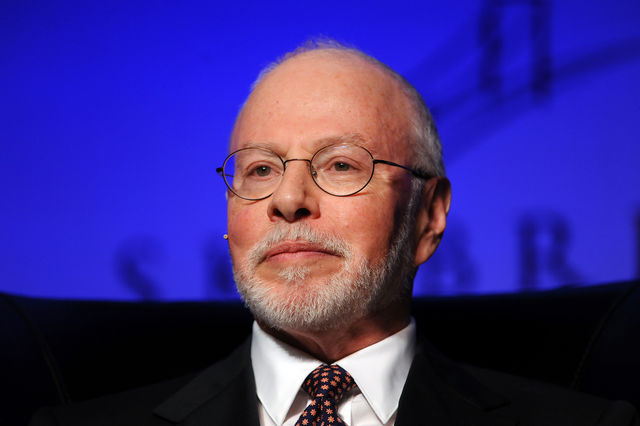

The consensus (bull case): The power of psychology is overwhelming, and investor sentiment indicates that asset prices are being driven higher by QE and Zirp, that the Fed can be trusted, and that we should not worry too much about the unintended consequences, because the Fed will be able to follow a path to normalization and a soft landing. In any event, America is now a safe haven and always will be a safe haven. Moreover, goes the case, we may be at the sweet spot of the economic cycle. It has taken a long time to get here, but finally we are getting sustainable growth, and we can expect more of the same, Interest rates are completely under control, in fact, long-term rates are in a secular decline, which is not nearly at its bottom. Inflation is virtually impossible, and we really ought to be worrying about deflation instead. If we focus on getting inflation higher, then growth will follow. The currency is also under control, goes this line of thinking, In fact, what could the dollar fall against? The competition is in much worse shape. Banks are in far better financial condition than in 2008 and will gradually bleed off any remaining toxic assets that they own. If anything starts to go wrong, the government will step in to fix it. Pushing investors out on the risk curve in search of yield is a good idea and a clever way to encourage them to do what they should be doing on their own (i.e., taking risks to help the ecobnomy grow). We should not worry, because things will be okay. We can even trust the representative branches of government, because elected officials will not have to do much that is unplatable or challending–the central bankers have it all covered. Above all, trust the Fed. –Paul Singer

So what’s it worth?

Please do a “down and dirty” valuation giving your assumptions within twenty minutes. I will post mine tomorrow!

PRIZE: A Date with my EX! for best valuation!

Pingback: Esco Electronics: An Exercise in Securities Valuation With Seth Klarman | Hurricane Capital