A must see discussion of today’s index investing distortions

http://horizonkinetics.com/market-commentary/4th-quarter-2016-commentary/ What will turn the tide for active investors. Or read commentary : Q4-2016-Commentary_Final

https://vimeo.com/209940152/f2154e4d3d Grant’s Conference Presentation

Kinetics_Market_Opportunities_11.02.2016

Q2 2016 Commentary FINAL (See section on ETFs vs. Individual Stocks)

Articles of interest:

- Under the Hood What is in Your Index Emerging Market_FINAL_Sep2015

- Under the Hood – The Beta Game – Part I

- Under the Hood – The Beta Game – Part II_FINAL

- Under the Hood – Momentum_FINAL

- Under the Hood – Robo-Adviser Part I_Final_Jan 2016

- Under the Hood – Robo-Adviser Part II_Final

- Under the Hood – How Indexation is Creating New Opportunities for Short-Sellers, And Why This Should Alarm Ordinary Buyers of Stock and Bond ETFs (NOTE!)

- Under the Hood – Why Utility Stocks Should Concern Income-Oriented Investors_May 2016

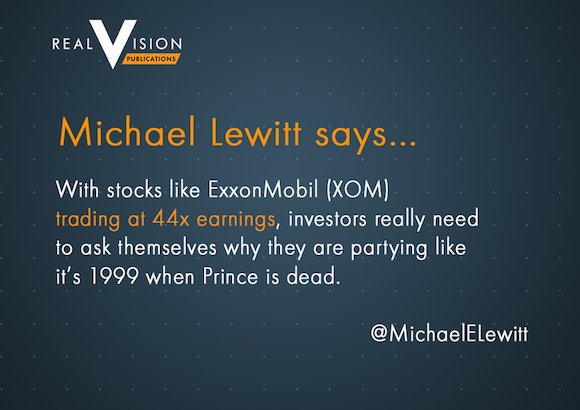

- Exxon Conundrum_July 16_FINAL Why Exxon becomes overvalued.

- Under the Hood – The Value of Cash

- Under-the-Hood-Gold-Miner-ETFs_FINAL_Dec2016 distortions galore!

- http://suremoneyinvestor.com/2017/04/the-real-reason-awful-companies-like-this-one-are-so-overvalued/ 52 ETFs own UAA

- https://blogs.cfainstitute.org/investor/2017/04/19/shortcuts-to-factor-investing-equities-and-beyond/

- http://www.zerohedge.com/news/2017-04-19/passive-negligence-cover-your-eyes-buy-investing

11 responses to “Indexing Madness or An Indexing Bubble”