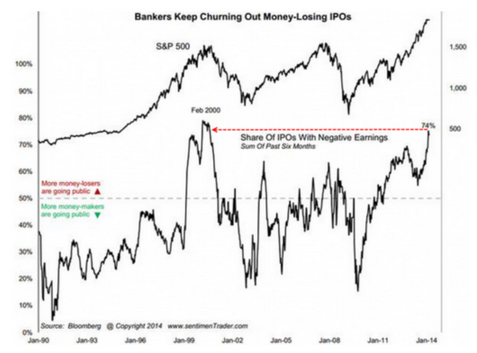

Today, staring fixedly back at the road they just traveled, most investors have rosy expectations. A … survey released in July shows that the least experienced investors – those who have invested for less than five years – expect annual returns over the next ten years of 22.6%. Even those who have invested for more than 20 years are expecting 12.9%. Now, I’d like to argue that we can’t come even remotely close to that 12.9% … In my opinion, you have to be wildly optimistic to believe that corporate profits as a percent of GDP can, for any sustained period, hold much above 6%. … Maybe you’d like to argue a different case. Fair enough. But give me your assumptions.

If you think the American public is going to make 12% a year in stocks, I think you have to say, for example, “Well, that’s because I expect GDP to grow at 10% a year, dividends to add two percentage points to returns, and interest rates to stay at a constant level.” Or you’ve got to rearrange these key variables in some other manner. The Tinker Bell approach – clap if you believe – just won’t cut it. — Warren Buffett

“Mr Buffett on the Stock Market” (Fortune, 22 November 1999)

Buffett_on_1999_Stock_Market_-_Fortune_Article & 2008 Market Call

A reader, Ruben, kindly pointed out Reisman’s book, Capitalism (see link below) and Chapter 16, The Net-Consumption/Net-Investment Theory of Profit and Interest.

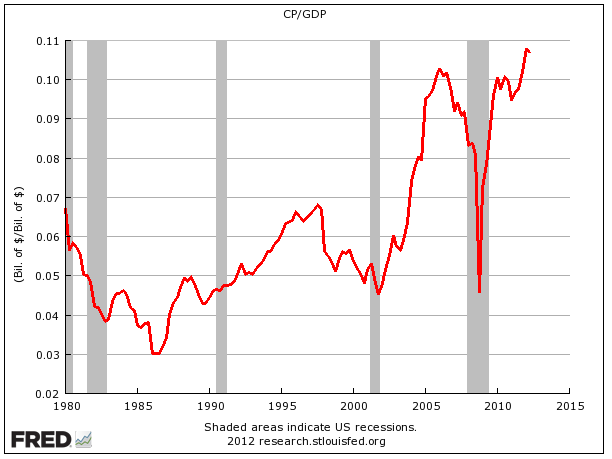

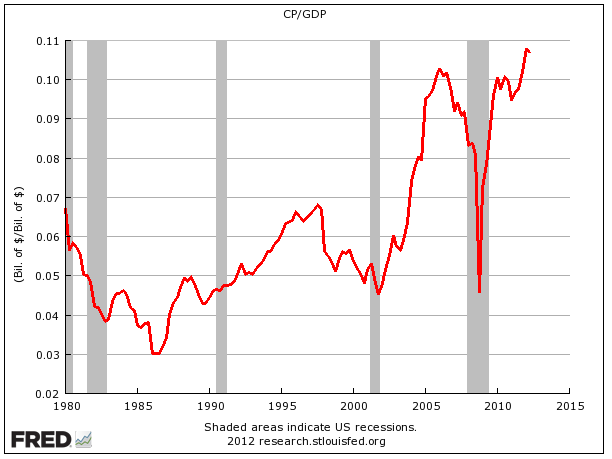

I have recommended the book, but I had not read Chapter 16. Thank heavens for the heads up. Now I am clear why HIGH profits are negative for the economy and why–unless deficit spending, money printing or QE INCREASE–then corporate profit margins will collapse, perhaps violently like in 2008/09–see chart above. You can understand the decision of CEOs not to invest much in the future while taking on debt to buy-in their shares.

From Chris Leithner’s letter on profit margins: http://www.leithner.com.au/newsletter/feb13_newsletter.pdf

Why is profit presently at a record high?

Because private domestic fixed investment stands at an all-time (since 1947) low; the supply of money as a percentage of GDP has reached a 40-year high; the government’s deficit has scaled unprecedented heights; and the government’s debt relative to GDP has returned to a level unknown since the Second World War. In short, the sickness – and NOT the strength – of the U.S. economy explains why profit has attained an unparalleled level. Capitalists’ saving, investment and pursuit of profit is the key to a higher standard of living. Their achievement of very high profits, on the other hand, reflects their fear of the future, particularly of the actions of the state (which Robert Higgs dubs regime uncertainty).

Reisman shows that a high rate of profit does not reflect a healthy pace of economic growth. Quite the contrary: it is a consequence of harmful circumstances – particularly unprecedented doses of the state’s monetary interventionism and fiscal profligacy. The mainstream does not grasp the fact that the existence of high profits is not (from the point of view of society as a whole) economically beneficial. It does not realise that to a significant extent the profits of recent decades are – because they derive from the government’s deficits and inflation – artificial and fraudulent (see pp. 26-27, 514-517, 927-928 and 957-963 in Capitalism by Reisman).

Implications for Investors

If (1) Reisman is correct, (2) I have understood him correctly and (3) deficits and debt cannot rise forever, then (4) at some point profits will cease to rise ever further into the stratosphere. The critical question is: will they plateau, recede gradually (i.e., as a result of the Fed’s astute “withdrawal of stimulus” and a “grand bargain” in the Congress) or abruptly (i.e., through a crisis)? Whether gradual or sudden, the end of unprecedented monetary and fiscal interventionism implies poorer profits; and if earnings drive stocks’ prices, as the mainstream stoutly maintains (they’ll likely change their mind if and when profits change course), then significantly smaller profits mean considerably lower prices. Perhaps shrunken profits and prices will encourage the mainstream finally to recognize the egregious errors they have committed for decades. In Marshall Auerback’s words (Are US Corporate Profits Inflated by Fraud? 18 January 2013), “it may be that investors will never know or care that U.S. corporate profits are greatly inflated by … fraud. But it is possible that such a reality may matter someday. It would be a negative for U.S. equity prices.” That’s putting it mildly.

If you only learn one thing this month let it be the concepts in Chapter 16 in – George Reisman’s book Capitalism: http://mises.org/books/capitalism.pdf

You can also read the partially flawed (See Leithner’s critique) – James Montier’s chapters 43-44: http://www.wertpapier-forum.de/index.phpapp=core&module=attach§ion=attach&attach_id=76874n on corporate profit margins.