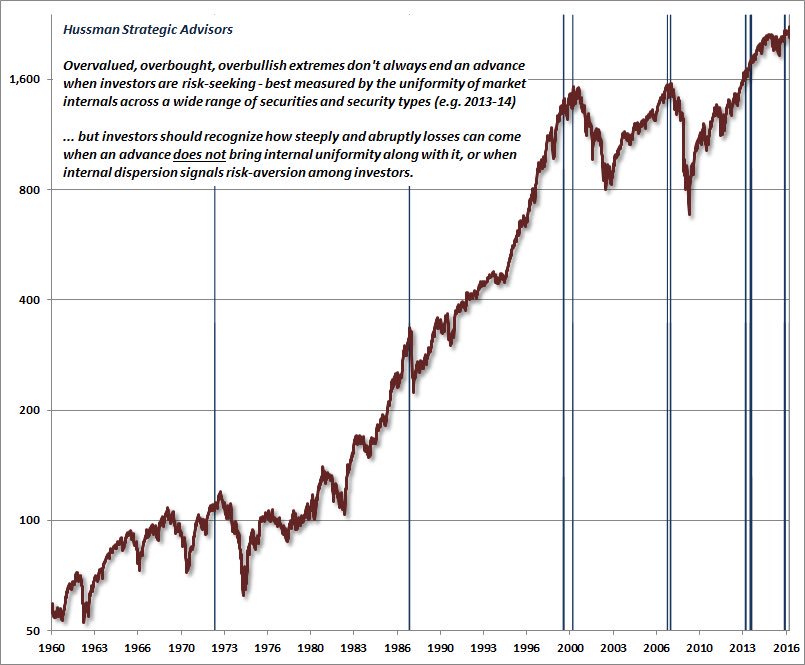

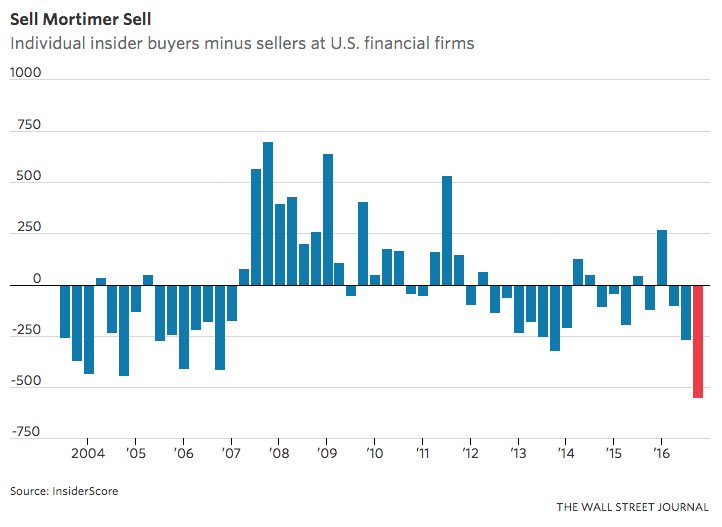

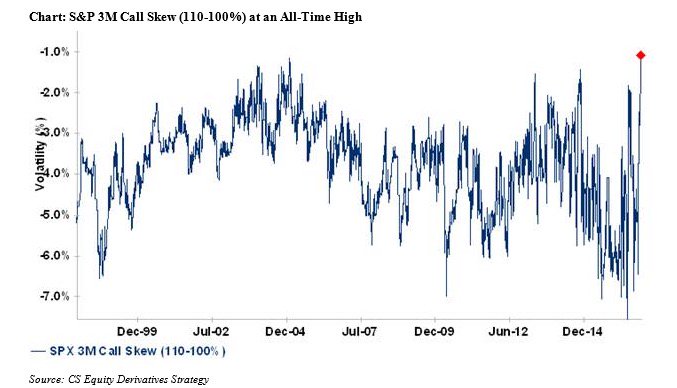

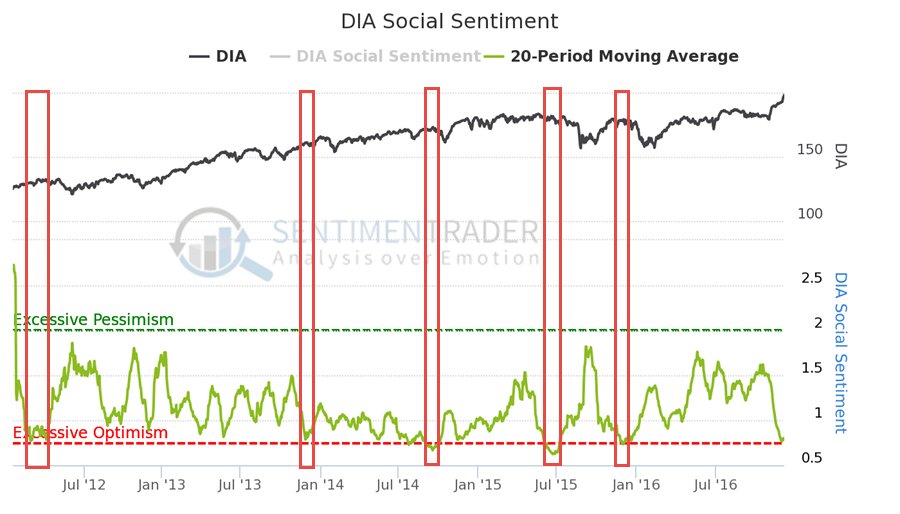

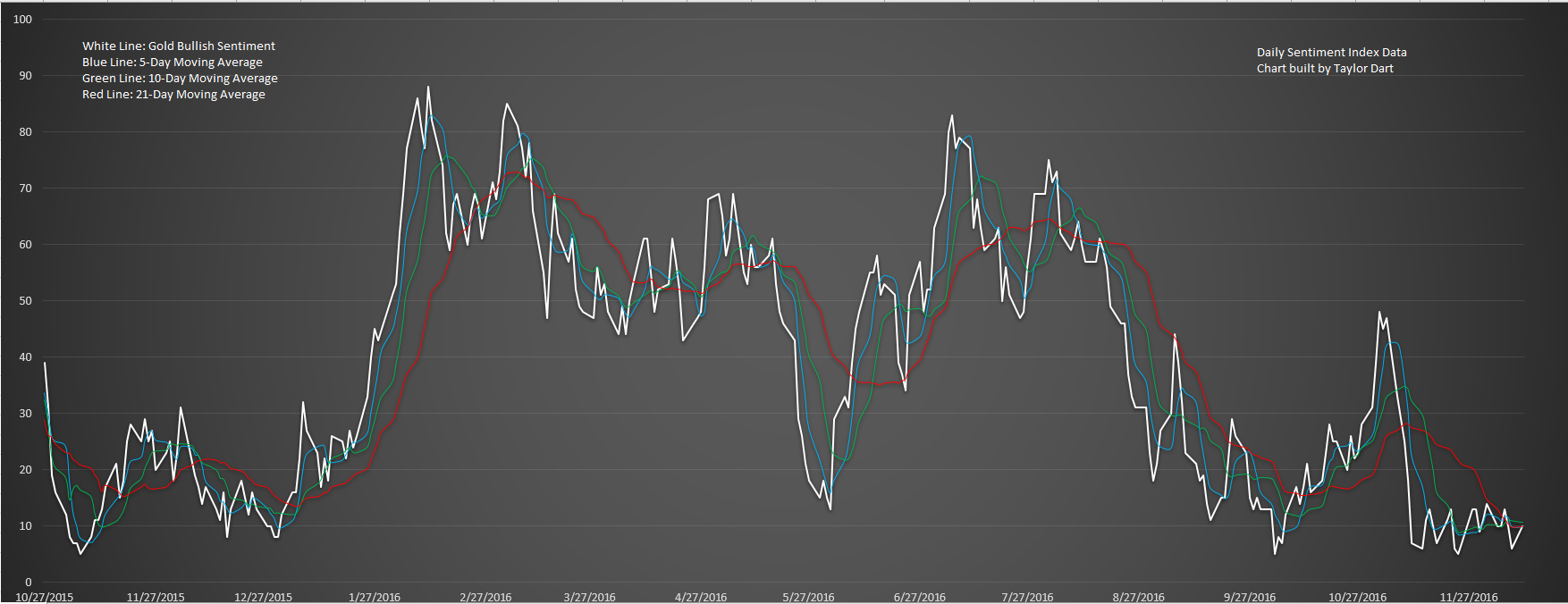

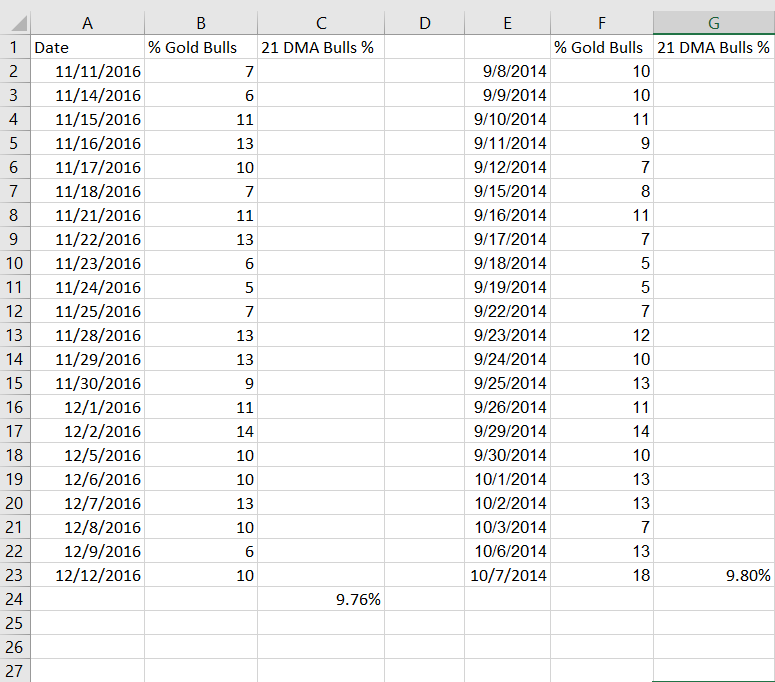

But no guarantee of a sell-off, just an indication of extreme momentum. Be fearful when others are greedy.

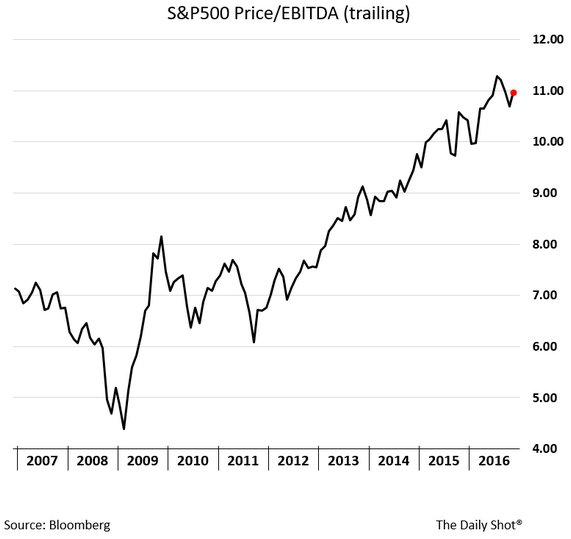

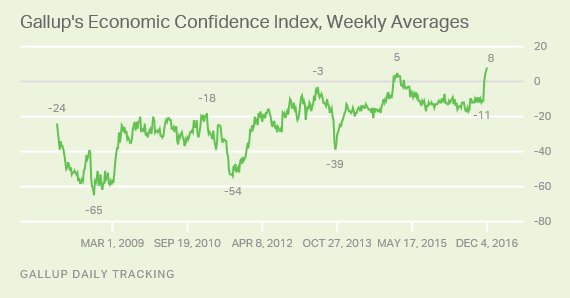

Not predicting a crash, but note how little risk is priced into many stocks! Meanwhile, I am SELLING! to buy more gold and bonds.

WHO ARE YOU?

http://www.selfauthoring.com/purchase.html

If you don’t know who you are, this is an expensive place to find out. –Adam Smith in The Money Game

Pingback: What we are reading on 12/15/2016 - UNDERVALUED STOCKS