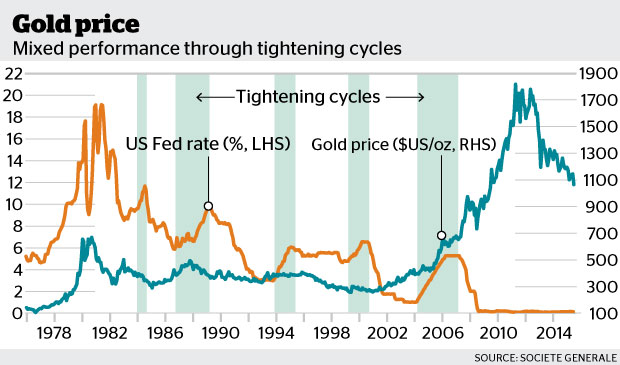

Bloomberg December 2015: But Societe Generale predicts gold will be a casualty of the rate hike, falling below $US1000 an ounce, to $US955 by the end of next year.

Head of global asset allocation Alain Bokobza says looking at the 2016 panorama, in which US interest rates tighten and the economy fares reasonably well, “that does not argue for a higher gold price.”

“Gold will be a casualty.”

CSInvesting: The purpose of this post is to remind you of ignoring expert advice and to do your own analysis. The above comment by Bokobza is meaningless blather. He is simply spouting the consensus view that rising rates mean a declining gold price since gold has no yield. Beware of simple narratives.

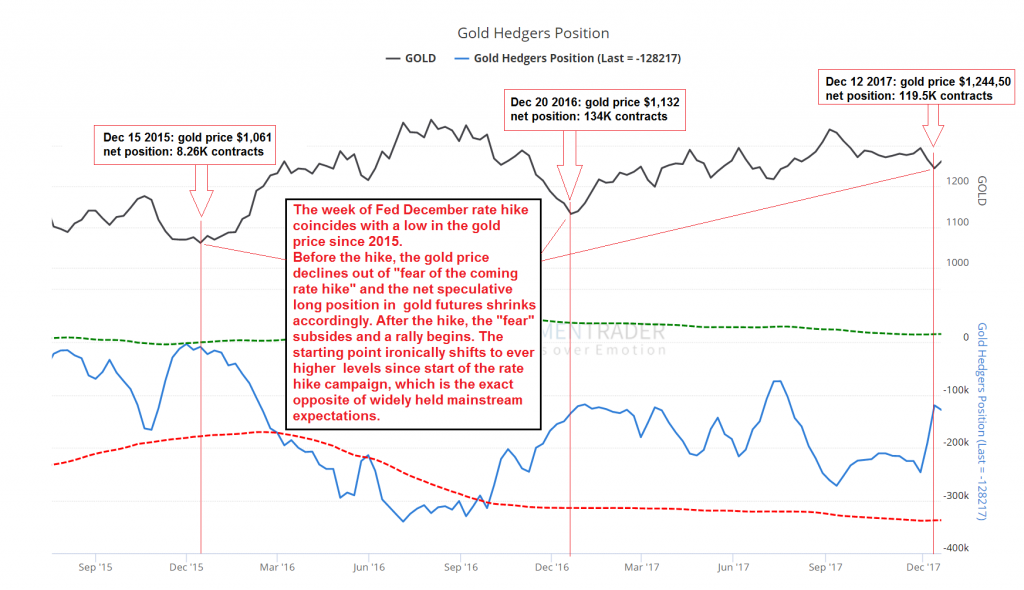

The assumption “Fed rate hikes equal a falling gold price” is not supported by a shred of empirical evidence. On the contrary, all that is revealed by the empirical record in this context is that there seems to be absolutely no discernible correlation between gold and FF rate. If anything, gold and the FF rate exhibit a positive correlation rather more frequently than a negative one! Source: www.acting-man.com

And today:

More here: Gold and the Federal Funds Rate and Gold and gold stocks Dec 26 2017

UPDATE: Interesting Read

- Update: David Collum’s 2017-Year-In-Review-PeakProsperity-final

- david_collum-30_years_investing

- 2016-Year-In-Review-PeakProsperity

Interview of David Collum: https://youtu.be/Vlr7_vDwg_M