Money transmits value, Mises taught, but money does not measure value. This distinction is fundamental in Mises’s theory of money. “Money is neither an abstract numeraire nor a standard of value or prices. It is necessarily an economic good and as such it is valued and appraised on its own merits, i.e., the services which a man/woman expects from holding cash. (Human Action, pp. 414-415). Gary North, Mises on Money

Money transmits value, Mises taught, but money does not measure value. This distinction is fundamental in Mises’s theory of money. “Money is neither an abstract numeraire nor a standard of value or prices. It is necessarily an economic good and as such it is valued and appraised on its own merits, i.e., the services which a man/woman expects from holding cash. (Human Action, pp. 414-415). Gary North, Mises on Money

Read more on the value of money: http://www.mises.org/daily/6380/The-Value-of-Money

What is, then, the best monetary policy? He argues that in light of his previous considerations “the state should at least refrain from exerting any sort of influence on the value of money. A metallic money, the augmentation or diminution of the quantity of metal available for which is independent of deliberate human intervention, is becoming the modern monetary ideal.”[17] He adds: “The significance of adherence to a metallic-money system lies in the freedom of the value of money from state influence that such a system guarantees.”[18]

The Case for Owning Gold Has Collapsed; Yellow metal could be headed much, much lower http://is.gd/h5KW6v. Gold could be headed not much lower, but much much lower. This was written on April 18, when the value assigned to the monetary relic (AKA its nominal price) resided at $1391 per ounce. So be warned, Mr. Gold advises that gold could go much much lower. Gold bugs take heed; Mr. Gold himself has put the double ‘much’ whammy on you!

The article: The Gold Dilemma. The article is riddled with logical fallacies. Using CPI and GDP to measure anything meaningful is a fantasy–even forgetting that those indexes are politically constructed by bureaucrats.

Another view of gold’s history: 99816519-Special-Report-Gold-2012-In-GOLD-We-TRUST.

Why I own gold bullion–as a hedge against monetary chaos. Own what the government can’t print.

All the Silver Ever Mined

All the Silver Ever Mined

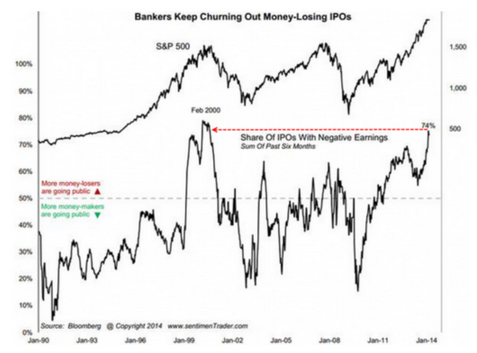

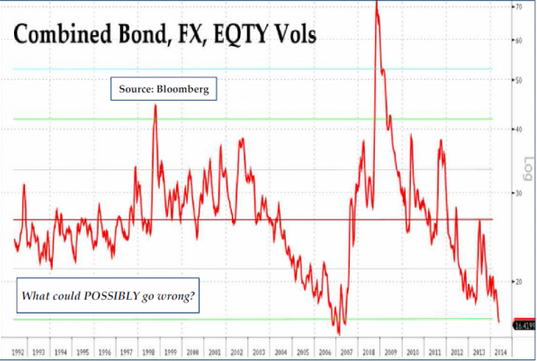

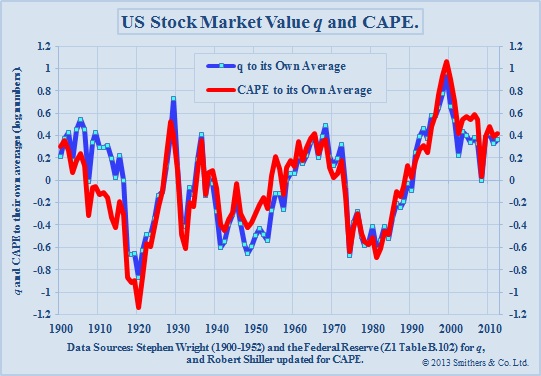

A reader’s question from the prior post: Am I 100% in cash? No, I have cash, gold bullion, selected precious metals mining companies, a few other companies, and a tiny short position in certain stocks like GE and CRM. If you think holding on through thick and thin after buying at the highs EVEN with UNSUSTAINABLE Fed manipulation of money and credit is a good plan, then view page 8 here: A Lesson in Financial History by Mish. Also, for more perspective on the unsustainability of current corporate mean-reverting profit margins see: An Unsustainable Equilibrium_Hussman. View the video presentations here and consider a donation to cure ALS: http://www.winecountryconference.com/2013-speaker-presentations/. People love to follow the crowd and momentum while mal-investment increases, so expect more S&P 500 movement to the upside until–unexpectedly–a surprise hits and people need to sell their “hot potato.”

But if you own great franchises at good prices then you have few worries. I wish I could find them now.

Short the SPY and Long PHYS for fun (not for real) at the highest offer for PHYS ($10,000 at $12.30 for PHYS) and lowest bid for SPY ($10,000 shorted at $158.10) on April 25 and lets see where we are in 12 months.

Short the SPY and Long PHYS for fun (not for real) at the highest offer for PHYS ($10,000 at $12.30 for PHYS) and lowest bid for SPY ($10,000 shorted at $158.10) on April 25 and lets see where we are in 12 months.

Update on April 29, 2013: