- Bronte Capitals Comments on Valeant Conference Call The Bronte posts will give you a thorough background on the controversies surrounding Valeant and Philidor.

- Valeant and its captive pharmacies-Bronte Capital

- Simple Proof that Philidor has shipped drugs where not licensed

A torrent of SeekingAlpha articles:

You can follow the reactions of investors and analysts at Seeking Alpha.

Hedge Fund Herding The psychological aspects of following others and the pressures of the short-term performance derby. Lesson: Never cease to do YOUR own thinking and analysis.

Ackman down 16% and will hold CC on Valeant this Friday (Oct . 30th) Below are charts of Ackman’s portfolio. The sharks front-run the potential liquidation as Ackman’s investors go queasy.

Link to CC on this Friday at 9 AM EST

Readers should share if they believe there are actionable lessons here for investors in terms of psychology, portfolio management and analysis. Time is precious so we need to learn the important lessons.

My take-away so far.

First, Valeant’s Low Valuation and Rip Roaring Growth (Aug. 20th 2015 by Barrons Note the author’s focus on growth–but IF that growth is not sustainable within a franchise (protected above the cost of capital profit margins) then cause this: changed investor expectations:

And that ladies and gentlemen is called a permanent loss of capital IF investors paid too much for growth in a company doing roll-ups of commodity-like products (generic drugs) at unsustainable retail prices (competition and insurer push-back will cap price gains).

—

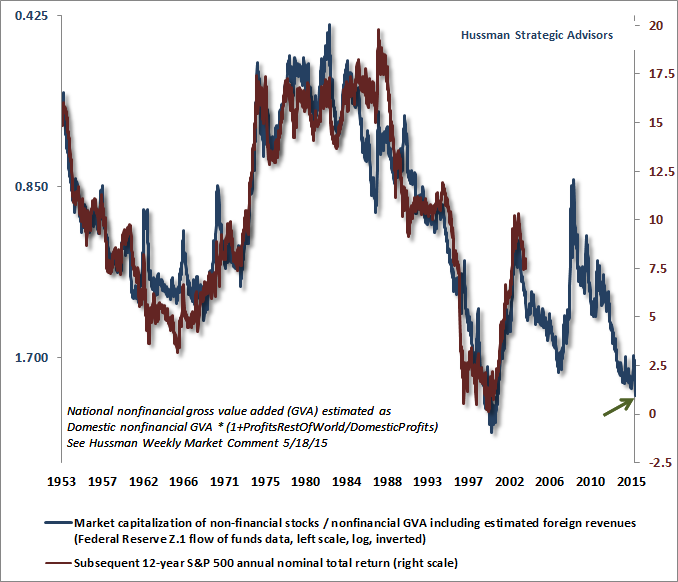

Meanwhile, investors face the second most overvalued equity market in history (Source: Hussman Funds).

3 responses to “The Ongoing Saga of Valeant Part II”