forecasts-forecasts-everywhere (A good post on psychology)

So the gold price drops, so the gold forecasts drop. Some recent calls in order of bearishness:

- Deutsche Bank– fair value $785

- Morgan Stanley– $800 under worst case scenario, $1,190 average for 2015

- Claude Erb– fair value $825, will overshoot on downside to $350

- Bloomberg Survey– $984 average estimate by 31 Dec 2015

- Goldman Sachs– could fall below $1,000

- ABN Amro– $1,000 by 31 Dec 2015 and $800 by 31 Dec 2016

- OCBC– $1,050 by 31 Dec 2015

- Capital Economics– $1,050 by 30 Sep 2015, $1,200 by 31 Dec 2015

- UBS– $1,180 average price over second half of 2015

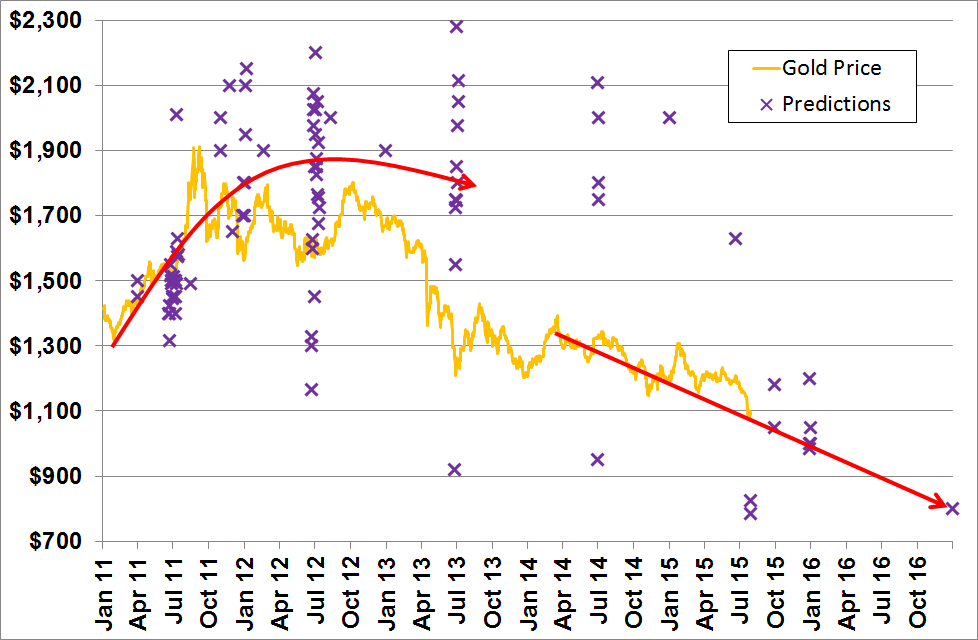

Towards the end of 2010 I (Bron Suchecki) started recording forecasts in a spreadsheet, as I noticed many analysts revised their forecasts frequently in response to moves in the gold price. By 2012 I had given up as it was a lot of work to make one point – that in general analysts were just following or projecting the trend.

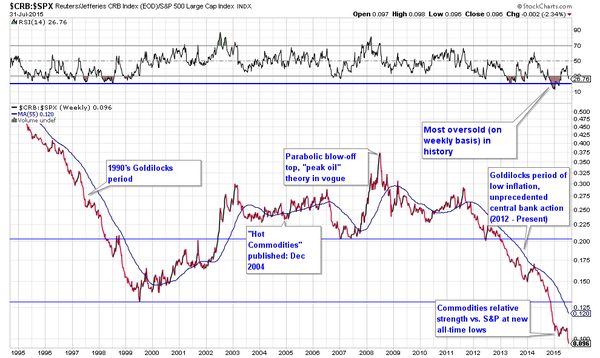

The chart below shows the forecasts I accumulated from late 2010 to early 2012 (the clustering around July are yearly average forecasts) and I’ve added in the recent ones above.

