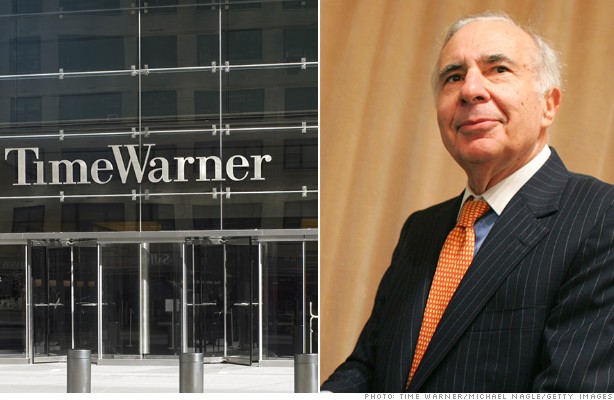

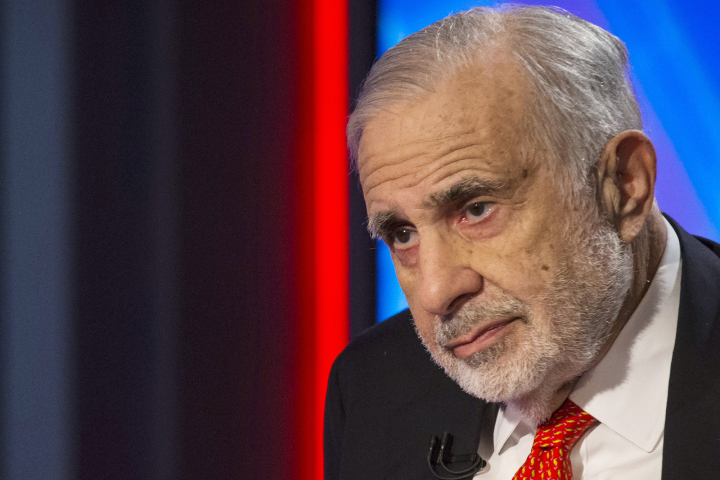

Billionaire activist-investor Carl Icahn gives an interview on FOX Business Network’s Neil Cavuto show in New York in this February 11, 2014 file photo. Icahn said October 9, 2014, Apple Inc’s shares could double in value and urged the company’s board to buy back more shares using its $133 billion cash pile. REUTERS/Brendan McDermid/Files (UNITED STATES)

Carl Icahn is becoming a DC activist just in time to help stimulate congressional talks on corporations being able to repatriate money to America at a lower tax rate, he told The Post.

Icahn — a day after GOP presidential front-runner Donald Trump unveiled his economic plan, which included corporate tax relief for repatriated funds — released a 15-minute video Tuesday titled “Danger Ahead,” giving his views on the US economy. Icahn also endorsed Trump for president.

The billionaire investor dedicated much of the video and a corresponding interview with The Post to the taxation rate of repatriated profits.

“We want to make sure companies have the ability to bring their funds [$2.2 trillion in overseas profits] back,” he told The Post.

“Repatriation [tax rate] should be 7 or 8 percent.” Presently, companies pay taxes in countries where they make the goods, and then a 35 percent rate when bringing the money back to the US.

Icahn said he had been in touch with Sens. Charles Schumer (D-NY) and Orrin Hatch (R-Utah) and Rep. Paul Ryan (R-Wis.), “and everyone wants to see a [reduced rate] bill” by December.

“I think Schumer, Hatch and Ryan want to see this happen,” Icahn said.

If they don’t succeed, Icahn said, the repatriation effort will stall in the 2016 presidential election year and the US will see more balance-sheet cash remaining overseas, out of Uncle Sam’s reach.

Icahn’s biggest stock position, meanwhile, is his stake in Apple, from which he would benefit greatly if the company can repatriate some of its $200 billion at a lower tax rate.

“Repatriation would be viewed as massively positive for Apple,” Friedman Billings Ramsey Capital analyst Dan Ives said.

Icahn Enterprises, the investor’s publicly traded vehicle that is a proxy for his investments, is down 28 percent this year and 37 percent over the past 12 months. The company took a $373 million loss last year, largely on energy stock declines.

Another top 10 Icahn holding is Herbalife, which, as of June 30, had 48 percent of its $750 million in cash overseas.

The foreign cash repatriation talks in Washington could use some help, a well-placed Senate source told The Post. “I think it’s a long shot it gets passed this year.”

The main problem is key Democrats want to spend the new proceeds collected from repatriation on a long-term highway funding bill.

But key Republicans are uncomfortable with that idea because they are concerned that once repatriated money slows, Congress may have to raise taxes to pay for continued highway funding.

Not all business interests, especially big tech companies, are for repatriation at lower tax rates as they now have an excuse to not bring back foreign profits. So Icahn calling senators and being vocal on the subject makes a difference, the source said.

Icahn in the video explains why he is for repatriation.

“If that money came back, it would [be used] for jobs.”

“That money is given to somebody who will invest in this country. As opposed to taking the money in Europe and investing in Ireland or somewhere like that.”

www.nypost.com