Video on Behavioral Portfolio Management

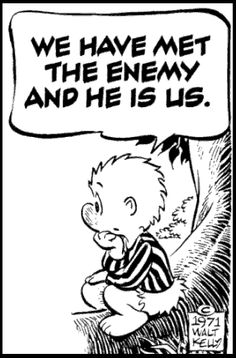

Emotional crowds dominate market volatility (nothing new here). Emotions trump arbitrage. If you learn anything from this post may it be that you concentrate on your best ideas and do not overdiversify beyond ten or twelve stocks. Also, understand randomness. Teams hurt performance. Avoid closet- indexers.

See slide 6 for a summary: 10495_Howard Presentation Slides

Behavioral Portfolio Management A research paper

T Howard CFA Behav PM Short article

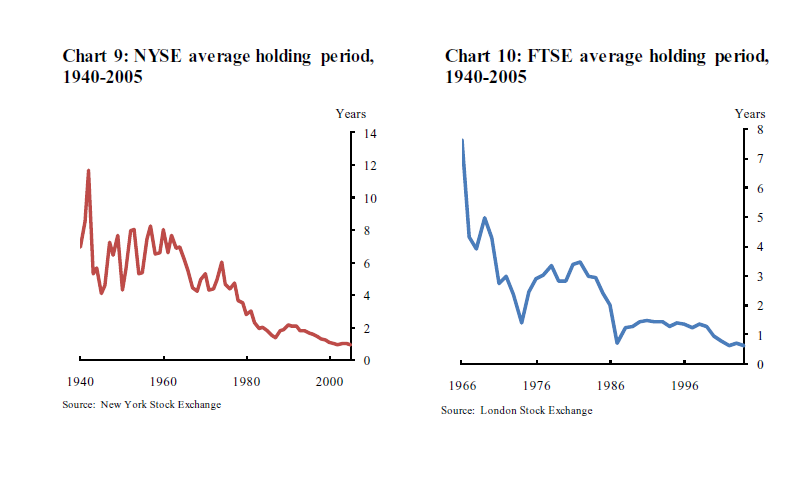

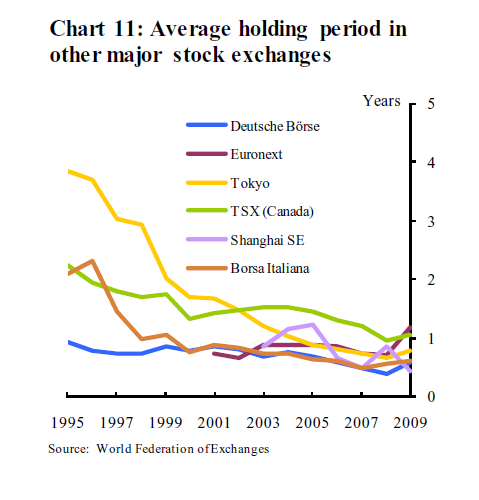

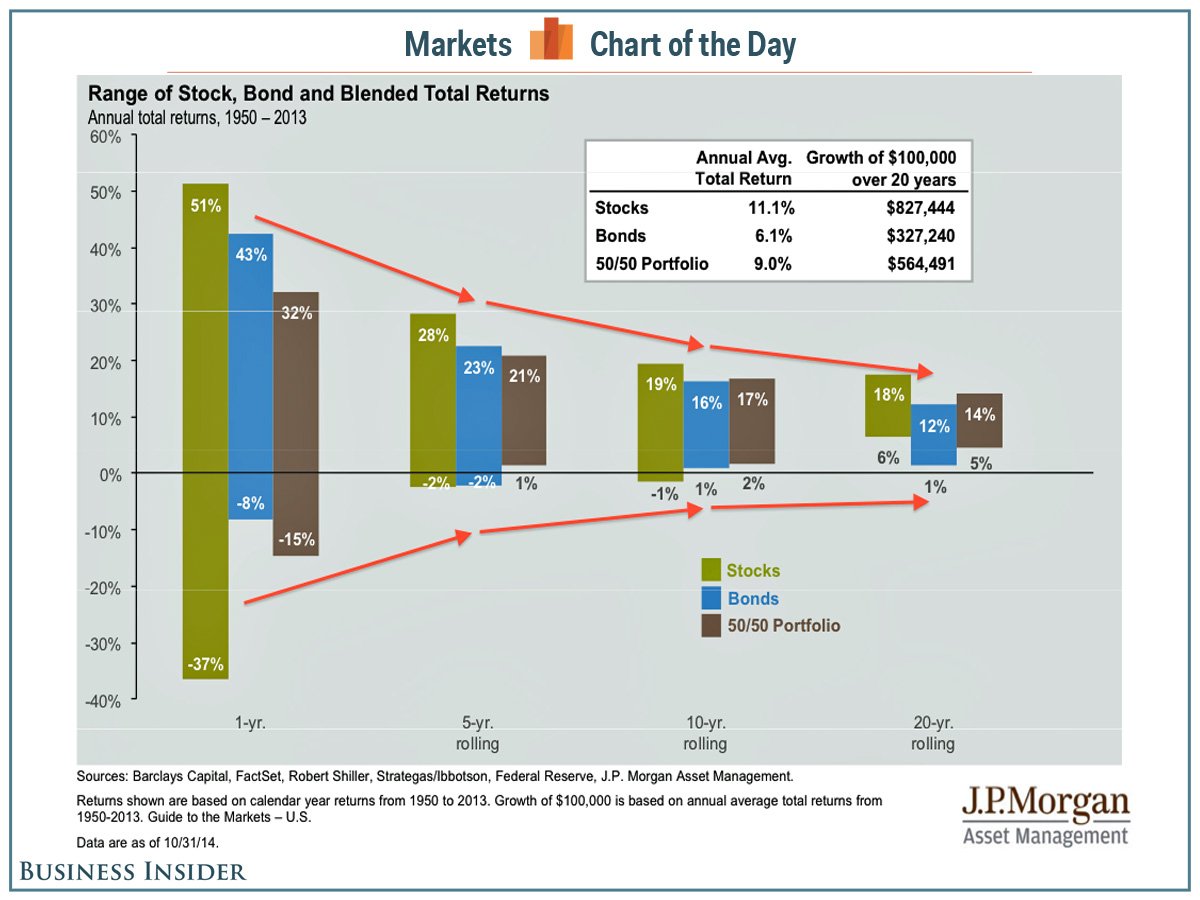

And here is a secret not to be shared with others: If you are going to have a behavioral edge, then don’t do what the mass of investors are doing–invest with a at least a five-year time horizon so you can give mean regression to work if you buy non-franchise companies (assets like cyclcial mining, manufacturing, etc.) or allow your franchise companies time to compound because of a slow mean reversion.

But holding stock five years or more is SCARY because of the VOLATILITY. Not so:

10 responses to “Time for Review: Behavioral Portfolio Managment”