Case Study in Pigeon Investing

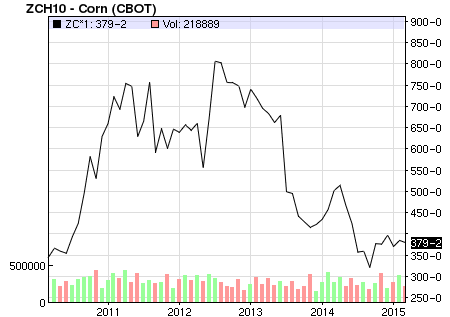

Times are hard. Your family has been struggling to make the mortgage payments on your farm since the 50% decline in corn prices.

Your lucky day! You get a call from a friend’s neighbor that he (The Pigeon King) desperately needs breeders for his growing pigeon business. With a $125,000 investment financed with a second mortgage against your farm you can buy 360 pairs of pigeons at $165 a pair. Then he offers to buy back the newly bred pigeons for $40 each (pigeons breed prolifically) with a ten-year contract. He says these pigeons are for racing. Then he gives you a list of five farmers in your state who are breeding pigeons for him. Take your time and do your due-diligence, he says.

You check his credit ratings–all good. No criminal or civil complaints. He owns his farm free and clear–he is a farmer like you! After meeting with three of the pigeon farmers who confirm with check stubs that he has been paying them on time and as promised. The returns are good–in excess of 80% to 100% in terms of food and overhead to raise the chicks. Considering your time to look over your pigeons, you figure you can net a 50% pre-tax return on your capital. Plus, your contract allows you to sell whatever you produce at the stipulated price, so growth will be profitable.

Also, you hire an investigator to interview the Pigeon King. She sends you this video interview: Making Fowl into good fare—it this a good idea and A successful pigeon farmer

Times are hard. What do you do? Before you decide, you are inspired by

You gotta have dreams and the will to believe!

You remember what you learned as a deep value investor over at csinvesting.org and you_________? Why? What INVESTING/BUSINESS principles help you in your decision?

Please write them down now. Then read on.

Many years later, you notice in the paper:

the-pigeon-king-and-the-ponzi-scheme-that-shook-canada.html

This article, The Pigeon King (same as the link above but with additional commentary for easier reading) is one of the most amazing stories–a farce, a tragedy, a comedy AND chock full of lessons for the investor. You may think you are too smart to be a pigeon or a bird-brain (sorry!) but ANYONE can be blind. What checklist items stop you (besides it’s too good to be true?).

What did YOU learn?

Money for nothing and your chicks for free

6 responses to “Time-out: A Case Study in Pigeons”