subscription

Categories

Do you want the keys to the Value Vault?

Simply send an email to aldridge56@aol.comTag Cloud

AAPL ABCT Ackman Austrian Economics bitcoin Blogs books Bubbles Buffett business Case Study Competition Demystified Contrarian Cuba Deep Value Economies of Scale economy Federal Reserve Franchises Gold Gold Stocks Graham Greenwald History inflation James Grant Klarman Learning Lectures miners Mises money Munger Politics Risk ROIC Rothbard Strategic Logic Strategy The Fed valuation Value Investing Resources Value Vault Videos WMT-

Recent Posts

Tag Archives: Soros

The Problem with Bubbles

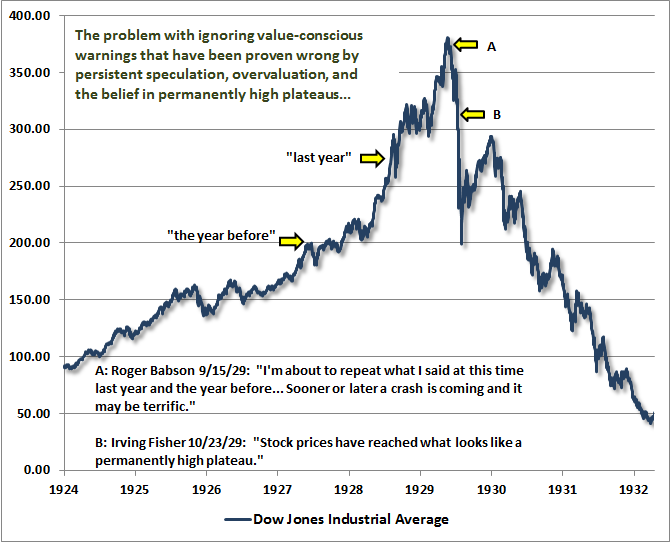

It’s the timing. Babson was two years early, so by the time the bubble peaked, no one cared. Sort of like today with six years of easy money/credit and rising prices in the US stock markets.

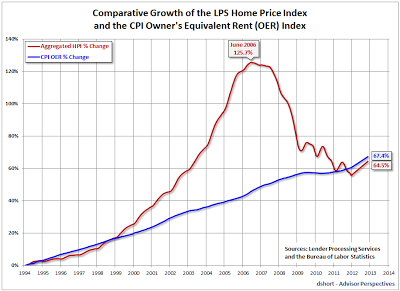

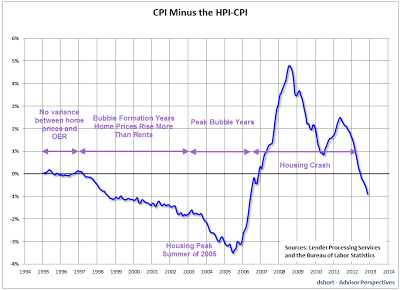

Note the housing bubble. Home prices were far above owner’s equivalent rent (the cash flow/income to support home prices) in 2002/2003 but then two to three years later the apex was reached. Soros in his theory of Reflexivity would propose to ride the bubble knowing you were in a bubble and then reversing course once it burst (the most marginal buyer has bought). Not easy in the hurly-burly world of investing.

Soros on the 2008 Crisis and Reflexivity (History)

I have started to develop a set of generalizations along these lines by introducing the concept of reflexivity. Reflexivity can be interpreted as a two-way feedback mechanism between the participants’ expectations and the actual course of events. The feedback may be positive or negative. Negative feedback serves to correct the participants’ misjudgments and misconceptions and brings their views closer to the actual state of affairs until, in an extreme case, they actually correspond to each other. In a positive feedback a distortion in the participants’ view causes mispricing in financial markets, which in turn affects the so-called fundamentals in a self-reinforcing fashion, driving the participants’ views and the actual state of affairs ever further apart. What renders the outcome uncertain is that a positive feedback cannot go on forever, yet the exact point at which it turns negative is inherently unpredictable. Such initially self-reinforcing but eventually self-defeating, boom-bust processes are just as characteristic of financial markets as the tendency towards equilibrium.

Instead of a universal and timeless tendency towards equilibrium, equilibrium turns out to be an extreme case of negative feedback. At the other extreme, positive feedback produces bubbles. Bubbles have two components: a trend that prevails in reality and a misconception relating to that trend. The trend that most commonly causes a bubble is the easy availability of credit and the most common misconception is that the availability of credit does not affect the value of the collateral. Of course it does, as we have seen in the recent housing bubble. But that’s not sufficient to fully explain the course of events.

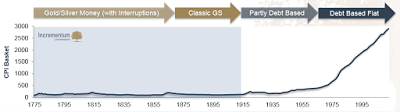

I have formulated a specific hypothesis for the crash of 2008 which holds that it was the result of a “super-bubble” that started forming in 1980 when Ronald Reagan became President of the United States and Margaret Thatcher was Prime Minister of the United Kingdom. The prevailing trend in the super-bubble was also the ever-increasing use of credit and leverage; but the misconception was different. It was the belief that markets correct their own excesses. Reagan called it the “magic of the marketplace”; I call it market fundamentalism. Since it was a misconception, it gave rise to bubbles.

