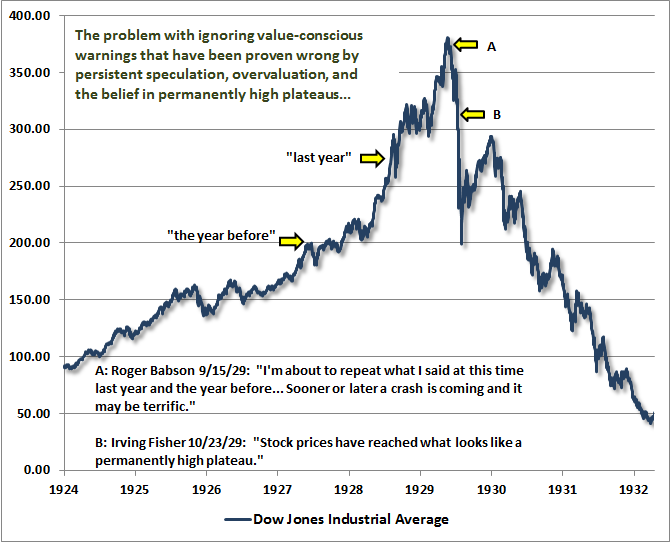

I have started to develop a set of generalizations along these lines by introducing the concept of reflexivity. Reflexivity can be interpreted as a two-way feedback mechanism between the participants’ expectations and the actual course of events. The feedback may be positive or negative. Negative feedback serves to correct the participants’ misjudgments and misconceptions and brings their views closer to the actual state of affairs until, in an extreme case, they actually correspond to each other. In a positive feedback a distortion in the participants’ view causes mispricing in financial markets, which in turn affects the so-called fundamentals in a self-reinforcing fashion, driving the participants’ views and the actual state of affairs ever further apart. What renders the outcome uncertain is that a positive feedback cannot go on forever, yet the exact point at which it turns negative is inherently unpredictable. Such initially self-reinforcing but eventually self-defeating, boom-bust processes are just as characteristic of financial markets as the tendency towards equilibrium.

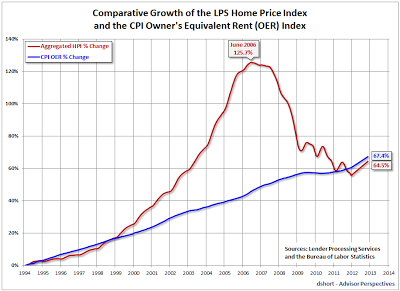

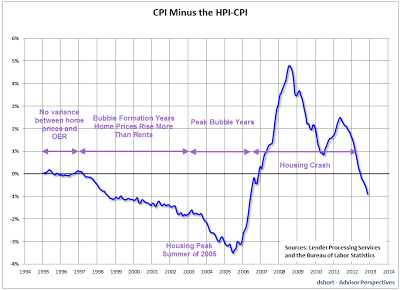

Instead of a universal and timeless tendency towards equilibrium, equilibrium turns out to be an extreme case of negative feedback. At the other extreme, positive feedback produces bubbles. Bubbles have two components: a trend that prevails in reality and a misconception relating to that trend. The trend that most commonly causes a bubble is the easy availability of credit and the most common misconception is that the availability of credit does not affect the value of the collateral. Of course it does, as we have seen in the recent housing bubble. But that’s not sufficient to fully explain the course of events.

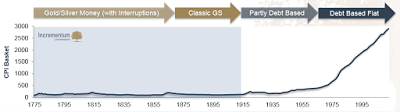

I have formulated a specific hypothesis for the crash of 2008 which holds that it was the result of a “super-bubble” that started forming in 1980 when Ronald Reagan became President of the United States and Margaret Thatcher was Prime Minister of the United Kingdom. The prevailing trend in the super-bubble was also the ever-increasing use of credit and leverage; but the misconception was different. It was the belief that markets correct their own excesses. Reagan called it the “magic of the marketplace”; I call it market fundamentalism. Since it was a misconception, it gave rise to bubbles.

Read more…

- Soros Anatomy of a Crisis

- George-Soros-Theory-of-Reflexivity-MIT-Speech