I updated this post: http://wp.me/p2OaYY-245

Lee Munson of Portfolio LLC says “Sell the gold rally“. (A hilarious video)

The question for investors and speculators alike is if gold has at long last marked the end of a wrenching nearly two-year pullback from the 2011 highs over $1,900. Lee Munson of Portfolio LLC says any rally marks a chance to make a graceful exit from their positions.

“Investors are confusing the fact that [gold] holds its value super long, hundred-year periods of time versus inflation versus making actual growth,” Munson says in the attached video. “It just holds its value. That’s not a reason to hold anything.”

Those who quibble with that analysis, parsing the numbers to maximize the apparent returns of gold versus stocks are missing the point. Gold has worked over shorter periods as a speculative vehicle but the die hard goldbugs have seen minimal returns at best and dramatically underperformed stocks.

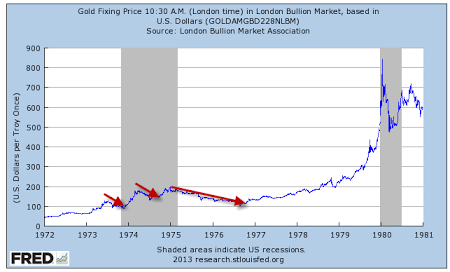

Since 1940 adjusted for inflation the only period over which gold has outperformed stocks is 2000 – 2010; and that lead is slipping fast. History suggests gold is extremely volatile in shorter terms but dramatically lags U.S. equities for the truly committed gold enthusiasts.

Munson has simple advice for gold investors enjoying the terrific rally from the recent lows. Sell. “Exit out of the trade. Get serious. Get real.”

Disingenuous or Clueless? (from “Mish”)

I do not profess to know what the price of gold will be at any time, but Munson seems to think he does, so much so that he screams sell after a measly rally.

Munson is certainly clueless about the fundamentals of gold.

If you don’t understand the fundamental driver (and it’s not jewelry or central bank selling) please consider Plague of Gold Bears Now Say “Gold Unsafe at Any Price”; What’s the Real Long-Term Driver for Gold?

Gold outperformed between 2000 and 20010 for a reason. And that reason is global central bank debasement of currency. Gold also outperformed in the late 70s for the same reason, but it did get ahead of itself.

Additional Reading

- Ritholtz on Gold and on Making Predictions; How Secular Bull Markets End; Winning vs. Investing

- Nouriel Roubini Seriously Misguided on Gold, on Equities, on Economic Growth, on Money

- Speculative Gold Bets at 5-Year Low; Metal Will Get “Crushed” Says Credit Suisse

Cash, Bonds, Equities, or Gold?

You have to put your money somewhere (and somewhere includes cash).

This is not about being a “die hard gold bug”. This is about understanding the case for gold as it exists now.

The fundamentals of gold are strong, yet sentiment is so extreme that bears says “gold is unsafe at ANY price”. Now Munson says this puny rally is a chance to exit.

With sentiment this extreme in the face of strong fundamentals and a rally, I like my chances here.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Read more at http://globaleconomicanalysis.blogspot.com/2013/07/fools-say-sell-gold-rally.html#5AsKu1e0jpiSssK3.99

http://globaleconomicanalysis.blogspot.com/2013/07/fools-say-sell-gold-rally.html

http://globaleconomicanalysis.blogspot.com/2013/06/plague-of-gold-bears-now-say-gold.html

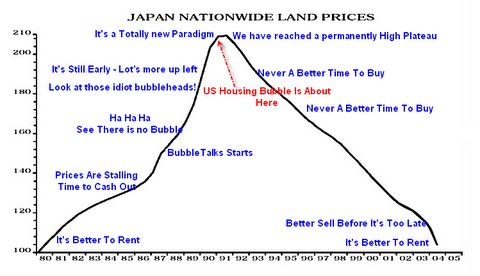

http://globaleconomicanalysis.blogspot.com/2006/04/us-vs-japan-land-prices-pictorial.html (A GREAT post for financial history buffs)

11 responses to “SELL Your Gold Now! Get Out While You Can”