Reading History

A reader asked me via email about what books to read to understand history. Please post your questions in the comments section because I most likely will lose your email–let others see your thoughts.

The book is here http://mises.org/rothbard/panic1819.pdf also read http://mises.org/books/desoto.pdf especially pages 476 to 508 (Empirical evidence of business cycles).

Then read with a critical eye: Fifty Years in Wall Street by Henry Clews (1908) and A Nation of Deadbeats by Scott Reynolds Nelson

Then The Great Bull Market, Wall Street in the 1920s by Rober Sobel

Move on to America’s Great Depression: http://mises.org/rothbard/agd.pdf

Then read Wall Street, A History by Charles R. Geisst.

That will get you started. Don’t forget to read more general history as well such as The Rise and Fall of the Third Reich-the mother of all bear markets for the human race. Couple that with Winston Churchill’s books on European history and WWII for another perspective.

Assessing Managements (See pages 7-9) Assessing Management

The Problem at JC Penney

Here is a good article that captures the problem at JCP. Essentially a retailer owns or leases space to sell goods to customers. The wider the mark-up and/or the faster the turnover of goods, the greater the profits, return on capital, etc. JCP HAS to get customers in the door AND then get them to buy–obviously. I don’t agree on all the comparison (Costco vs. a Dept. Store) in the graphs, but you get the picture.

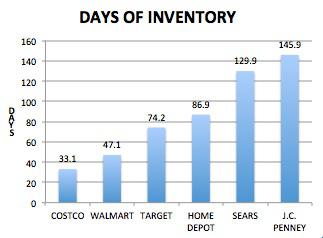

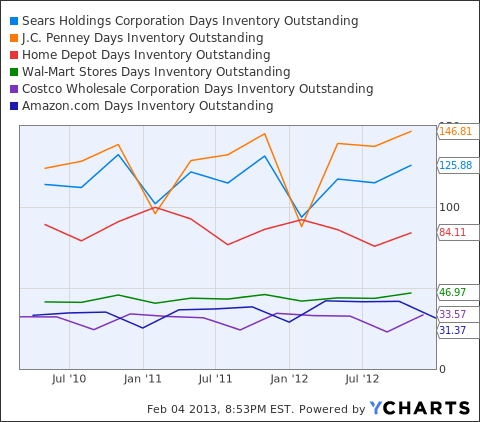

(Days of Inventory = Inventory/Cost of goods x 365 days. Data courtesy of Morningstar.com in TTM time frame.)

http://seekingalpha.com/article/1159231-j-c-penney-and-searsmore-museum-than-store

Any slower inventory management and Penney and Sears might as well advertise in Frommer’s Guide to museums.

Make no mistake: Sears (SHLD) and J.C. Penney (JCP) act more like museums than retailers. They’ve become simply corridors to get to the rest of the mall. The tip off: The two can’t unload their inventory. Goods move at a trickling pace and it’s killing the bottom line.

Check the length of time it takes these brick-and-mortar retailers to move their goods: Costco (COST), Wal-Mart (WMT), Target (TGT), Home Depot (HD), Sears and J.C. Penney. The chart shows how long it takes to turnover inventory. The longer the days of inventory, the longer dollars are tied up.

http://seekingalpha.com/article/439101-have-sears-and-j-c-penney-become-museums

I think Buffett said, “Don’t look for seven foot walls to scale but three inch bumps to step over.”

Finding Quality Stocks

http://greenbackd.com/2013/03/04/how-to-find-high-quality-stocks/

The Quality Dimension of Value Investing

try to couple that with a fair/good price.

2 responses to “Suggested Reading”