From Best to Worst. There are typically two ways to make 100 to 1 on your money. 1. The preferred way–in my view because the company has more control of its destiny–would be to invest early in a high ROIC company that can redeploy capital at high rates for MANY years.

From Best to Worst. There are typically two ways to make 100 to 1 on your money. 1. The preferred way–in my view because the company has more control of its destiny–would be to invest early in a high ROIC company that can redeploy capital at high rates for MANY years.

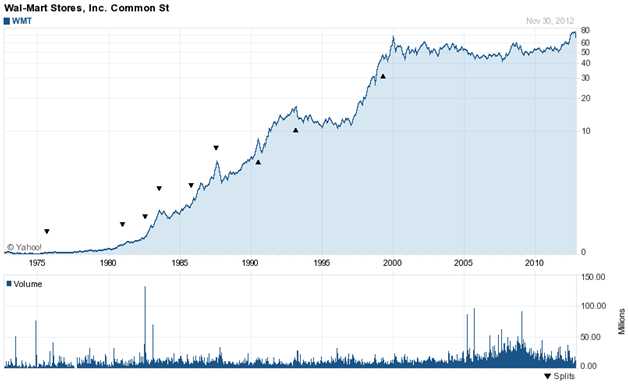

Note how the chart has gone sideways for 18 years as the ability to redeploy at high rates has declined. WMT can’t grow with regional economies of scale in Germany as it could in Arkansas back in 1965. You have to hold on through the inevitable 50% price plunges which you are able to do because of your understanding of the company’s competitive edge in the market.

Note how the chart has gone sideways for 18 years as the ability to redeploy at high rates has declined. WMT can’t grow with regional economies of scale in Germany as it could in Arkansas back in 1965. You have to hold on through the inevitable 50% price plunges which you are able to do because of your understanding of the company’s competitive edge in the market.

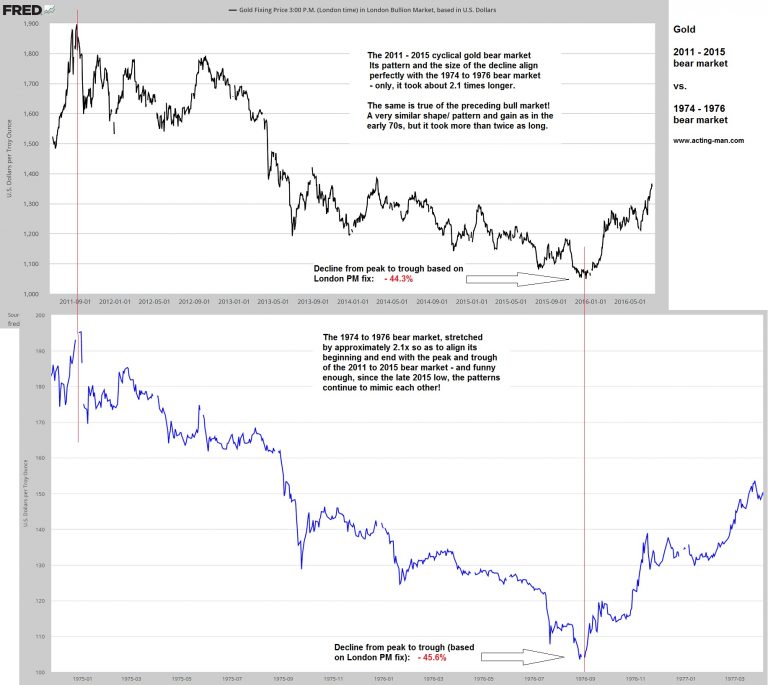

2. Or, you find an extremely cheap, beaten-up cyclical company (TECK) in an industry that has had low capital investment, then hold on for the boom which you then sell out at the top–harder and more nerve-wracking than the example above.

The worst performing sectors are where you want to look, but realize that some industries like phone companies may be under structural change.

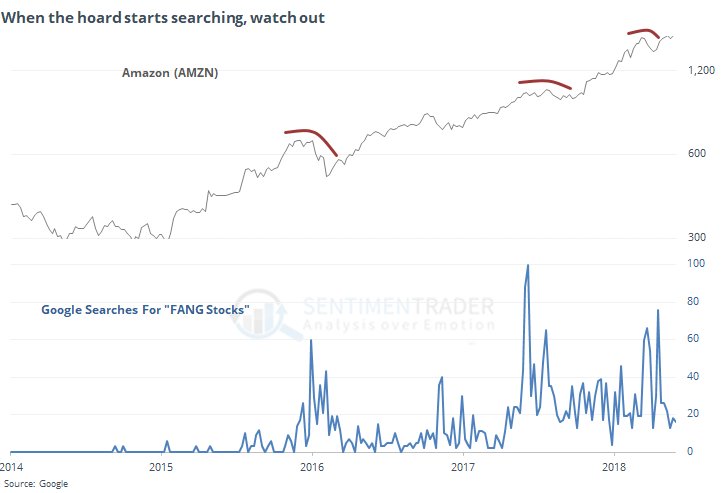

The Anthesis of Out-of-Favor

The Psychology of Sales

Hedge Fund Pop Quiz (Accounting)

Why is EBITDA so different than operating cash flow? Is that a problem or an opportunity. See: WTTR Mar 31 2018

A good research report on WTTR: Permian WDDC

<