Momentum Mauled: http://www.acting-man.com/?p=29724#more-29724

When momentum stocks crack, this is what it feels like: http://youtu.be/go9uekKOcKM

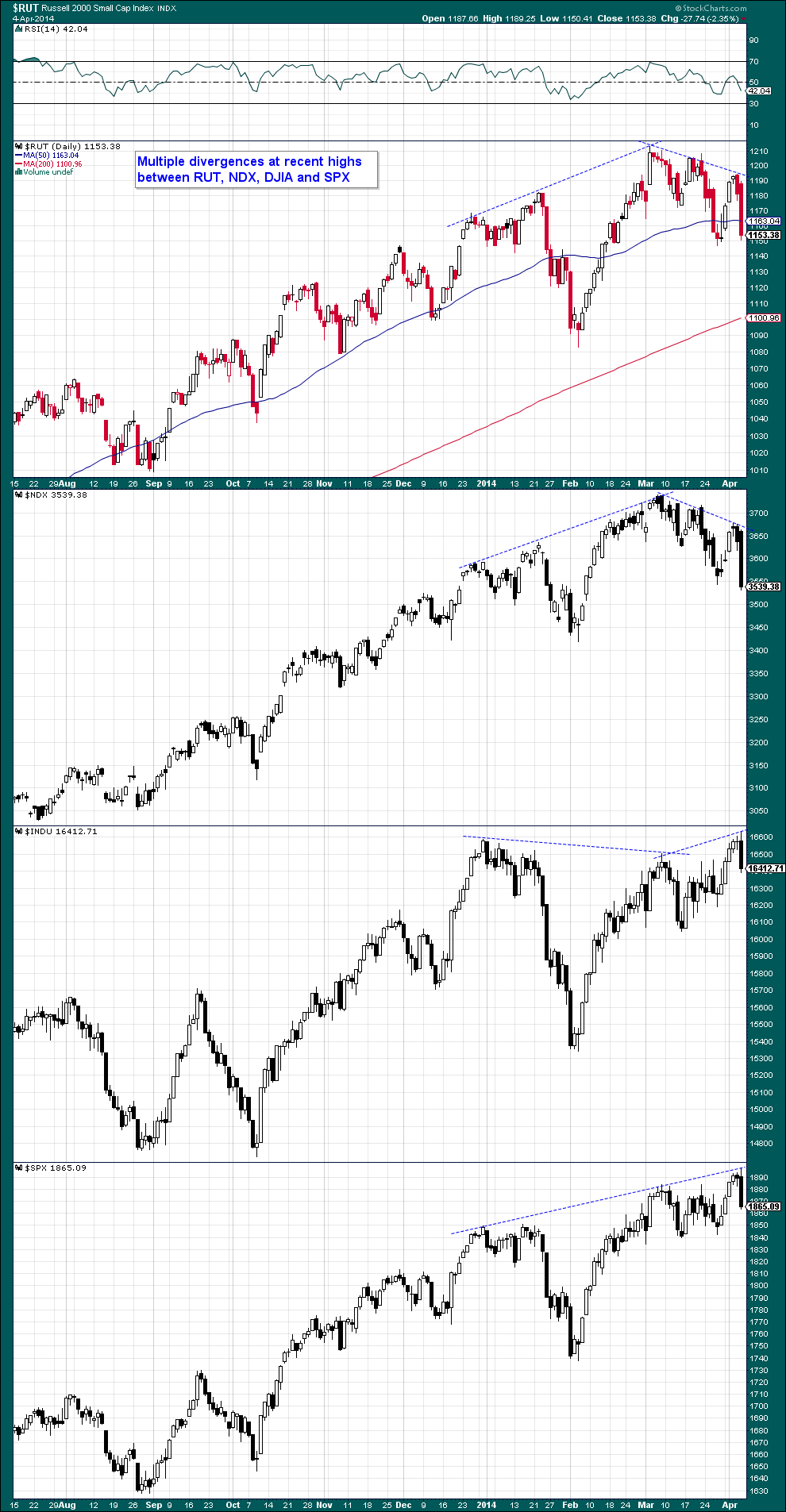

When retail investors blindly buy Yelp, Tesla, Concur Technologies, and IBB, I see:

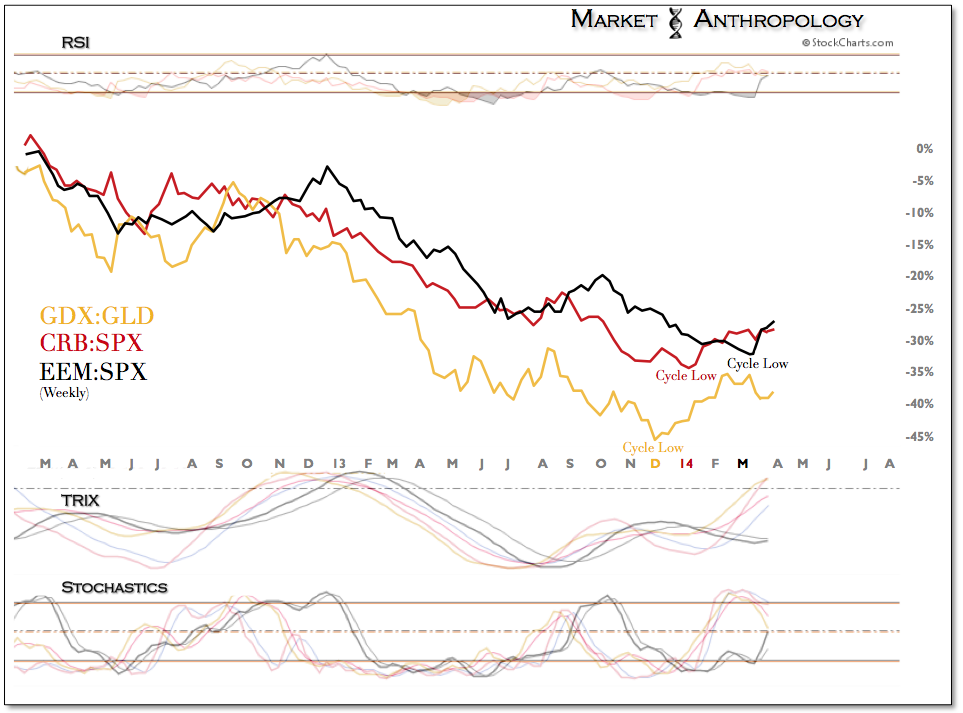

A reader asked if ABCT was helpful in timing purchases or sales. I don’t believe so, but you see where the canaries are beginning to die in the coal mine. If artificially manipulated interest rates–through the Fed’s manipulating the value of the currency (The Fed monetizes the debt through “quantitative easing” which is just currency debasement/printing up fiat currency)–cause mal-investment, then you would expect to see the first cracks in the most over-valued areas of the market first. Note the collapse of sub-prime in 2007 before the general equity collapse in 2008/09.

Here Ludvig Von Mises(1881 – 1973) explains, “The boom can last only as long as the credit expansion progresses AT AN EVER-ACCELERATED pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market.” Note that the Fed is “tapering” or buying fewer bonds with newly issued fiat currency. For the boom to continue, the Fed would need to VASTLY INCREASE the monetary madness.

This fractional reserve banking system allows banks to engage in credit creation by issuing notes and bank balances unsupported by any new wealth. Or the Fed simply creates the money out of thin air to purchase Treasury Debt from other individuals and institutions. Since money substitutes are created out of thin air, the whole process is a risky venture. On its face, such a practice would be fraudulent except that it has a legal basis whereby central banks give commercial banks the legal right to issue “counterfeit” money.

All the interference of free market prices by the Fed to lower interest rates just promotes business activity that would be uneconomic at normalized interest rates (read: a higher cost of capital). Can you be surprised when Tesla, Yelp or Pets.com (in 2000) are the first to plunge?

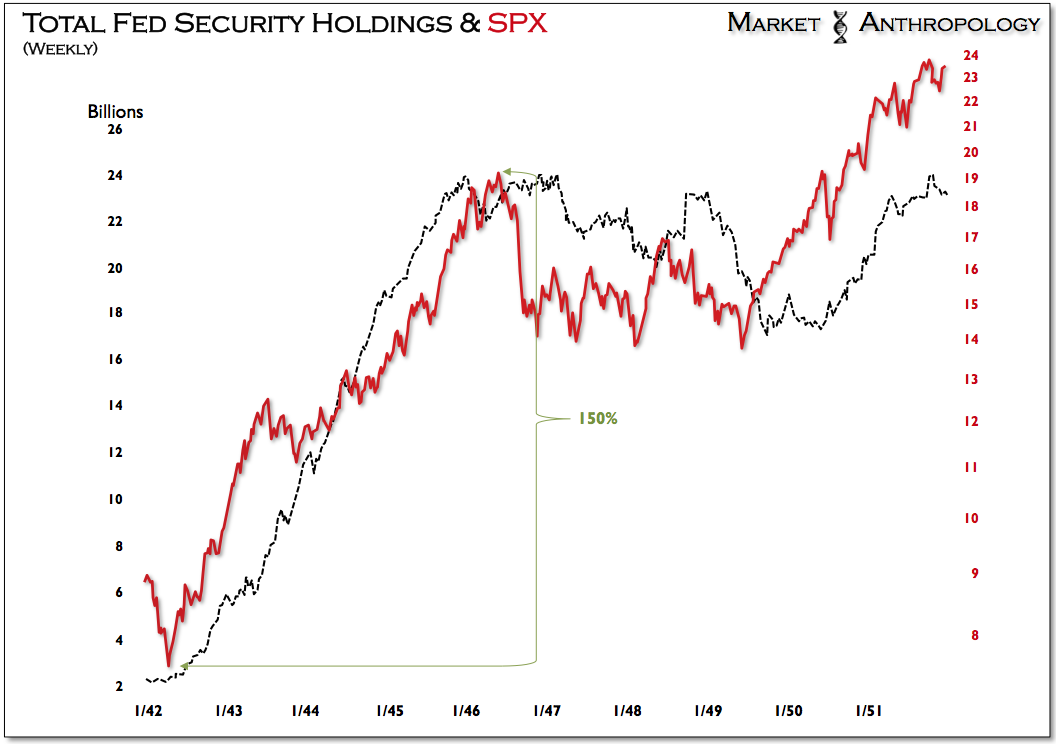

A great blog: http://www.marketanthropology.com/2014/04/a-staggered-start_7.html In the chart above, note the last time in the 1940s when the Fed was monetizing the government’s debt to pay for WWII.