—

Continued….on recent gold “smash”

- Ross Norman: They choose the optimal moment in the early morning and when Japan was closed for a holiday to get the biggest bang for the buck. It was clearly ‘short’ traders using leverage to trigger (technical) stops” he said. The price later regained some of its ground, allegedly as the profiteers cashed in jackpot gains on options that they also had. “It was a trade within a trade”. (link)

- Marex Spectron: no coincidence that this happened in the quietest, thinnest period of the week … they deliberately want to move it in a big way (link)

- “Traders”: Gold also fell in the Chinese derivatives market, which, traders said, added to the impression of an orchestrated attempt to push the price down, triggering others to sell their positions. (link)

- Martin Armstrong: many rumors floating around from China off-loading because wrong storage figures were released, to a large spec investor who sold 6 tonnes and has taken a huge loss on a leveraged trade! (link)

- “Traders and Analysts”: attributed the massive move to high-frequency trading algorithms as well as stop-loss selling. (link)

- Societe Generale: It was just a bit of a bear raid and there was nobody on the other side to mop up the selling (link)

- Chuck Butler: maybe the gold sale on the SGE was “margin influenced,” which would mean that large investors use gold as collateral on stock trades, and as the Chinese stock market has dropped the margin calls have come in (link)

- “Market Participant”: The fact that it was done in Asian hours and in a loud, messy manner suggests it may be done by people not directly under European and US regulation (link)

- Singapore-based trader: “We do see a lot of people in China selling gold to get fast cash to go back into the equity market” (link)

- Phillip Securities: “It looks like the end of an era for gold, China has been grappling with oversupply after importing a record volume in 2013.” (link)

- Societe Generale: “We have breached significant support levels, we know U.S. rate hikes are coming, there is no inflation and there is no catalyst to hold gold when other markets are doing better” (link)

- Momentum Holdings Ltd: “With low global inflation and an improving U.S. economy, I doubt we’ll see big economic shocks, which is not good for gold” (link)

- KBC Asset Management: “Gold is a hedge against everything that can go wrong. But at the moment it appears that not a lot is going wrong. We have an Iran deal, a Greece deal and we have good news from European and U.S. economies. There is no real reason for us to invest in gold and gold companies.” (link)

- Deutsche Bank: “the “fair value” for gold is around $750. … “All the ducks are now aligned for a gold slide: real interest rates are rising, the dollar is getting stronger and the risk premium on equities is going down” (link)

Former Gold Bug Turns Bearish: Http://www.armstrongeconomics.com/archives/35556

No Matter What Book You Read Do Not Buy Gold

Current Sentiment (note small specs INCREASING their shorts as price moves sideways this past week).

