A Reader’s Question

I am a student at XXX. To cap off my summer internship, I am working on a series of projects which I will present to the investment team at my firm. One idea I would like to pursue is “Investing in a Rising Interest Rate Environment.” Are there any books/resources you would suggest for this project?

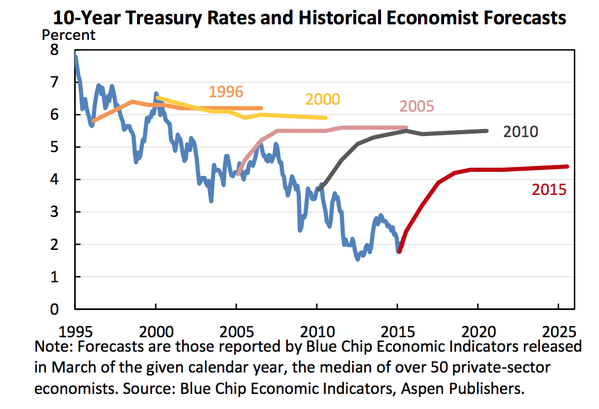

My response: Well, if you knew rates would rise over a long period of time (decades) then a ladder of short duration bonds would probably be wiser than 30- year Treasury bonds. But when you talk about interest rates–what rates? 3-month, 10 year? Government debt or corporate debt? Are real interest rates rising? You could have nominal interest rates rising while inflation is rising faster so real rates become more negative–sort of like today’s financial repression. You can’t just look at interest rates without looking at changes over time in commodity prices and producer prices.

Ask, “What is an interest rate?” Find out by reading Man, Economy and State by Murray Rothbard–see Chapter 6: Production: The Rate of Interest and its Determination. Go to www.mises.org/books/mespm.pdf

Two great books on financial history:

A History of Interest rates (4th Edition) by Sidney Homer and Richard Sylla.

The Golden Constant: The English and American Experience 1560 to 2007 by Roy W. Jastram (reprinted with additional material 2009). See a discussion here: alc56_golden_constant

The Golden Constant was the first statistical proof of gold’s property as an inflation hedge over the centuries–a seminal study.

What does the research say:

Gold is a poor hedge against major inflation and that gold appreciates in purchasing power in times of deflation. The conclusions make sense when you consider that gold prior to 1971 was considered money. When prices rise, then, by definition, the value of money declines relative to goods and services that money is exchanged for.

Since the 14th Century, gold’s purchasing power has maintained a broadly constant level. To put this in practical terms, an ounce of gold has repeatedly bought a mid-range outfit of clothing. This was true in the fourteenth century, when an ounce of gold was worth £1.25 to £1.33; it was true in the late 18th century and it remained true at the beginning of this century (2000 to 2008), when an ounce of gold averaged £269 or $472. Even the exchange rate between gold and commodities has been relatively constant over the centuries.

On the other hand, the US dollar that bought 14.5 loaves of bread in 1900 buys only 3/4 of a loaf today. While inflation and other forces have ravaged the value of the world’s currencies, gold has emerged with its capacity for wealth preservation firmly intact. Being no-one’s liability, gold exhibits the same wealth preserving qualities in the face of financial turmoil, earning a reputation as a crisis hedge in addition to its credentials as an inflation hedge.

The Golden Constant: The English and American Experience 1560-2007 by Roy W Jastram with updated material by Jill Leyland. Published 2009 by Edward Elgar Publishing Ltd (www.e-elgar.com), hardback, 368 pages, ISBN: 978 1 84720 261 1.

How about today?

But from 1971 the opposite is true and we revert to what we today consider the more normal situation of gold acting as a hedge against inflation, as in the 1970s, or the fear of inflation, as in recent times (2009). Note that gold may hold its purchasing power through the decades, there are substantial deviations in price as compared to an index–which index to use?

or………

The key takeaway after 453 years is that despite often substantial fluctuations, gold has held its purchasing power over the centuries in every country. A German family owning a certain quantity of gold at the end of the nineteenth century would find, if it still owned it today, that it would still buy approximately the same quantity of good and services. In contrast, any quantity of German currency held at the end of the nineteenth century would today be worthless.

Since gold is no one’s liability, it can be viewed as the alternative to fiat money. Investors turn to it when confidence in fiat money, and particular in the US dollar as the world’s leading fiat money, falls. However, gold, despite severe fluctuations, does hold its real value over the centuries and the fact that it has repeatedly shown its ability to safeguard wealth through crises.

History combined with a solid grasp of economic principles allows us to place even gold into perspective.