JOBS AVAILABLE Candidates sought for our market stabilization teams. Applicants should be from an Ivy-League school, have attended an investment training program and have market knowledge of stocks, bonds and commodities. You should be able to work closely with our affiliates, Goldman Sachs and JP Morgan, in maintaining market and price stability. There are several teams that need members: Gold and Silver Suppression, U.S. Government Bond Buying, S&P 500 Plunge-Protection, and Carnage Control. Candidates must be able to implement and execute complex market strategies such as described here: http://sibileau.com/martin/

JOBS AVAILABLE Candidates sought for our market stabilization teams. Applicants should be from an Ivy-League school, have attended an investment training program and have market knowledge of stocks, bonds and commodities. You should be able to work closely with our affiliates, Goldman Sachs and JP Morgan, in maintaining market and price stability. There are several teams that need members: Gold and Silver Suppression, U.S. Government Bond Buying, S&P 500 Plunge-Protection, and Carnage Control. Candidates must be able to implement and execute complex market strategies such as described here: http://sibileau.com/martin/

Also, there are openings for our investigative team to uncover why this is happening:  Massive withdrawals from Comex warehouses: http://bullmarketthinking.com/comex-gold-inventories-collapse-by-largest-amount-on-record/

Massive withdrawals from Comex warehouses: http://bullmarketthinking.com/comex-gold-inventories-collapse-by-largest-amount-on-record/

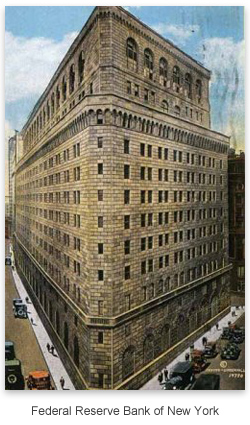

All applicants should send a resume with cover letter to : Federal Reserve Bank of New York 33 Liberty Street, New York, NY 10045

Can Knowing Austrian Economics Make You Rich? http://www.lewrockwell.com/lewrockwell-show/2013/04/02/359-does-knowing-austrian-economics-help-you-get-rich/

Readings on Bitcoin: Bitcoin

virtual currency schemes 201210en

Which Country You Invest In MATTERS! http://greenbackd.com/2013/04/09/domicile-matters-backtest-of-performance-by-equal-weight-country-index/

Kyle Bass

April 9 (Bloomberg) — J. Kyle Bass, head of Dallas-based hedge fund Hayman Advisors LP, talks about the outlook for Japanese government bonds, gold, and the U.S. housing market. Bass, speaking with Erik Schatzker and Stephhanie Ruhle on Bloomberg Television’s “Market Makers,” also discussses activist investing. Bloomberg Industries metals and mining analyst Andrew Cosgrove also speaks. (Source: Bloomberg) http://bloom.bg/11P3V3V Thanks to David Hui Lau! (Beg to be on his email list: dahhuilaudavid@gmail.com)

A Young Value Investor Interview http://www.eurosharelab.com/newsletter-archive/462-interview-with-a-remarkable-value-investor-josh-tarasoff

M. Thatcher R. I. P.

Watch your thoughts for they become words.

Watch your words for they become actions.

Watch your actions for they become habits.

Watch your habits for they become your character.

And watch your character for it becomes your destiny.

What we think, we become. My father always said that… and I think I am fine. –Margaret Thatcher