A beginning analyst sent me a research report to discuss: Ensco PLC Write-Up

A beginning analyst sent me a research report to discuss: Ensco PLC Write-Up

Now before I start, realize that when I was beginning, my idea of a research report was to mimic Cramer. Buy because the “chart” looks good and I gotta feelin’. One time my hedge fund boss said his time was worth $1,000 an hour so the six minutes he took to read my incoherent report meant that I OWED HIM, $100. Well, we all have to start somewhere. The point of this exercise is to learn.

Buffett’s  idea may apply. If you only had twenty investment ideas over a lifetime–one every two to three years–would this be it? Would you put all of your money and family’s money into the idea and why?

idea may apply. If you only had twenty investment ideas over a lifetime–one every two to three years–would this be it? Would you put all of your money and family’s money into the idea and why?

Or, you pretend that you have a 45-second ride in the elevator to the top of the Time Warner building with Carl Icahn while selling your idea.

Bill Miller once said that money managers had the attention span of knats. You had to summarize your thesis and then give three or four supporting reasons within thirty seconds.

My critique of Ensco PLC

Instead of four paragraphs to tell me what Ensco does, perhaps you can be more succinct while putting forth what is compelling about your investment thesis.

ESV (Ensco, PLC) is an owner/operator of offshore contract drilling rigs/services that is trading at X% under tangible book value. This is a cyclical, asset-intensive business subject to swings in natural gas and oil prices. Over a fully cycle, the company earns normal returns on capital of XX?

The price: Enterprise Value

Returns: over several prior cycles?

Capital structure and terms of debt?

Bottom line: this is a non-franchise or asset-based investment that is currently and cyclically out of favor. OK. But if this is an asset based business what are the assets worth? You would need to dig into tangible book–what is there? What is the current and expected replacement value of their assets? Liquidation value? Is their fleet of rigs unique? Who are their competitors? Any hidden assets or potential assets like, say, NOLs or assets outside their core business for example?

What is their cash flow and owner earnings? I would like to see enterprise value over EBITDA-MCX over the past decade to get an idea of how the market priced ESV over a cycle.

Who is management? What skin do they have in the game? Are they good operators and capital allocators? Insider buying? Who owns this company? I don’t have much to go on in the above report so I jump to my handy VL: ESV_VL. Whoa! I see debt has jumped about 35% from 2013. How does their capital structure compare to competitors? It seems like there isn’t much free cash flow. Capex eats up most of the company’s cash flow.

Where is the margin of safety? Book value has been growing but during an up-cycle in drilling. What happens in a prolonged down-cycle? What are the risks? You mention a DCF? Where did that come from? Your assumptions?

I will let others in the Deep-Value group chime in, but for a first-ever research report I give a D- which isn’t bad. At least the writer has good instincts to look at an out-of-favor company, but the core analysis of the assets needs to be provided. Also the competitive landscape. Obviously, it is a business without a competitive advantage due to the low and cyclical nature of the returns, so how does this business compare operationally, financially and value-wise to their main competitors? Who are their customers and how are they faring?

The only way to improve is to write, practice and look at other reports. Go to www.valueinvestorsclub.com and sign up. Then look at the highest rated ideas and study those along side the 10-K of the company mentioned.

Study Other Examples of Research

Or The_Security_I_Like_Best_Buffett_1951 Warren Buffett on Geico.

https://sumzero.com/sp/bc_winner (you may have to paste into your browser) and as reference, Rockwell Automation Inc and ROK_VL from a Deep-Value member, Thomas Harris. We can critique this next if you wish.

Carl Icahn paid $500,000 for an investment bank to furnish a report on breaking up Time-Warner: lazard_twx (worth a look!) and Icahn was right about Time Warner

Analyzing Debt

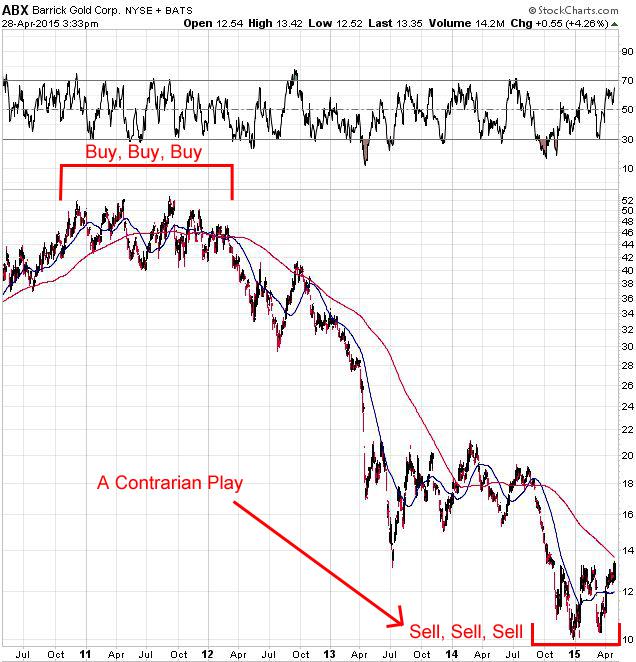

ABX Sombull along with Barrick Annual Report 2014 and Barrick 1 Q 2015

https://www.coursera.org/learn/learning-how-to-learn

http://en.wikipedia.org/wiki/How_to_Read_a_Book

Stay with it………writing is hard and finding great ideas even harder.

7 responses to “Don’t Spare the Rod: Critique of Investment Research Reports”