The investment management business is unlike most businesses in that the “average” product (in this case, investment returns) is unsatisfactory from the consumers point of view. Managers who even outperform their respective peer groups could well be an unsatisfactory experience as well for the client if returns are less than the market index.

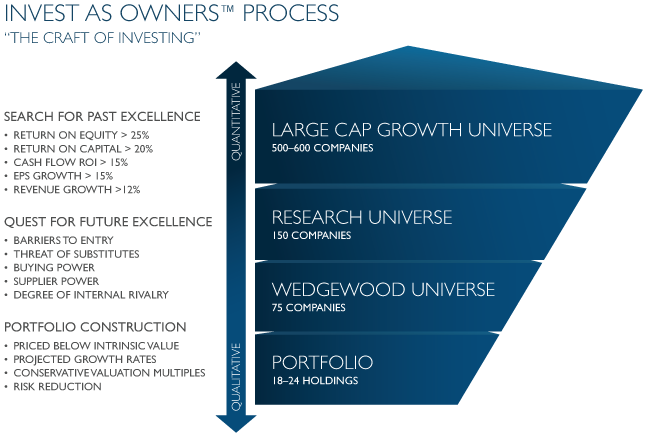

Our respect for index investing and investing as business owners has led us to two aspects of our approach that are quite different than our competitors. To outperform an index, we believe that our portfolios must be constructed as different from an index as possible. Thinking and acting like business owners reduces our interest to those few businesses which are superior. Both of these views lead to our focused (concentrated) approach.

To outperform our peers, we believe that we must emulate the most powerful attributes of index investing. By definition, index investing is “buy and hold” investing. This leads us to our history of minimum turnover of our portfolios. As a corollary, this also affects our stock selection. If we expect to invest in companies for many years, we must then focus on those select companies with the brightest multi-year prospects for growth. In addition, our view on risk is contrary to the typical manager as well. We do not view risk via individual security price volatility (beta), rather all of our risk analysis is centered on the individual business.

Wedgewood’s underlying equity investment philosophy is predicated on a strong belief that significant long-term wealth will be created by investing as “owners” in companies. In our “Invest as Business Owners” approach, we seek companies that the following characteristics:

- A dominant product or service that is practically irreplaceable or lacks substitutes.

- A sustainable and consistent level of growing revenues, earnings and dividends.

- A high level of profitability, measured by return on equity without the use of excessive debt.

- A strong management team that is shareholder oriented.

Once we have validated company performance against this set of criteria, we then analyze prospective companies with an eye toward those organizations who have reasonable, if not cheap, valuations.

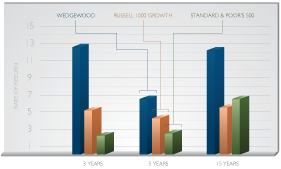

With a plus 15 year history of outperforming index investing and most active managers our results are testament to the viability of our investment philosophy. It is this approach that sets us apart from our competition… we think and act unlike the vast majority of active managers.

Below are the firm’s top Ten Holdings……..

|

638,033 |

$ 282,431,690 |

9.68% |

|

|

1,499,469 |

$ 101,154,177 |

3.47% |

|

|

1,946,211 |

$ 202,795,180 |

6.95% |

|

|

1,193,801 |

$ 138,254,091 |

4.74% |

|

|

2,280,812 |

$ 114,017,796 |

3.91% |

|

|

1,854,397 |

$ 142,083,903 |

4.87% |

|

|

4,907,434 |

$ 117,238,595 |

4.02% |

|

|

2,909,120 |

$ 167,623,491 |

5.74% |

|

|

2,849,284 |

$ 101,804,916 |

3.49% |

|

|

2,251,933 |

$ 110,209,598 |

3.78% |

|

|

226,535 |

$ 179,911,832 |

6.16% |

To see all their holdings go here: Wedgewood Partners Case Study

So, the question I ask my readers, “Why don’t more money managers follow their strategy?” Invest in franchise companies at a good price for the long-term? If you click on their site:

http://www.wedgewoodpartners.com/

you can read an interview and see their track record–it is excellent.Wedgewood Partners 2013 Interview and

Contrast this with:Southeastern_2013 Annual Meeting – Transcript

8 responses to “SEARCH PROCESS: Wedgewood Partners”