—

—

Posted in History, Investor Psychology, Search Strategies

Tagged CCJ, cyclical markets, Gold, gold miners, Psychology, Uranium

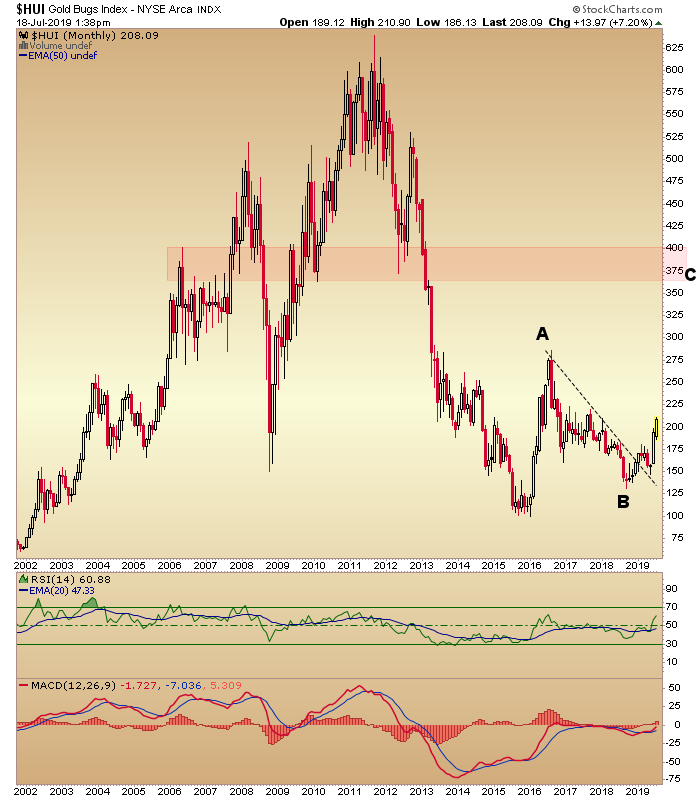

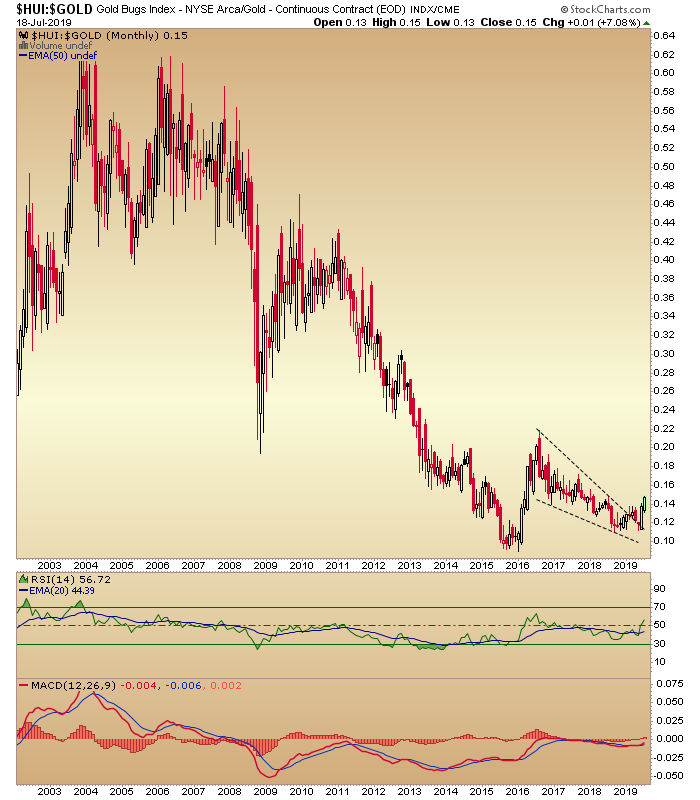

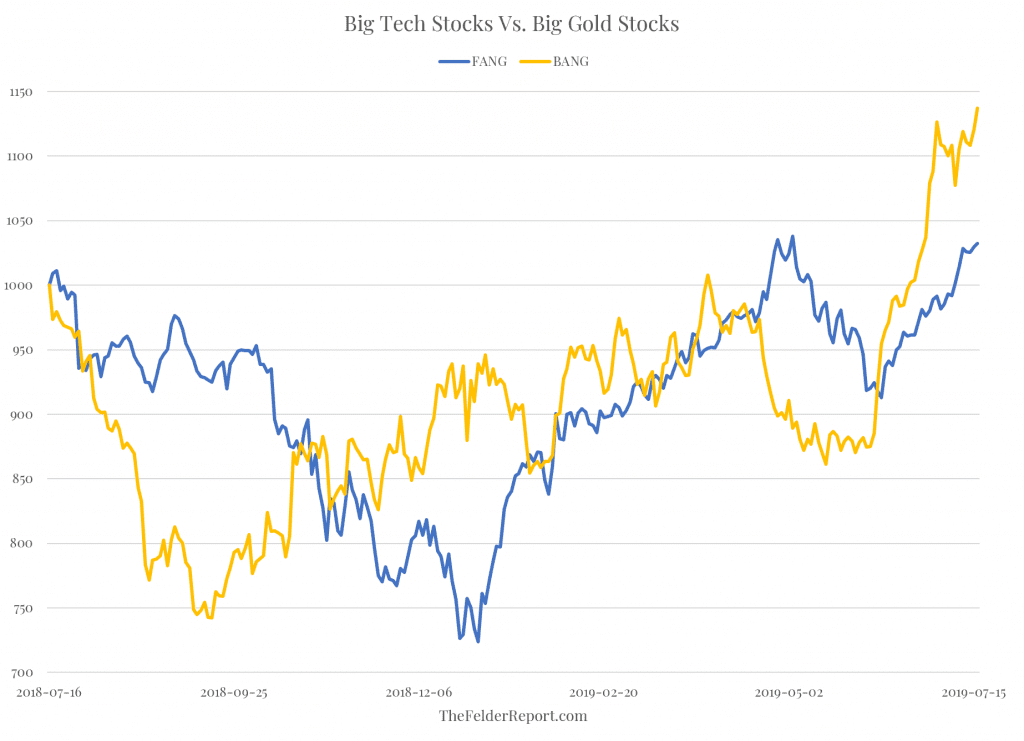

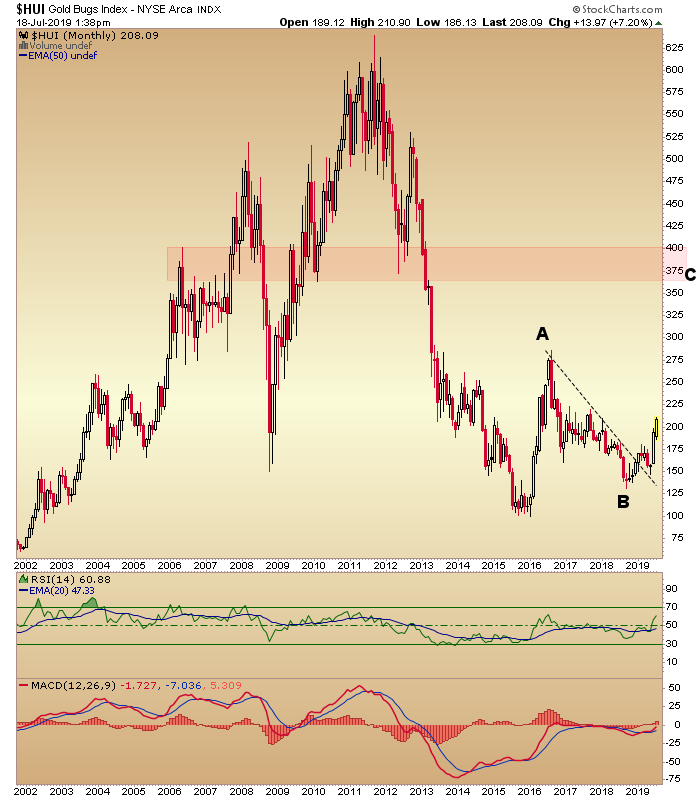