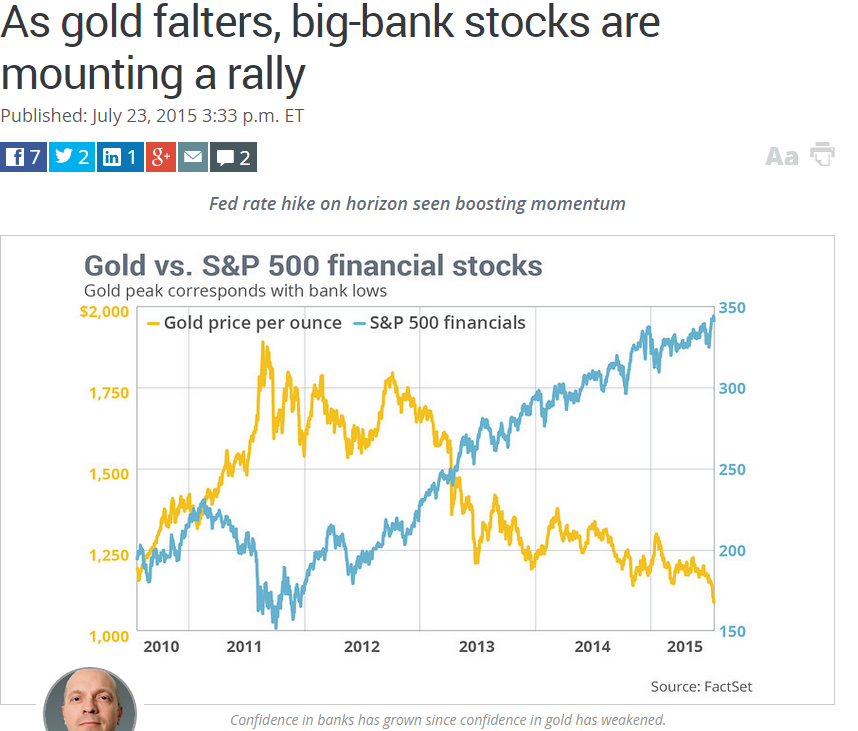

From Bloomberg (Bloomberg belongs to a limousine socialist, and is well-known for its pro-central banking/ pro-money printing and anti-gold editorial line. Some of the most ludicrous articles about gold ever published have appeared on Bloomberg):

Gold Slump Not Over as Speculators Go Net-Short for First Time – apparently Bloomberg’s authors have yet to hear about contrarian signals.

Gold Is Only Going to Get Worse (“Our survey shows a majority of traders and investors aren’t optimistic”) – indeed, Bloomberg seems to be blissfully unaware of contrarian sentiment analysis.

Gold Could Fall to the $1,000 Mark (video)

Good Luck Bargain Hunting for Gold Miners – naturally, gold miners are even more doomed than gold itself…

From the Wall Street Journal:

Let’s Get Real About Gold: It’s a Pet Rock – actually, as we have previously pointed out, it’s a door stop, not a pet rock. We should perhaps mention here what Jason Zweig, the author of this WSJ article, wrote in 2011 right at gold’s peak. From Mr. Zweig’s WSJ Article of September 17, 2011:

“Growing numbers of investing experts have been declaring that gold is a bubble: an insanely overvalued asset whose price is bound to burst. There is no basis for that opinion.”

With respect to gold miners (which since then are down by more than 80%) he opined:

“But there is one aspect of gold investing where it is possible to make rational estimates of value: the stocks of gold-mining companies. And, by historical standards, they seem cheap—based not on subjective forecasts of continuing fiscal apocalypse, but on objective measures of stock-market valuation.”

This is really a textbook example of how market sentiment works.

From Marketwatch:

The carnage isn’t over in gold, other metals-mining stocks

Study predicts gold could plunge to $350 an ounce (i.e., here come the extreme predictions, the inverse of the vast bullish consensus and the extreme bullish predictions that were made at the peak by gold bulls)

And all of this was finally crowned with the following pronouncement in the Washington Post:

Interestingly the author of this article, Matt O’Brian, actually gets one thing right, although his conclusion remains utterly wrong – he writes:

“When you think about it, a bet on gold is really a bet that the people in charge don’t know what they’re doing.”

That’s exactly what it is Mr. O’Brian. The wrong conclusion he comes to is this one:

”But economists do, for the most part, know what they’re doing.”

Yes, in some parallel universe perhaps. That people can profess such beliefs after the twin debacles of the tech and housing bust and after yet another giant asset bubble has been blown by these “economists who know what they are doing” is truly stunning. How blind and naïve can one possibly be? This article is a good example of statist propaganda. Our wise leaders know what they are doing! How can anyone doubt it!

Meanwhile, the mirror image of bearishness, we see:

2015 has seen the largest amount ever raised in a biotech IPO, as well as the largest valuation for bio IPO with no drugs. via @IPOtweet. Can anyone guess how those investments will do over the next five years?

Additional Reading

A reader contributes: http://www.buffettfaq.com/ The blog has questions and answers of Buffett and Munger categorized by different parts of investing.

Common_Stocks_and_Uucommon_profits_and_other_writings.pdf

Also, worth a look: This Blog Analyzes Money Managers