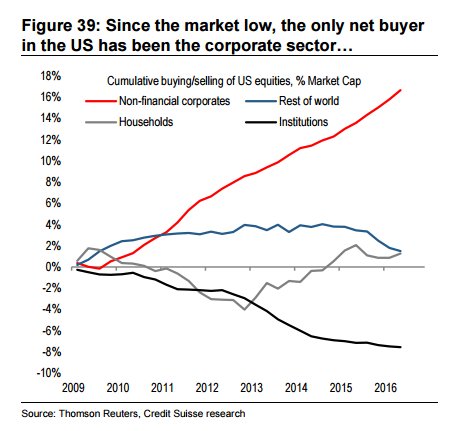

helped by ultra-easy-money

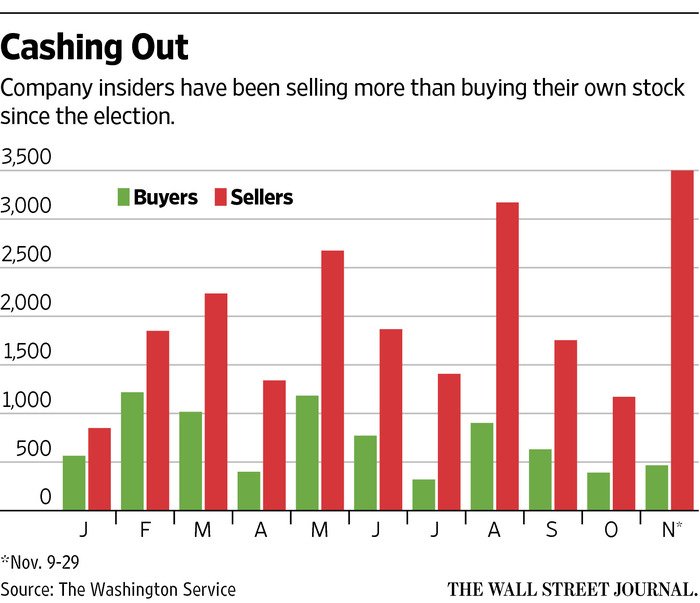

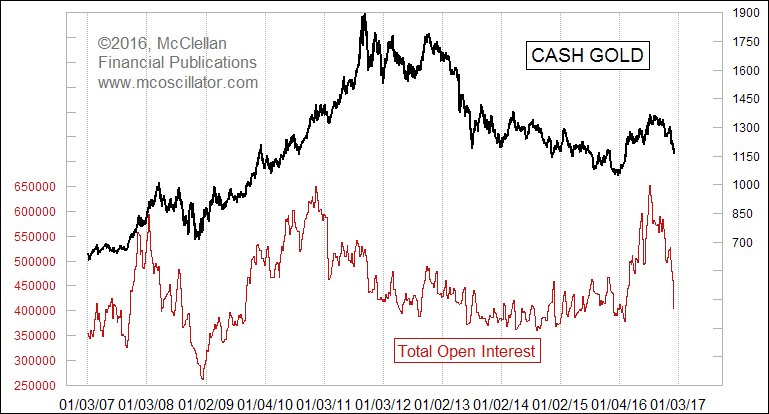

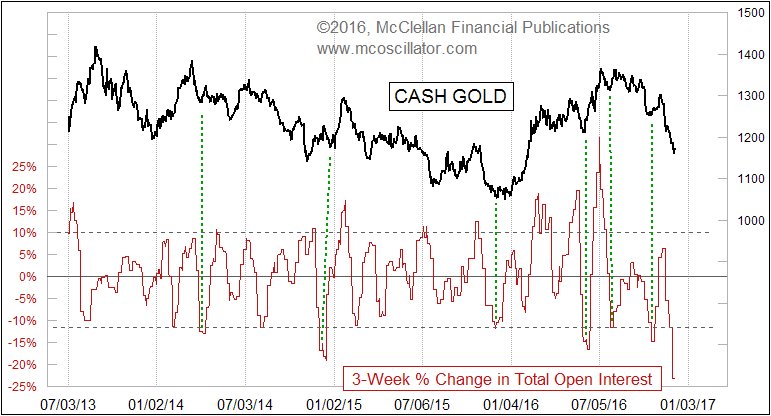

Specs liquidating at a furious pace in gold. US Dollar on the cover of the Economist, insider selling in stocks–all lend support to real asset undervaluation.

Specs liquidating at a furious pace in gold. US Dollar on the cover of the Economist, insider selling in stocks–all lend support to real asset undervaluation.

Who wants gold?

The Dow in dollar terms (yellow) and the Dow in gold terms.

The Dow in dollar terms (yellow) and the Dow in gold terms.

Remember that you don’t have a good contrarian trade UNLESS this happens: