One often thinks of prices as determining values, instead of vice-versa. But as accurate as markets are, they cannot claim infallibility.–Ben Graham

Notes on a Lecture on Valuation Technique by Ben Graham in 1947

These notes are a supplement to our previous and ongoing discussion of valuing growth stocks found here http://wp.me/p2OaYY-1se

Old set of notes:graham_valuation_technique or retyped notes for easier reading: Valuation Technique by Ben Graham from Class Notes

Despite being a brilliant man or because of his insight into himself and human nature, Graham had the ability to remain humble and accept his limitations of analyzing securities, especially growth stocks. He felt picking growth stocks required shrewdness which could not be considered a typical trait for an analyst.

Graham asserts that there is no definite, proper value for a given bond, preferred, or common stock. Equally so, no magic calculation formula exists that will infallibly produce a specific intrinsic value with absolute accuracy. (Source: Benjamin Graham on Investing by David Karst)

Los Angeles hedge-fund manager Jamie Rosenwald has launched a value-investing class at New York University. Smart lessons, savvy stock picks.

For years, Sudeep Shrestha, 31, a native of Nepal who works at one of Wall Street’s most prominent hedge funds, watched the investment action from the sidelines. For an accountant in the private-equity division, there was no easy path from the back office to the fist-pumping and cork-popping in the front. When his business-school catalog arrived, including a class in value investing, Shrestha sat up. He waited about two seconds before logging on and enrolling.

The class, at New York University’s Stern School of Business, would make a table-pounding case for stock-picking—in particular, seeking undervalued, underloved issues—at a time when the efficient market hypothesis had convinced a big swath of investors that it was impossible to beat the market. The teacher was a little-known hedge-fund manager from Los Angeles who promised to bring his friends to class to help with lessons. By the time Shrestha completed Global Value Investing: Theory and Practice, he was sold on value investing, and convinced that the market is very inefficient, indeed.

To win, “you need to buy $1 for 50 cents, buy $1 for 50 cents,” he hummed to himself, over and over. So did the two dozen other M.B.A. candidates in the class taught by Jamie Rosenwald, a first-time teacher and co-founder of Santa Monica, Calif.-based Dalton Investments. If the lessons learned translate into market-beating returns, NYU’s first value-investing class won’t be its last by a long shot.

VALUE INVESTING TRADITIONALLY has been associated with Columbia University, 112 blocks to the north. Benjamin Graham, the father of value investing, taught at Columbia; Warren Buffett was his student, and the Columbia Business School runs a popular value-investing program through its Heilbrunn Center for Graham and Dodd Investing. (David Dodd co-wrote Security Analysis, the bible of value investing, with Graham.)

Still, plenty of renowned value investors attended NYU. Larry Tisch, the late co-chairman of Loews (ticker: L), was a graduate and major benefactor. Joe Steinberg, president of Leucadia National (LUK), went to NYU, as did Bill Berkley, founder of insurer W.R. Berkley (WRB). Rosenwald, an engaging 54-year-old, attended NYU, too. “I was jealous that Columbia had street cred,” he says.

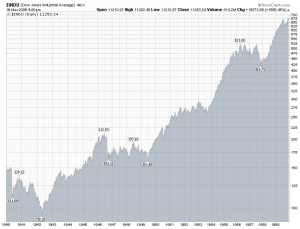

Although value investing is undergoing one of its periodic lapses in favor, Rosenwald knew it could beat the market over the long haul. He had only to point to nine of Graham’s successful protégés, discussed by Buffett in an influential 1984 article titled, “The Superinvestors of Graham-and-Doddsville.”

Waiting for the market to come around to your way of thinking is a long game, and Rosenwald has it in his genes: His grandfather was Graham’s financial-services analyst. When Jamie was 12, Grandpa Rosenwald made him fill out spreadsheets, using graph paper and a slide rule, as an exercise in assessing company valuations. A couple of years later, he made Jamie read Fred Schwed’s jeremiad against Wall Street, “Where are the Customers’ Yachts?”

THE LESSONS STOOD ROSENWALD in good stead. Dalton, with $2 billion under management, runs value-oriented hedge funds, and its principals have a reputation for investing in profitable contrarian situations—California apartment buildings after the savings-and-loan crisis, Shanghai real estate after SARS, and distressed mortgages. Now they are backing a fund investing in apartments in hard-hit markets such as Las Vegas. “In chemistry terms, Jamie is the activation energy,” says a fund manager who asked not to be named. “When a reaction should happen, he’s the catalyst.”

Rosenwald steered a fund investing in Japanese management buyouts that produced nice returns despite a tough slog. Eventually, he merged it into Dalton Asia, which he runs with his young co-manager, Tony Hsu. Since its January 2008 inception, Dalton Asia is up 45%, versus a 23% decline in the MSCI Asia Pacific benchmark.

When NYU gave Rosenwald the green light to develop a class, he thought about how best to structure it. There would be six sessions of three hours each. The bulk of the grade, he figured, would reflect attendance, since life is mostly about showing up. The final would be a stock pitch. Rosenwald and his wife, Laura, would stake $1 million for NYU’s endowment, a tenth of which would be invested in one or two stocks a year, chosen based on students’ recommendations.

