If women ran the world we wouldn’t have wars, just intense negotiations every 28 days. –Robin Williams

Return Measures by Damordaran 2007 (More on ROIC)

REGRESSION TO THE MEAN

This is a key concept to learn along with EV/EBITDA, MCX, and cheapness wins.

REGRESSION TO THE MEAN A good read by an Australian Graham & Dodd-like Investor.

When an investor turns to the research on regression to the mean and investors overreacting to poor company performance/bad news in Richard Thaler research, he or she sees that prices of the winner and loser portfolios take three-to-seven years to revert. See also The New Finance: The Case Against Efficient Markets by Robert A. Haugen and Inefficient Markets by Andrei Schleifer.

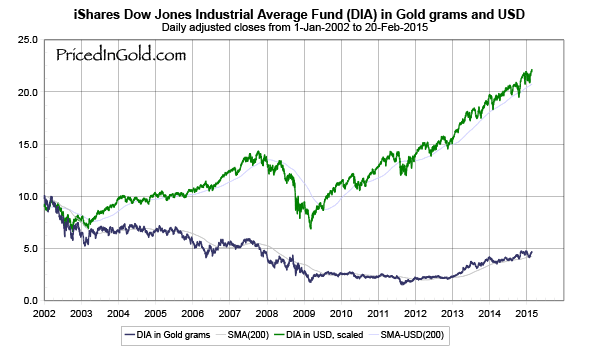

Illustration by S of Reversion to the Mean

We next progress to Chapter 5: A Clockwork Market, Mean Reversion and the Wheel of Fortune in Deep Value.

From there we will read chapters 3 and 4 in Quantitative Value.

One response to “ROIC and Reversion to the Mean”