Money Supply Growth is Declining

The Fed is shrinking their balance sheet: See this CNBC video interview of Jim Grant and the graph of money supply growth is shown about 1.5 minutes into the interview….http://video.cnbc.com/gallery/?video=3000094677&play=1

The Fed was very stimulative up until the Spring of 2011, but in the past three months the Fed has been withdrawing stimulus. At the margin, the Fed is tight. Unless QE3 occurs or there is a reverse of fear money into US Treasuries, market may struggle. This is not a reason to sell good, undervalued stocks.; just be aware of conditions.

Transcript

CNBC Money Honey (“MH”):Let’s solve this, All right. Welcome back it’s the hot topic on wall street. Are we going the way of Europe and headed for recession? Warren Buffett told the economic council that we’re not smarter than the people in the 1930s. We just have a system that works that’s been working since 1776. He has under his wing, I think, 80 or 79 operating companies and he’s got one of the better views on the macro economy.

Let me ask you (James Grant) about the Federal Reserve’s testimony tomorrow. Ben Bernanke is back before congress tomorrow. What are you expecting him to say? A lot of debate in terms of suggestion of more stimulus, QE 3, what do you think?

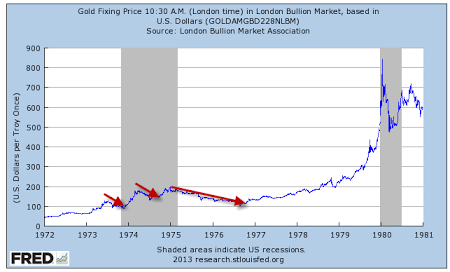

James Grant, “I think we should plan for platitudes but there’s a difference between what the FED is saying and notice what they are doing. They have increased their balance sheet and the maximum rate of growth occurred a year ago in the spring of 2010. In the last three months it’s mainly treasuries, securities, and mortgages, that has totalled an annual rate of almost 10%. The FED is withdrawing stimulus even as more and more of the governors and reserve bank presidents are talking about QE 3. Something to bear in mind when you listen to Bernanke talk. What is he actually doing? And what they is actually doing at the margin is shrinking the money supply.

MH: What do you think about that? Give me your analysis on that.

Jim Grant: Unless they continue buying securities, some of these bills, bonds, and mortgages mature and run off. That’s what is happening now. The portfolio is shrinking just by the natural tendency of things to come to the end of their financial lives. So unless there is some new initiative, the portfolio will continue to shrink and as the FED asset shrinks, so does the stimulus and the accumulation of those assets. I expect that there will be QE 3.

MH: “You do?”

James Grant: “I do. I think that very little prodding to do what they have done continuously almost for four or five years and….” – MH: “look, Jim, let’s face it. We had a terrible jobs number. 69,000 jobs created in the last month. I know you’re not a fan of all of this stimulus.

James Grant, “It’s market manipulation in the past. Isn’t it a fun drug? They keep on printing the stuff and we keep on expecting more and today I think part of the source of the levitation was in Wisconsin. People are maybe discounting the prospect of something like freer or if not free markets come the fall if the GOP wins but a good part of what is going on in the market is the presence of hope of QE3, withdrawal of that hope. It is a grand manipulation.

MH, “I think you brought up a very important part with the Wisconsin thing (Public Unions lost their recall vote against the Wisconsin Governor). I’ve been asking this thing, are investors going to look at this data as it keeps on worsening and say, “Are going to have a new president and then start rallying on the expectation that it’s a Romney rally?

James Grant: I think so. I think that in a way the worst is better. The supreme court is going to hold forth on whether Obamacare is constitutional. I can see a GOP victory and the market will discount that. If in fact we were to see more expectations that President Obama loses the re-election, then this market rallies? That’s the best hope for this stock market? It’s one hope and it’s not in I think it’s one bullish feature to be aware of.

MH, “Give me the long-term implications for all of this money. Let’s say we get QE3. Long-term implications are bad. There is nothing free in this life, in money least of all. The world I think has 2008 in its brain. The world is preoccupied with the awful memories of the 2008 and 2009. If you look at the market and volatility market, people are buying protection against a deflationary collapse. The bank regulators are demanding a deflationary event. Unexpectedly it began to generate higher than expected rates of inflation, what if interest rates went up. That might be the surprise. That’s what I’m thinking about, that we have all designated on the one hand risk assets. On the other hand, nonrisk assets, right? How about if the labels were stuck up wrong? Which they may very well be.

MH, “Are you worried about Europe? How much of an issue is Europe? At the end of the day I want you to button up and say, how is the investment play here? let me answer it with one short breath. We are looking for microeconomic specific opportunities in Europe. Equities, distressed debt, busted LBOs, cheap real estate. We can’t know the future. We can’t really handicapped these macroeconomic outcomes. But what we can do is troll for opportunity. That’s what we’re doing. How about just cool, calm, and collected analysis? That’s what we’re trying to do. That usually works.

MH, “Jim Grant, fantastic analysis, as always.

3 Months 6 Months 12 Months

M-1 Growth Rates 4.3% 10.1% 17.1%

M-2 4.0 5.9 9.1

M Zero Maturity 5.0 6.9 8.6

Note the deceleration of Money Growth–Yellow Lights Flashing

—

Last week, the Fed numbers came in with 13-week annualized seasonally adjusted money supply (M2) growing at 5.5%. Non-seasonally adjusted growing at 5.4%. And most dramatic is the simple month versus 4 month out money supply growth. It has now gone NEGATIVE with an annualized growth rate of -1.9%.

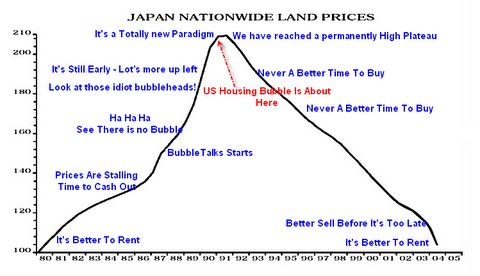

This is a major crash in money supply growth. That said, the potential for a reversal is very strong. If hot money flows into the U.S. reverse, money supply will rocket. Further, it appears that the Fed appears ready, in co-ordination with the European Central Bank, to start a new money pumping scheme. But if at least one of these factors doesn’t kick-in, pressure in the economy and stock market are likely.

What must be watched very closely is the trend of hot money flowing into the Treasury market. This hot/scared money, by putting downward pressure on rates, is causing the Fed to drain reserves because of its target Fed funds rate at 0.15%

Where’s this hot money coming from? It’s domestic and foreign money. The demand among average U.S. investors has swelled so much, in fact, that they bought more Treasury securities in the first quarter than by foreigners.

U.S households picked up about $170 billion in the low-yielding government debt during the quarter, while foreigners increased their holdings by $110 billion.

When this money moves out of Treasury securities, it will push rates higher very quickly and cause the Fed to add reserves (and grow the money supply very rapidly) The switch in the direction of Treasury security hot money can occur very quickly. (Source: www.economicpolicyjournal.com)