Rosenwald believed that students, like the companies they would invest in, needed skin in the game. At the first session, he made the enticing offer of a tuition refund if they didn’t learn at least three important things from the class. But since value investing pays off over the long term, they would have to wait 20 years to get their money back. The students grinned.

By definition, most investors can’t beat the market. But market-beating practices can be taught, beginning with a change in one’s mind-set. Over succeeding weeks, Rosenwald laid them out. The key was to think of yourself as an owner, choosing managers and making sure the numbers were in your favor. He explained to the class Graham’s principles, among them the need to choose stocks that have a margin of safety, and trade at prices that are low relative to book value and earnings.

Rosenwald also walked his students through Buffett’s investment requirements—that businesses be simple and understandable, have a history of predictable earnings, and generate high returns on equity as well as high and stable profit margins. The best companies have so-called economic moats: assets that warrant premium prices. They also have trustworthy managers who actually buy the company’s shares. Students had to think like owners from Day One; Rosenwald himself won’t buy a stock without meeting management first.

Rosenwald added a twist: Overseas markets, he told the class, were a good place to hunt for bargains.

Other lessons: Buying companies at 50 cents on the dollar dramatically lessened a risk of loss. Intensive research also abridged the risk, and reduced the need to diversify. As day follows night, stock prices eventually reflect fundamentals. The students waded through Berkshire Hathaway’s annual reports and shareholder letters from renowned investor Seth Klarman of the Baupost Group.

One night, a young man who worked for a big property developer asked Rosenwald if he should diversify. Rosenwald’s eyes grew round. “Are you making so much money in your late 20s that you can afford to diversify, or are you making a small amount of money now that will grow over time?” he asked.

The latter, the student acknowledged. “Then there’s zero reason to diversify,” Rosenwald counseled. “You should bet it all on black, where you have done your own research.”

Even if the investment didn’t pan out, the student would have learned a valuable lesson about the importance of thorough research. The great investor Leon Cooperman, Rosenwald told the class, believed that outstanding investors had the following characteristics: They were intense, wanted to be the best, and knew the P&L (profit-and-loss statement) cold. They could identify their own comparative advantages and capitalize on them.

To bring the lessons home, he invited his fellow value investors to class. David Abrams of Boston’s Abrams Capital, who got his start with Klarman, told about an early and costly mistake, when he persuaded his boss to buy a fifth of a company that turned out to be a fraud. “Be very wary of book value,” Abrams warned the students. “The problem with Excel [spreadsheets] is that [they] give you a very false sense of precision.”

Bob Robotti, another prominent investor, got his start as an accountant. “You have to understand the numbers,” Robotti said. “But you don’t have to be Warren Buffett to do this right.”

THE LAST DAY OF CLASS was a festive one: Rosenwald’s colleague, Tony Hsu, would listen to student pitches and decide which stock the NYU endowment would buy. Then, Rosenwald would take everyone to dinner. Each stock should return 10% a year plus inflation, a bogey that Rosenwald lifted from another celebrated investor, Mason Hawkins of Southeastern Asset Management.

First up was Shrestha, whose pleasant, square face beamed above his crisp blue shirt. He pitched Leucadia, “a minor Berkshire” that invests in undervalued companies. Unlike Berkshire, however, it turns them around and sells them. He pulled up Leucadia’s Website, whose stripped-down look is eerily similar to Berkshire’s.

“Sudeep, it trades at $22 a share,” said Rosenwald. “What is the value exactly?”

Shrestha pointed out that Leucadia’s mining investments had turned off investors. As a result, it traded at a discount to book. In the past 30 years it had traded at a discount only three times. The chairman and president collectively owned a fifth of the company. One issue, he pointed out, was that they were elderly. (A few weeks later, Leucadia addressed that concern by buying 71% of the investment bank Jefferies Group [JEF] it didn’t own; Jefferies’ CEO would become CEO of the combined company.)

The students lined up enthusiastically to pitch. One touted the contingent value rights of the drug company Sanofi (SNY); another pitched Genworth Financial (GNW), and still another talked about the value in American Residential Properties, which did a private offering over the summer.

Then came Neil Dudich, a portly, well-spoken student. Dudich described the charms of trucking company Arkansas Best (ABFS), whose ability to compete during the recession was curtailed by an ill-timed contract with its unionized workforce in 2008. Since then, the stock had collapsed by 80%, to 0.6 times tangible book, a fraction of its 10-year average. The market value was now about equal to the price Arkansas Best paid for a logistics firm early this year. Arkansas Best was about to negotiate a new union contract that Dudich believed would be more favorable, and the market was “losing sight of the mid- and long-term.”

Dudich, 35, thought that he knew what he was talking about. He worked for the union representing movie and TV directors. In the following days, Hsu picked Arkansas Best and Leucadia for the NYU endowment.

THE NEXT WEEK, ROSENWALD was on a plane to Asia to check on investments such as Transcosmos (9715.Japan), a Japanese outsourcing company whose founding family “lives for dividends,” and Fosun International (656.Hong Kong), often referred to as China’s Berkshire.

The investments were outside the U.S. but followed the same principles: “Find something worth $1 trading at 50 cents; research, research, research; and then buy it and sit on it,” Rosenwald says. “I wouldn’t want to be taught that there’s no way to make extra money in the world, that all knowledge is known and in stock prices. My grandfather would say that’s ridiculous.”