Continuing from where we left off in the capitulation series, a case study, http://csinvesting.org/?p=11351

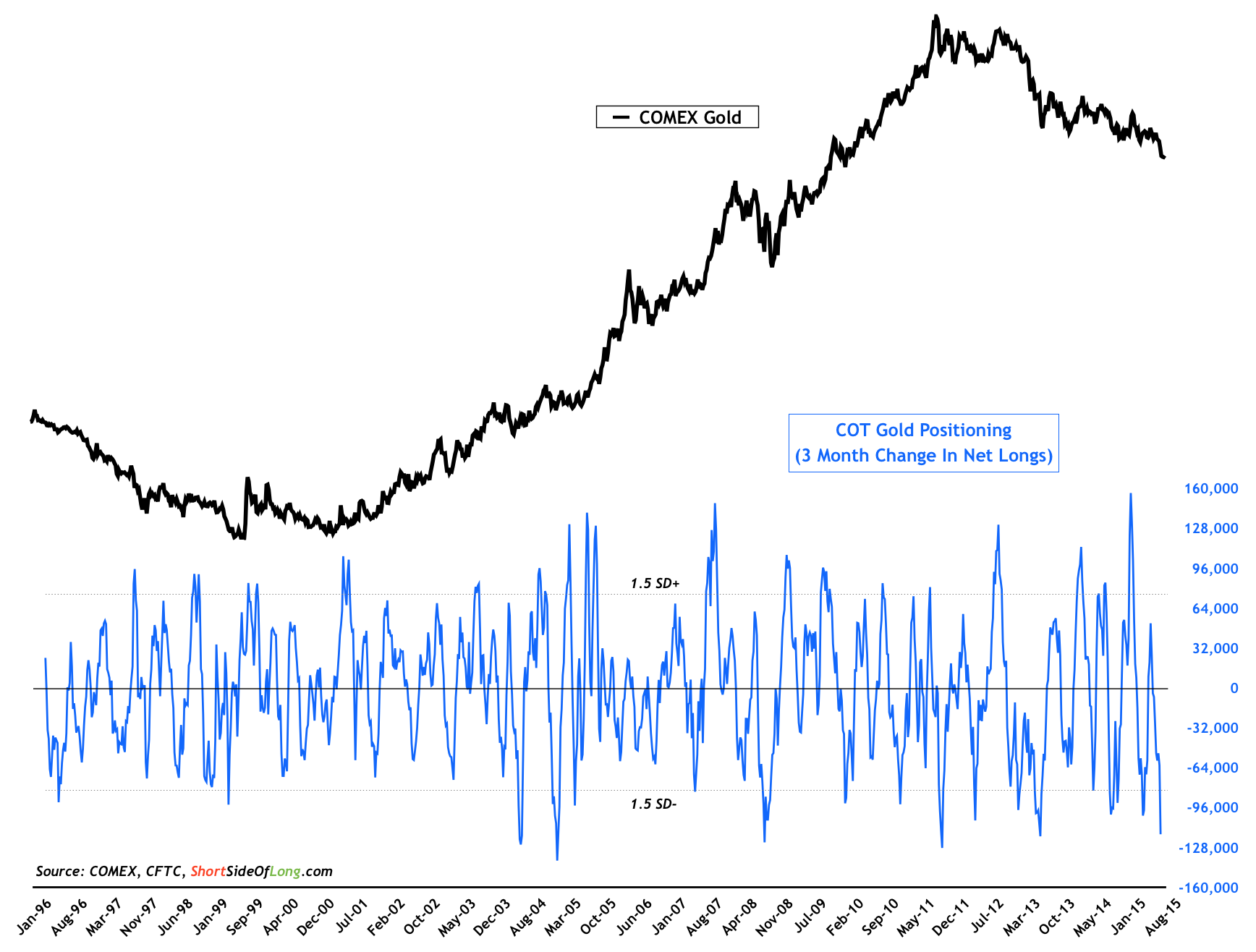