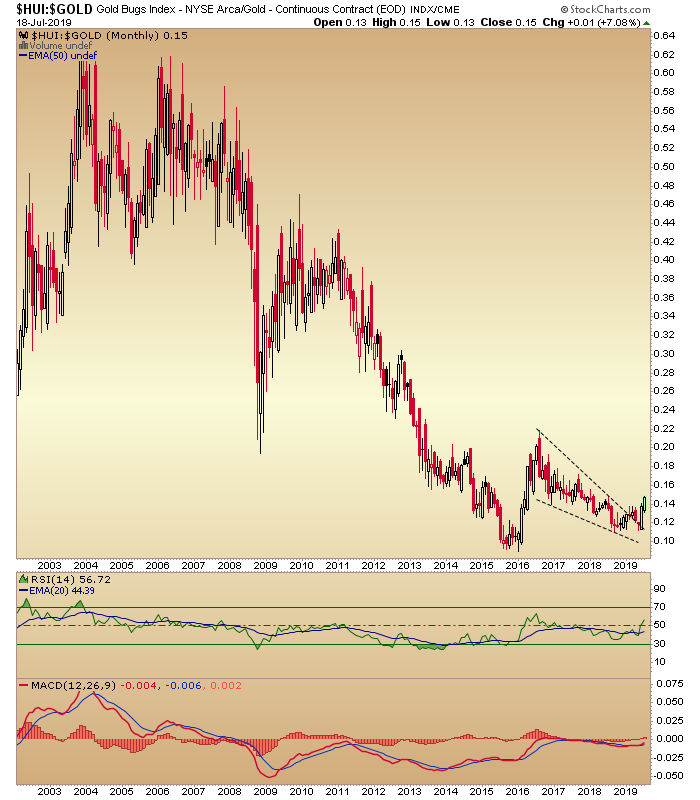

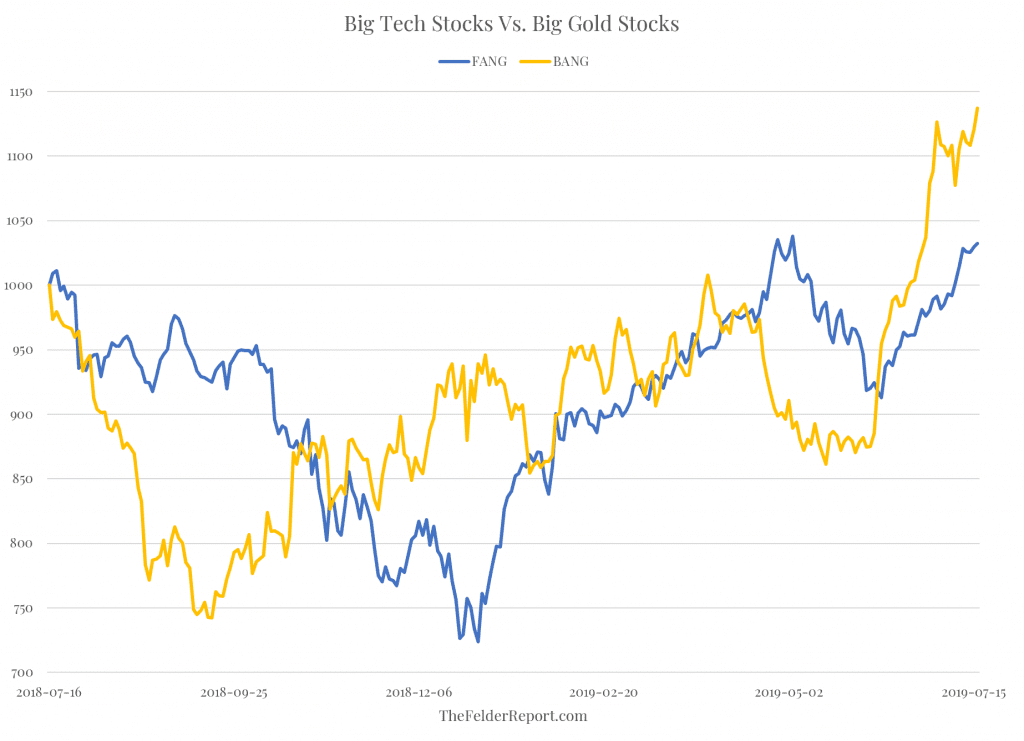

I am on my knees buying gold/silver/uranium miners with both hand this prior week (ouch!). Since the chart of the futures positions (COTS) is now more extreme–money managers are probably short now like back at end 2015/beginning 2016. I use the blog as a diary/bulletin board on occasion. I hate miners as a business but love the values. Note the vast underperformance of hard (read: miners) vs. financial assets (SPY). Not a recommendation, just a “diary” post.

