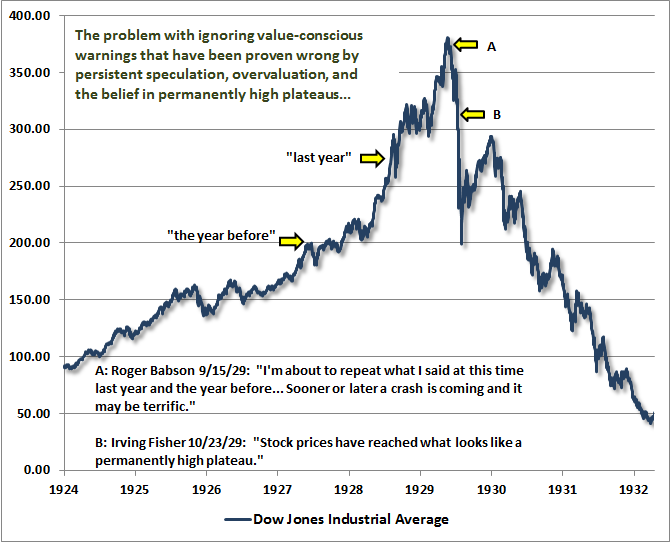

It’s the timing. Babson was two years early, so by the time the bubble peaked, no one cared. Sort of like today with six years of easy money/credit and rising prices in the US stock markets.

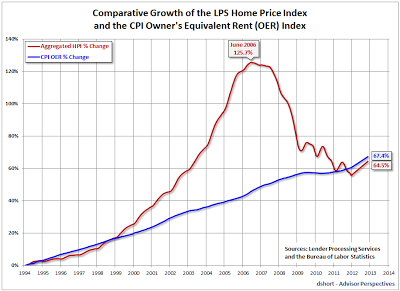

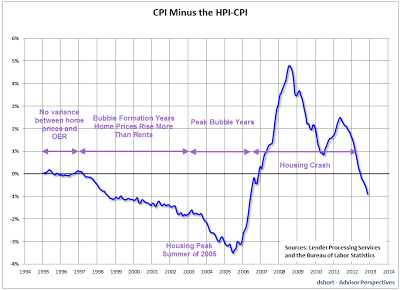

Note the housing bubble. Home prices were far above owner’s equivalent rent (the cash flow/income to support home prices) in 2002/2003 but then two to three years later the apex was reached. Soros in his theory of Reflexivity would propose to ride the bubble knowing you were in a bubble and then reversing course once it burst (the most marginal buyer has bought). Not easy in the hurly-burly world of investing.

2 responses to “The Problem with Bubbles”