Economies of scale.

If costs per unit decline as volume increases, because fixed costs make up a large share of total costs, then even with the same basic technology, an incumbent firm operating at large scale will enjoy lower costs than its competitors.

—

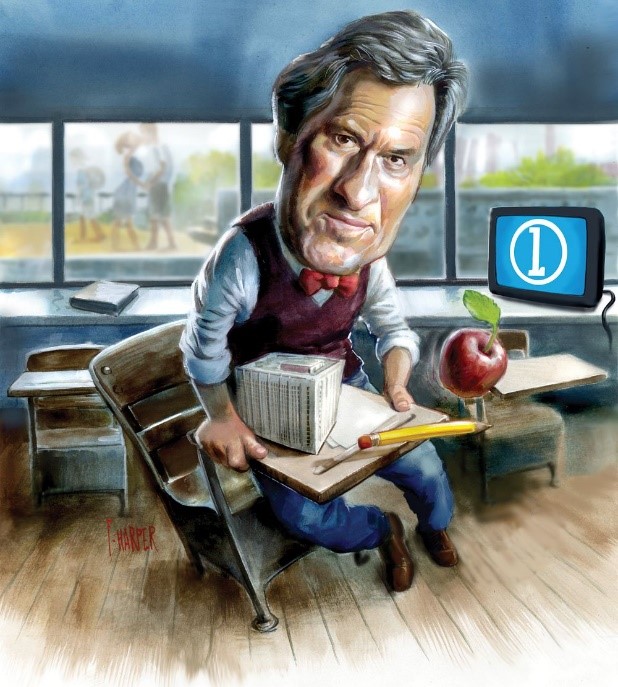

Edison Schools IPO’d at $18 per share and now it trades near $14. Your boss runs in and throws the Edison School’s 2001 annual report on your desk and a top-rated analyst’s report on Edison. “Get back to me in thirty minutes on what should we do: Buy a boat-load of stock, buy some, buy a little, short or stand aside?” Your Boss says that management owns a lot of stock along with “smart” money.

You glance at the analyst report:

Greg Capelli, MBA, at Credit Suisse First Boston issued a $30 dollar price target in his fifty-page report. Capelli says that Edison Schools is extremely undervalued because of “first-mover advantage” and “INCREASING OPERATING LEVERAGE THROUGH ECONOMIES OF SCALE.”

As a refresher you whip out Greenwald’s Competition Demystified:

LOCAL CHAMPIONS

In an increasingly global environment, with lower trade barriers, cheaper transportation, faster flow of information, and relentless competition from both established rivals and newly liberalized economies, it might appear that competitive advantages and barriers to entry will diminish. The fate of once powerful American firms in industries like machine tools (Cincinnati), textiles (Burlington Industries, J. P. Stevens), and even automobiles (Chrysler, GM, and Ford) seems to support this position. Either profits have shrunk or companies have disappeared entirely under the onslaught of imports. But this macro view misses one essential feature of competitive advantages—that competitive advantages are almost always grounded in what are essentially “local” circumstances.

Consider the history of Wal-Mart, one of the greatest economic success stories of the late twentieth century. The retail business, especially discount retailing, is not an industry with many trade secrets or rare skills. The practices for which Wal-Mart is known, like “everyday low prices” and efficient distribution, are hardly proprietary technologies, impossible for other firms to duplicate. Yet Wal-Mart has successfully dominated many, although not all, of the markets in which it competes. The way in which it achieved this position is instructive.

Wal-Mart began as a small and regionally focused discounter in a part of the country where it had little competition. It expanded incrementally outward from this geographic base, adding new stores and distribution centers at the periphery of its existing territory. The market that it dominated and in which it first enjoyed competitive advantages was not discount retailing in the United States, but discount retailing within a clearly circumscribed region. As it pushed the boundaries of this region outward, it consolidated its position in the newly entered territory before continuing its expansion. As we shall see, when it moved too far beyond its base, its results deteriorated.

An Analyst ALWAYS ASKS:

—

OK, now you dig in quickly to the Edison Schools AR_2001

What do you say to your boss? Your comments should be no more than a sentence or two of explanation backed up by a few simple calculations. Besides the financials, what do you point out in the annual report? Take no more than twenty minutes. You go immediately to the important data and disregard the rest.

Address Capelli’s “First Mover Advantage” comment.

Next week, I will post analysis.

AFTER you have answered, you can see the future for investors in Edison: https://youtu.be/QUYKSWQmkrg

—

UPDATE 4/17/2017

ETF Insanity is destroying price discovery–opportunity will return.

https://vimeo.com/209940152/f2154e4d3d

Part 1 of this post: http://csinvesting.org/2017/04/20/edison-schools-cs-on-econ-of-scale-part-ii/

15 responses to “Hedge Fund Quiz: Economies of Scale”