Why we are doomed

http://www.oftwominds.com/blogjuly14/interest-debt7-14.html

Update on Hyperinflation Talk Presented 2010 by Victor Sperandeo,

EAM Partners L.P. May 13, 2013

On February 16, 2010, I first gave a speech titled “Hyperinflation: A Statistical Inevitability” at a charity event in Dallas, Texas. In essence, the talk was a “warning” that unless the growth of the nominal debt versus nominal GDP changed to a more normal balance, the US would “eventually” suffer from hyperinflation.

Hyperinflation is a debt problem whose root cause is when a country’s level of debt rises to a level that when its economy goes into a deep recession (or depression) the country cannot borrow money or raise enough taxes to cover its expenditures, and therefore it is forced to print money to cover a greater percentage of its expenditures than the markets and investors think is sustainable. This concludes in the country’s inability to pay the interest on its debt, which progressively consumes its overall budget, causing the country to continue to print money to pay its ever increasing debts and interest thereon, which ultimately leads to a loss in confidence in its currency, ending with hyperinflation as the result.

Editor: Note the difference between inflation and hyperinflation (hyperinflation is NOT just an ultra-high rate of inflation) See links below.

…

Where the U.S. Stands Today

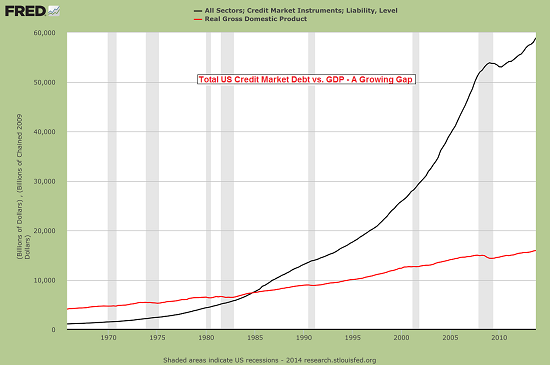

My original speech was based on the 2010 Congressional Budget Office’s Budget and Economic Outlook Fiscal Years 2010-2020. At the time, total US debt was growing at an unsustainable rate of 11.90% compounded from 2006 -2010 (fiscal years) while gross GDP was growing at a nominal rate of 2.75%. Debt was increasing at 4.3 x’s higher than growth. Clearly, this was an unsustainable situation.

Further, the reason that I state hyperinflation will occur “within” the next 10 years has a logical basis. If one takes the position that the net debt will grow at 5% a year, total U.S. debt will be $27.324 trillion in 10 years (not including current off-balance sheet items or unfunded liabilities). As the CBO does not project total U.S. debt, only public debt, the $27.324 trillion figure is based on my projection.

Now, what will interest rates be in 10 years? The CBO says an average yield is 4.6% (CBO 2/13 Report page 5), but let’s assume it reverts to the mean for bills and bonds of the last 52 years, or from 1961, which was 6.01%. Assuming that spending increases 5.08% a year from 2014-2023 (CBO 2/13 Report page 3), they say annual spending will be $5.082 trillion in 2023 net of annual interest.

However, annual interest in 2023 on my projected $27.324 trillion total U.S. debt (using the historic average interest rate of 6.01%) will be $1.642 trillion, or 32% of projected 2023 annual spending without interest and 24% of projected 2023 annual spending with interest. Today, interest is 6% of the budget. Therefore, one has to ask the question, where does the approximately 20% difference come from? I believe U.S. bond holders will sell what they own, the U.S. dollar will decline, and the Fed will print money at a rate that will make today’s Fed look like they are Shaolin Monks.

See full article here:Hyperinflation by Victor Sperandeo

A history of hyperinflation in pre-revolutionary France: Fiat_Inflation_in_France_by_White

An Austrian economist, Joseph Salerno discusses in nineteen minutes the theory of hyperinflation (High School Lecture) http://youtu.be/xVDZVhdT2gY

I am interested to hear from readers how the U.S. will AVOID hyperinflation assuming our current trends continue. What will politicians try to avoid default. What do YOU think?

Two short, six minute videos discussing Market Wizard, Victor Sperandeo: http://youtu.be/OBkb69tvVqs and http://youtu.be/8XfSz3MT3Xg

Yamana valuation to be posted Friday.

9 responses to “Victor Sperandeo on the Inevitability of U.S. Hyperinflation”