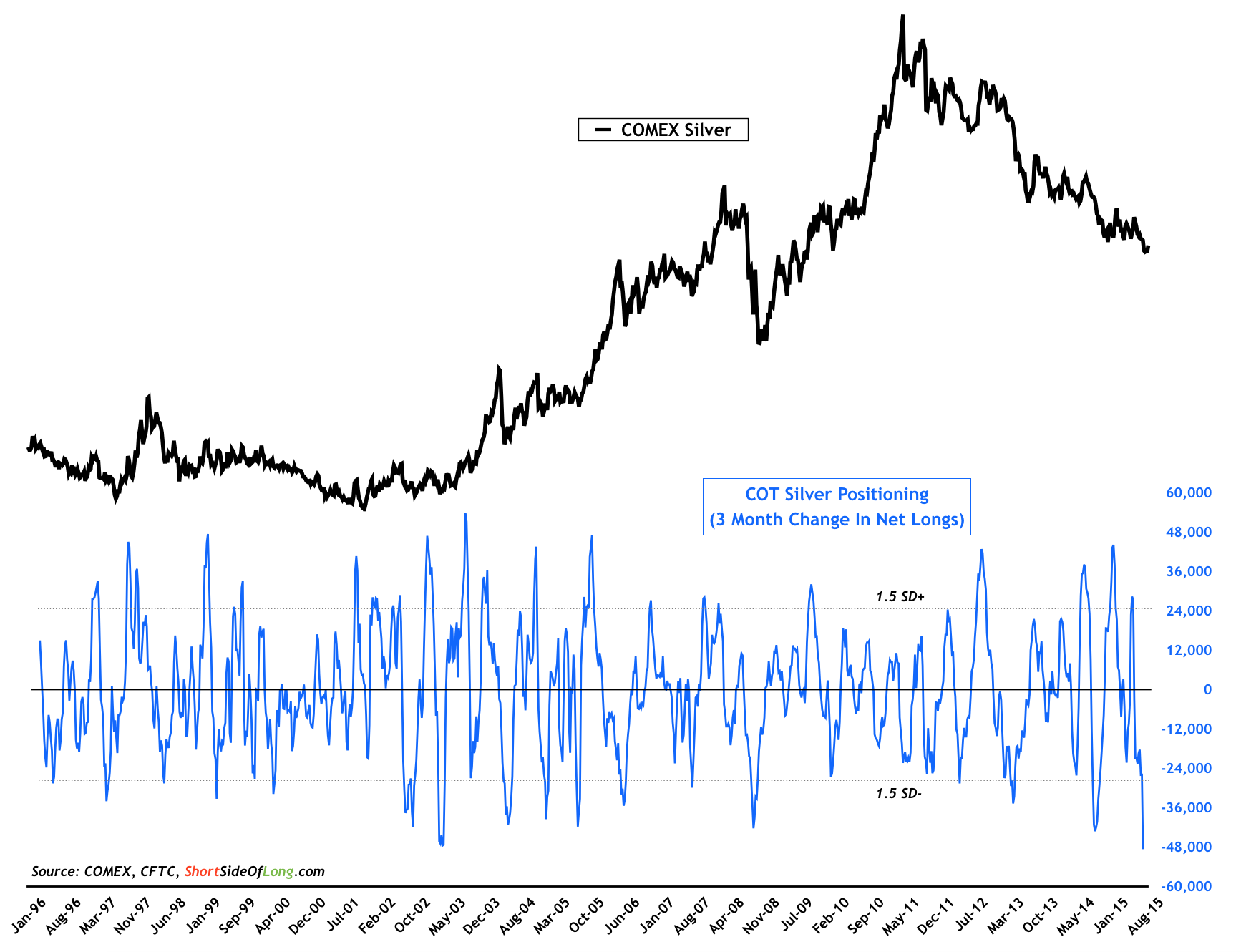

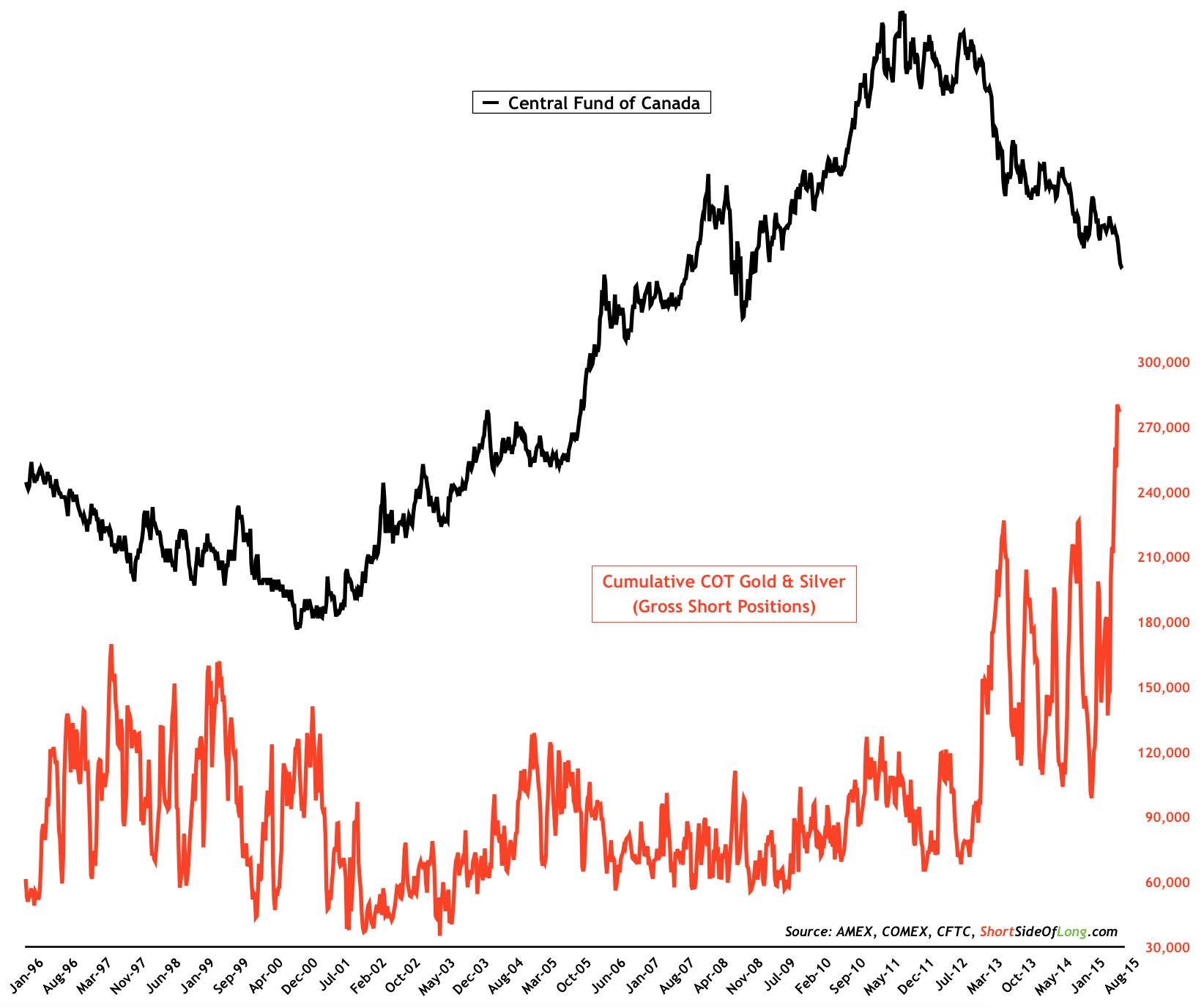

The above charts show the massive swing in sentiment as speculators moved from long to short expecting gold to fall INEVITABLY to $1,000 or so the pundits say:

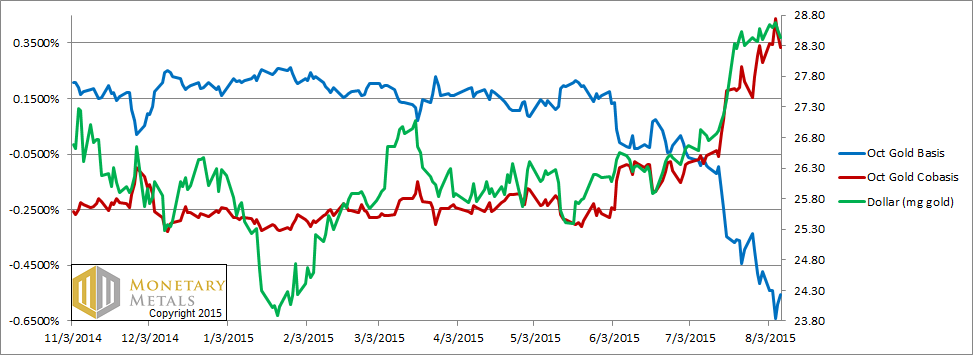

Demand for gold bullion remains stronger than the supply offered through the futures market–the co-basis is rising:

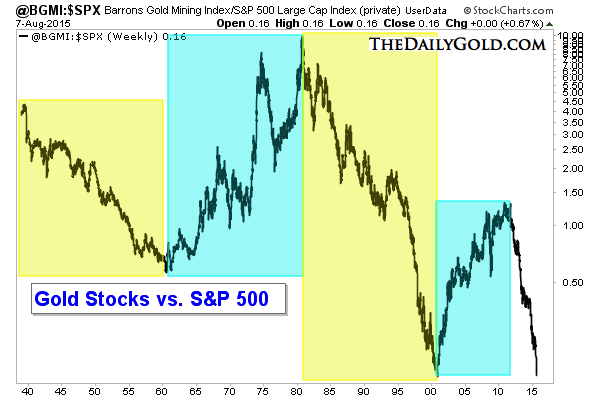

Meanwhile, could divergences be developing in miners vs. gold? Note prior bottoms in 1986 (bear market rally) and 2000, the beginning of a major rally.

Mining stocks shunned

This post is not a recommendation but compiling the case study of capitulation in gold and associated miners. Remember Why Gold Mining is a Tough Business_Pollitt (a MUST read!) and Why-is-gold-mining-such-a-crappy-business Summary and…

http://thefelderreport.com/2015/07/21/its-time-to-get-greedy-in-the-gold-market/ John Chew: Don’t ever just concentrate in one gold stock since the company and operational risks can be high. SDGJ by Sprott offers diversification and sensible companies. Sprott Junior ETF Mining. Why even consider investing in such a bad industry? Because of price and the counter-cyclical nature of these stocks. You buy when the industry is losing money and hated and sell when the pundits recommend it and the trend is forever extrapolated higher. There is no law that miners won’t go lower; miners are extremely volatile moving up and down 10% in one day.

What Happens When You Buy Assets Down 80%? farber

We’ve done a lot of articles on value and drawdowns on the blog before (search the archives). I was curious what happens when you bought the US equity sectors back when they were really hammered (French Fama to 1920s).

Average 3 year nominal returns when buying a sector down since 1920s:

60% = 57%

70% = 87%

80% = 172%

90% = 240% The average of 80% to 90% down is a triple.

Average 3 year nominal returns when buying an industry down since 1920s:

60% = 71%

70% = 96%

80% = 136%

90% = 115%

Average 3 year nominal returns when buying a country down since 1970s:

60% = 107%

70% = 116%

80% = 118%

90% = 156%

2 responses to “Capitulation in Gold (Continued….)”