A Stoic would agree with this quote from the above book:

The most important thing successful investors have in common is worrying about what they can control. They don’t waste time worrying about which way the market will go or what the Federal Reserve will do or what inflation or interest rates will be next year. They stay within their circle of competence, however narrow that might be.

Other useful quotes:

In my nearly fifty years of experience in Wall Street I have found that I know less and less about what the stock market is going to do but I know more and more about what investors ought to do; and that is a pretty vital change in attitude — Ben Graham

Investment success accrues not so much to the brilliant as to the disciplined.– William Bernstein

Investors who confine themselves to what they know, as difficult as that may be, have a considerable advantage over everyone else — Seth Klarman

Genius is a rising market — John Galbraith

In a winner’s game the outcome is determined by the correct actions of the winner. In a loser’s game, the outcome is determined by mistakes made by the loser. — Charlie Ellis

How could economics not be behavioral? If it isn’t behavioral, what the hell is it? — Charlie Munger

You need patience, discipline, and an ability to take losses without going crazy — Charlie Munger, 2005

You will do a great disservice to yourselves, to your clients, and to your businesses, if you view behavioral finance mainly as a window onto the world. In truth, it is also a mirror that you must hold up to yourselves. — Jason Zweig

If I could sum up the lesson of the above 175-page book at $35, it would be that IF you invest long-term in compounders or franchise companies that redeploy their capital at high rates of return, then expect to suffer through multiple 50% to 60% declines in stock price as you hold on for the long-term. And remember that a price decline of 50% does not necessarily indicate a bargain.

You can see the 50% sell-off in Bershire’s stock in 1999/2000 while you can barely make out the multiple 50% or more declines in AMZN over the past twenty years. Investing is HARD!

You must factor in those facts with your own psychology.

—

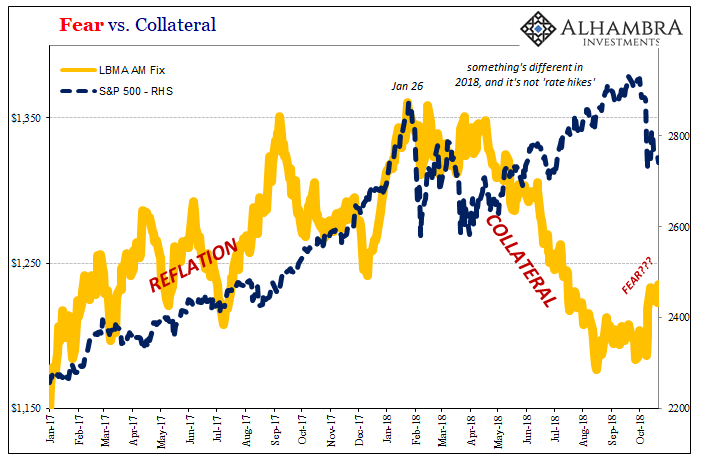

A reader asked: When do you buy gold for a portfolio?

No one has the perfect answer. Just remember that gold is money and not an investment. Gold just sits there in the vault as a STORE of Wealth. Here is a good article, though: http://www.myrmikan.com/pub/Myrmikan_Research_2018_01_15.pdf

9 responses to “Investing is hard. Big Mistakes and Moats”