Why Are Gold and Commodities So Darn Volatile?

By Mark Skousen, Editor, Forecasts & Strategies

Why are commodities and commodity stocks so volatile? Commodity speculating is not for the faint of heart, and many investors give up on gold, silver, and mining stocks because they can lose 40-90% of their value in a short period of time. Gold’s recent drop from $1,900 to $1,200 is a case in point. You have to expect a volatile market.

The reason why commodity prices vary so much can be found in an understanding of Austrian economics, the free-market school that is endorsed by Doug Casey, Rick Rule, and many other commodity experts. As developed by Ludwig von Mises and Friedrich Hayek in the 20th century, the Austrian school of economics explains why commodity prices are so volatile.

Austrian economists call it “the structure of production.” As a follower of the Austrian school, I wrote a book titled The Structure of Production (New York University Press, 1990). Rick Rule told me he loves the book and has bought hundreds of copies to give to his clients.

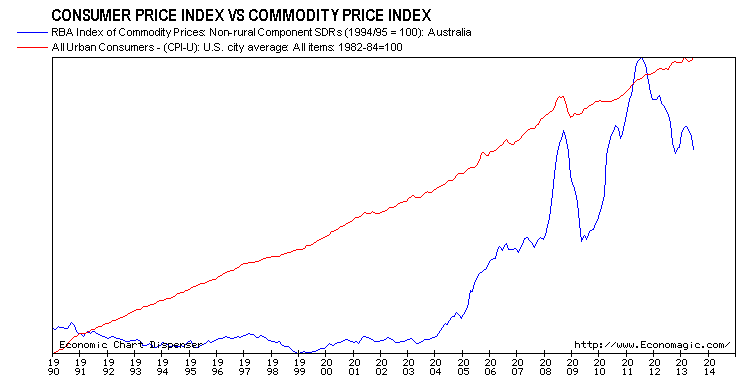

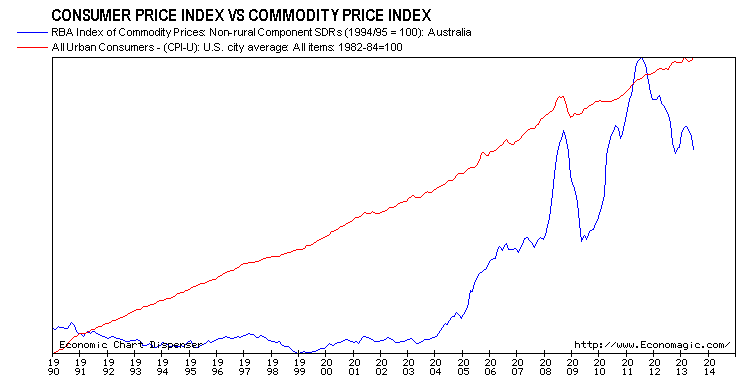

Austrian economists emphasize the structure of the economy—the structure of interest rates, production, employment, and inventories. It is a complex theory, but the basic idea is that price volatility depends on how far away the product or service is from final consumption. Consumer prices are the most stable, producer or wholesale prices less stable, and commodities are the furthest from final use; therefore, those prices are the most volatile. You can see this difference in the graph below, where the Consumer Price Index (CPI) is far more stable than the RBA Commodity Index.

Take oil and gasoline, for example. Oil is far removed from final use (gasoline) and has varied from $30 to $140 a barrel during the past ten years… and yet the gasoline price (final consumption) is far more stable, varying from $3 to $4 a gallon.

But there’s a silver lining in this story. While commodity prices are far more volatile, it also means that commodities and commodity stocks can be much more profitable on the upside… if you buy right. And with commodity prices down 40% or more (with oil being an exception), now may be a great buying opportunity.

Mark Skousen Editor, Forecasts & Strategieswww.markskousen.com

—

You must understand the structure of production if you invest in any cyclical business (and what business isn’t cyclical?). Understanding time is critical in investing. After the over-building in 2005, the housing bubble needed time to clear away mal-investments. All the demand pumping, interest rate manipulating, and subsidies could not change that process. I highly recommend Skousen’s book.

To learn more: Structure_Production_Reconsidered