Cyclical Markets

The NASDAQ bubble showed the highest P/E ratios in stock market history due to low or no earnings technology companies.

Kopernik 1Q 2017 – Conference Call – Final Worth a read–note high and low market cap sectors of the market (see page 9)–a proxy for expensive and cheap. A search strategy.

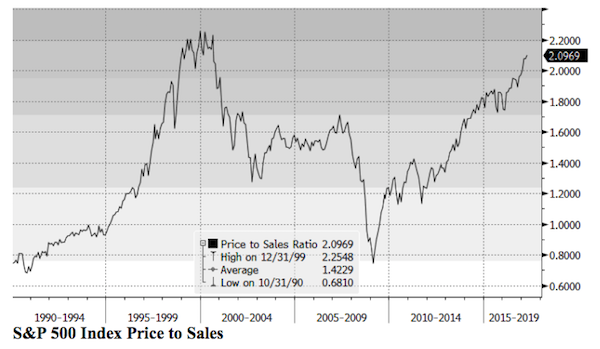

Time in a Bottle – Final A good discussion of valuation methods in an era of distorted interest rates.

Join https://microcapclub.com/

http://tsi-blog.com/2017/04/are-rising-nominal-interest-rates-bullish-or-bearish-for-gold/ A discussion of how to understand interest rates and gold. Note the analysis using data going back 90 years. Do not use a small smaple size.

Also, see ETF Weapons of mass destruction FPA 1Q2017 Commentary

https://youtu.be/bZfPJCAVQg0 Recent Greenblatt talk at Google.

3 responses to “The World is Cyclical; Valuation in a World of Zero Interest Rates”