Read more…

Posted in Economics & Politics, Investing Gurus

Tagged 2008 Crisis, History, Reflexivity, Soros

Investing “Guru” Mark Tier’s Interview

In finance, you cannot easily prove a model right by observation. Data are scarce and, more importantly, markets are arenas of action and reaction, dialectics of thesis, antithesis and synthesis. People learn from past mistakes and go on to make new ones. What is right in one regime is wrong in the next.

In finance you play against God’s creatures, agents who value assets based on their ephemeral opinions. Can you comprehend other pretenders’ uncertainty?–Mark Bradbury

Mark Tier, An “Austrian Investment Guru”

Mark Tier on Effective Investing, Where the World Is Headed and Why Financial Literacy Helps

Sunday, February 26, 2012 – with Anthony Wile

My lessons: Austrian economics is important for understanding reality but beware of being a macro-economist. Mark Tier filed as an investor but then learned from Soros and Buffett. If he can, you can too!

Excerpt:

Mark Tier: I’m from Australia but in 1977 I moved to Hong Kong. I’m still based there, but I spend most of my time these days in the Philippines. In a sense I’ve been a nomad all my life. My father was in the army so we rarely spent more than three years in any one place. We ended up in Canberra − that’s Australia’s equivalent of Washington − where I went to high school and university.

I studied economics and political science at the Australian National University. In my final year of economics I discovered Ludwig von Mises (thanks to Ayn Rand). In what should have been my last exam I made a fundamental mistake: I argued from Mises’ perspective against the examiners. So I had to repeat that final year to get the degree.

Then, when I got out into the real world, I found that I had to unlearn pretty much everything I’d been taught. (I also had to struggle to unlearn nonsense economics from university).

My professors were all Keynesians; reality is Misesian.

Daily Bell: Bring us up to the present and how you began to focus on investing.

Mark Tier: I’ve always wanted to be a writer. When I was 14, I’d get up early and pound an ancient typewriter for a couple of hours before going to school.

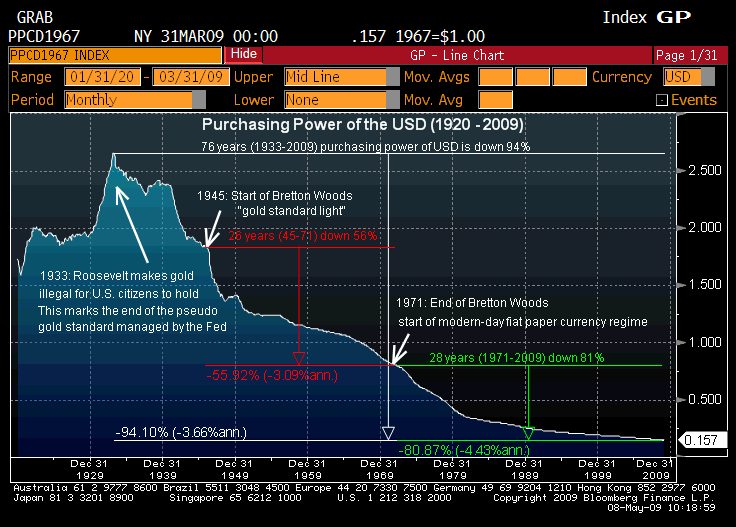

After graduating, I started writing a book that was published as Understanding Inflation (and became an Australian bestseller in 1974). I put an ad in the back for an investment newsletter − and I’ve been “unemployable” ever since. When I moved to Hong Kong I renamed it World Money Analyst. In 1991 I sold it and “retired.” That lasted about three months. I was a partner in another newsletter business for a few years. Since 2000 or thereabouts, I’ve written three books and am now working on a couple of others.

Daily Bell: What’s your track record been like?

Mark Tier: Actually, until I figured out what became The Winning Investment Habits of Warren Buffett & George Soros, lousy.

Ironically, in the World Money Analyst I advised other people what they should do with their money. My own forays into the market usually ended with burnt fingers.

Once I applied (starting in 1998) what I call the 23 “winning investment habits” to my own investing, everything changed.

For the next six years my personal stock investments went up an average of 24.4% per year − compared to the S&P’s 2.3% − without a single losing year, compared to three for the S&P. A major, major transformation.

I can’t tell you my precise track record since then as I stopped keeping track of it. Put it this way: except for a dip in 2008, my net worth has gone up or remained stable. And that’s after paying the rent, putting food on the table, putting four kids through private schools and university, and indulging in vices like latest electronic gadgets and expensive cigars.

And when I get up in the morning, I have the luxury of choosing to do whatever I want to do with my day. Mostly, I write.

Entire interview here:http://www.thedailybell.com/3644/Anthony-Wile-Mark-Tier-on

Mark Tier’s web-site and books on investing:http://marktier.com/Main/index.php

Video lecture on smoking and property rights:http://www.youtube.com/watch?v=udlouHR4YcQ

Audio Interview: http://www.la.org.au/audio/221011/interview-mark-tier

Posted in Investing Gurus, Uncategorized

Tagged Austrian Economist, Mark Tier, Mises, Property Rights, Soros