James Grant argued for a return to the classical gold standard at the New York Federal Reserve. Note Grant’s command of financial and economic history. He references several books which you might find of interest. The beauty and purpose of the gold standard is that it takes monetary policy out of the control of moneyed elites and allows the market to work. Critics will say that the nation had recurring booms and busts while on the classical gold standard, but they may be confusing the chaos of fractional reserve banking (being able to pyramid loans on top of deposits with fiduciary media) with the classical gold standard (the citizenry is able to convert currency into a fixed amount of gold).

James Grant argued for a return to the classical gold standard at the New York Federal Reserve. Note Grant’s command of financial and economic history. He references several books which you might find of interest. The beauty and purpose of the gold standard is that it takes monetary policy out of the control of moneyed elites and allows the market to work. Critics will say that the nation had recurring booms and busts while on the classical gold standard, but they may be confusing the chaos of fractional reserve banking (being able to pyramid loans on top of deposits with fiduciary media) with the classical gold standard (the citizenry is able to convert currency into a fixed amount of gold).

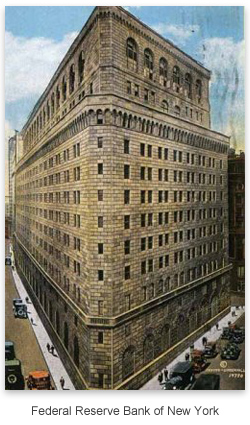

Grant’s Speech to the New York Federal Reserve

My annotated copy is here:James Grant Speech on Gold and the FED April 2012

Robert Wenzel Speech

Another excellent critique of the Federal Reserve is Robert Wenzel’s speech on April 25th, 2012 http://www.mises.org/daily/6028/New-York-Fed-Leave-the-Building.

An excerpt: I simply do not understand most of the thinking that goes on here at the Fed, and I do not understand how this thinking can go on when in my view it smacks up against reality.

Please allow me to begin with methodology. I hold the view developed by such great economic thinkers as Ludwig von Mises, Friedrich Hayek, and Murray Rothbard that there are no constants in the science of economics similar to those in the physical sciences.

In the science of physics, we know that water freezes at 32 degrees. We can predict with immense accuracy exactly how far a rocket ship will travel filled with 500 gallons of fuel. There is preciseness because there are constants, which do not change and upon which equations can be constructed.

There are no such constants in the field of economics, because the science of economics deals with human action, which can change at any time. If potato prices remain the same for 10 weeks, it does not mean they will be the same the following day. I defy anyone in this room to provide me with a constant in the field of economics that has the same unchanging constancy that exists in the fields of physics or chemistry.

And yet, in paper after paper here at the Federal Reserve, I see equations built as though constants do exist. It is as if one were to assume a constant relationship existed between interest rates here and in Russia and throughout the world, and create equations based on this belief and then attempt to trade based on these equations. That was tried and the result was the blow up of the fund Long Term Capital Management — a blow up that resulted in high-level meetings in this very building.

It is as if traders assumed a given default rate was constant for subprime mortgage paper and traded on that belief. Only to see it blow up in their faces, as it did, again, with intense meetings being held in this very building.

Yet, the equations, assuming constants, continue to be published in papers throughout the Fed system. I scratch my head.

Origin of the Federal Reserve

The Origins of the Federal Reserve by Murray N. Rothbard (128 pages) http://library.mises.org/books/Murray%20N%20Rothbard/The%20Origins%20of%20the%20Federal%20Reserve.pdf

If you read and understand the above articles and book, you will have a good inkling of why the rich become richer and the poor become poorer.