There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. Paul Tudor Jones

I am selling about 1/5 to 1/6 of my speculative miners like Minco Silver. It was trading back in Jan. 2016 at about 30 cents.

This miner didn’t fit all my criteria like jurisdiction and top-flight management, but it had $1 per share in cash and short-term investments and $2.00 per share (basic shares outstanding) in book value with no debt. I viewed the stock as a cheap call option. My position was not a full position but diversified in these type of exploration/pre-development type of companies.

MSV_2015YE_FS Minco Financials

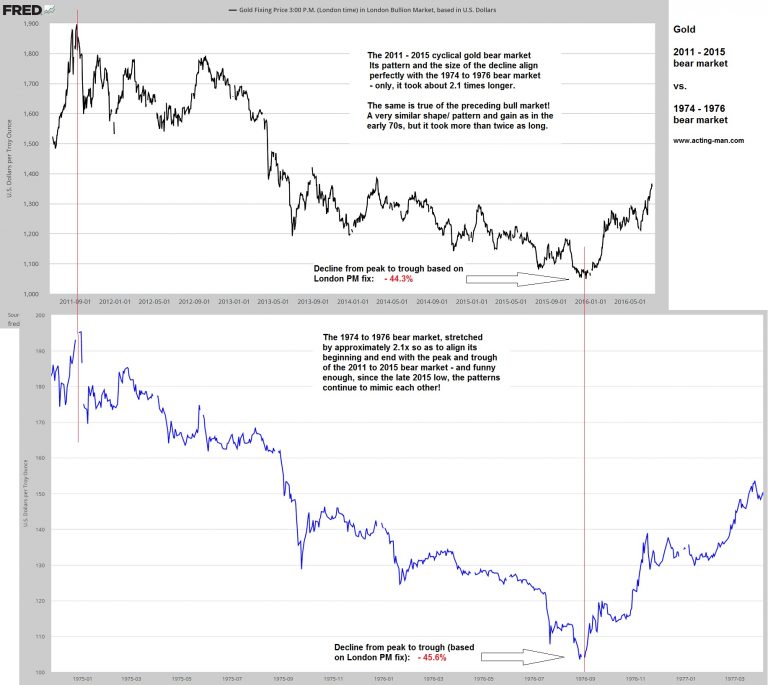

This bull market is starting to smell like the 1970 rally!

So, I expect this bull market to last perhaps years or for miners to multiply several times over. You make your money SITTING. But when you start feeling smart or, worse, other people think you are smart (where were you in 2015 when my accounts were down 35% to 40%?), it is time to peel some positions off. Sell into strength. Note the past history of the miners.

I wanna go back to the 70’s.

An educational video on the Federal Reserve or why you should own some gold

Have a Great Weekend!

4 responses to “Time to Sell Some Miners, But Not Much”