A gold mine is a hole in the ground with a liar on top–Mark Twain

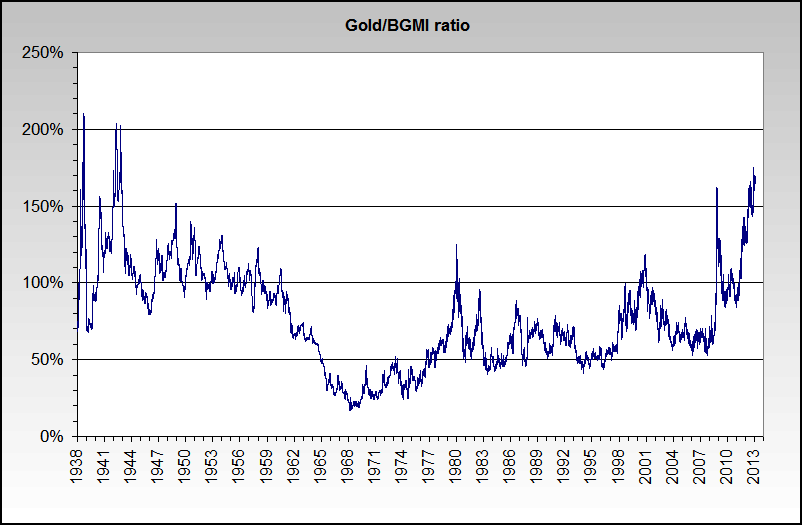

The above chart illustrates how historically cheap gold mining equities are to gold. Not since the Great Depression and Pearl Harbor have equities been so cheap on market cap to production, reserves and cash costs. See the XAU (Index of gold and silver miners) below as a percentage of the gold price–currently below the Great Recession lows of 2008:

For about six years, equities have under-performed due to poor management, rising input costs, dilution, and growth for growth’s sake. That’s the bad news. The good news is that many managements have been replaced and now the focus in on return ON capital. Dividend yields on the senior miners are above 20-year bond rates. The market is forcing managements to focus on returns and that bodes well for the future. And some input prices are falling. However, many weak companies will go bust leaving less competition for the survivors. Therefore, you must diversify into a basket of WELL-FINANCED Companies operating with good properties in safe jurisdictions for mining and, of course, with proven management. Mining is extremely risky. However, the historic cheapness of mining equities give you a margin of error, but choose wisely.

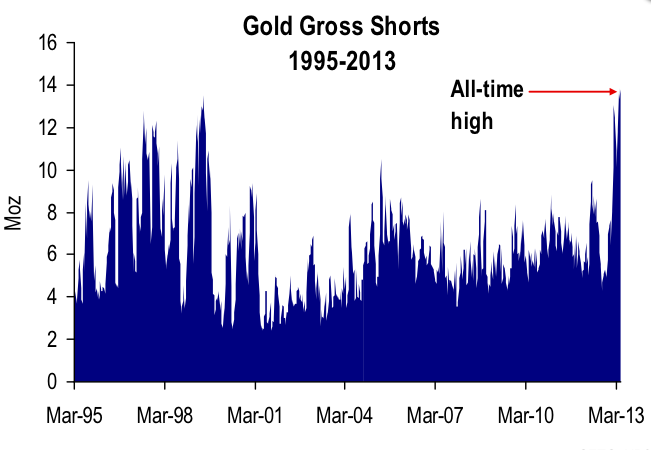

Pessimism is rampant:

Note below that for a risk-free asset, gold which has no counter-party risk, there is a closed end fund holding silver and gold bullion that trades at a 2% to 5% discount (A great way to buy bullion). People want out!

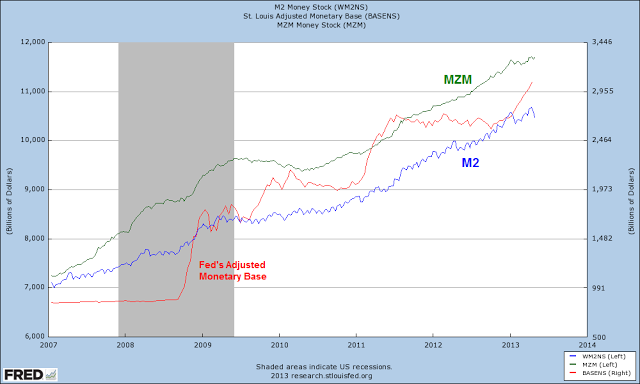

Monetary Mayhem is being overlooked (Many believe central banks have solved our debt problems and can eventually “exit” when the economy reaches “escape velocity.”) Ha! Ha!

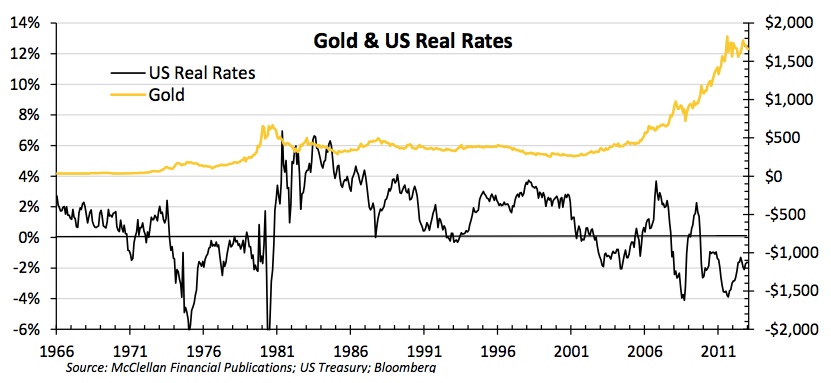

The last two charts illustrate growing debt that as the chart below will show below is being monetized–coupled with negative real interest rates–the current environment is conducive to higher gold prices. While Western speculators flee from ETFs, Chinese Grandmas rush to buy gold for their savings.

Real Interest Rates are supportive for gold

If the US government practiced fiscal discipline and interest rates were allowed to rise to their natural level, the bull market in gold would probably be finished. When your cab driver suggests that you buy gold for safety that will also be a read flag. Gold and precious metal miners and commodities, in general, are hated, shorted and/or ignored.

Meanwhile, investors have been flocking (some by selling their insurance like gold) to buy stocks, but risks are rising in the stock market due to higher valuations. Margin debt is near all-time highs, insiders have been selling, and a Barron’s poll recently had 75% of all money managers bullish. Of course, the majority expect gold prices to decline. Note the chart below indicates the stock market relative to its Q Ratio or replacement cost of asset, a proxy for value.

And sentiment is upbeat:

Going contrary to massive market sentiment is painful, but going where the bargains are greatest will lead to better returns and safety in the long run (2 to 5 years). Depressed prices alleviate a lot of your investment risk while elevated prices (MMM, CLX, and junk bonds) raise your risks.

But risks overall have never been so high due to central bank intervention into the credit markets. Be careful and have a great weekend. I will be back next week.