Bob Moriarty Archives Jul 3, 2018

Entire article: http://www.321gold.com/editorials/moriarty/moriarty070318.html

Buying resource stocks has nearly nothing to do with the commodity. And near zero to do with management or country risk or interest rates or the dollar or what the DOW is doing. Those who are always wrong about markets spend a lot of time mumbling about all those things and they are just wasting ink.

Unbeknownst to GATA or the other PermaBulls who believe some munchkin at the Federal Reserve pulls the levers all of the time, markets go up and markets go down. They all do and they do it constantly. So if someone is telling you silver is the rarest mineral known to mankind and it should go up everyday of the week, forever, he’s lying to you in order to get you to pay for a subscription to his service. In short he’s like a bible thumping preacher or politician, he wants your support, and he specializes in telling you the lies you want to hear.

During the bull phase of the metals markets even the biggest piece of crap stocks go up. During the eventual bear phase of the metals markets even the best run with the most desired commodity in the safest jurisdiction goes down.

So investors in junior resource stocks need to keep two things in mind. You have to trade markets and take a profit when you can or the only alternative is to take a loss. I have had hundreds of investors tell me their biggest mistake was not taking a profit when they could. And given that something like 95% of investors in junior lottery tickets lose money, sell when you can, not when you have to.

You need to align yourself with the phase of the market you are in and let the wind be on your back. We had major lows in 2001 in gold and silver, again in 2008 and late in 2015. Don’t try to second-guess the market. If you were a buyer of anything from 2001 until 2008 you had a wonderful opportunity to profit. If you bought in 2009 or 2016, it was like shooting fish in a barrel. If you didn’t sell in March of 2008 or September of 2011, you got creamed regardless of the merits of the project or company. The phase of the market will either put money in your pocket or extract it regardless of what anyone says about a company.

Posted in Investor Psychology, Search Strategies, YOU

Tagged bob moriarty, gold miners, gold mining, market cycles

2Q 2016 Tocqueville Gold Strategy Letter – Final

The above charts came from this article. I would ignore the conclusions but focus on the historical perspective.

http://seekingalpha.com/article/4003004-gold-mining-stocks-best-investment-asset-next-decade

—

GOOD MANANGEMENT

Enterprise Product Partners August 2016 Presentation

Note the information they give investors. How management communicates is important. Do they provide sufficient detail for you to assess their capital allocation skills and operational performance. Note page 5.

Celebrate when your stock gets downgraged

There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. Paul Tudor Jones

I am selling about 1/5 to 1/6 of my speculative miners like Minco Silver. It was trading back in Jan. 2016 at about 30 cents.

This miner didn’t fit all my criteria like jurisdiction and top-flight management, but it had $1 per share in cash and short-term investments and $2.00 per share (basic shares outstanding) in book value with no debt. I viewed the stock as a cheap call option. My position was not a full position but diversified in these type of exploration/pre-development type of companies.

MSV_2015YE_FS Minco Financials

This bull market is starting to smell like the 1970 rally!

So, I expect this bull market to last perhaps years or for miners to multiply several times over. You make your money SITTING. But when you start feeling smart or, worse, other people think you are smart (where were you in 2015 when my accounts were down 35% to 40%?), it is time to peel some positions off. Sell into strength. Note the past history of the miners.

I wanna go back to the 70’s.

An educational video on the Federal Reserve or why you should own some gold

Have a Great Weekend!

Posted in Economics & Politics, Risk Management

Tagged gold miners, Minco Silver, Selling

Gold is money, not an investment.

Gold is money, not an investment.

Value Investing Videos (Manual of Ideas)

https://www.youtube.com/user/manualofideas?feature=watch

Pabrai lectures in India: https://www.youtube.com/watch?feature=player_embedded&v=Py95fWZV2Vo

—

Reader’s Questions

My reply: Actually, it is a bottom-up decision. I have pawed through my 250 stocks that I target in Value-line but see little margin of safety. Yes, I owned COH many months ago but sold near $58 as I had about a $60 to $65 valuation on it. I am very skeptical that the high end of their profit margins can be sustained because of their clientele and QE. But the undervaluations in miners gave me a better uses for my capital. So bottom up on both sides push/pull.

My reply: Well, set aside geography, because the same principles apply to any country. The most mean reverting metric of companies in general would be profit margins. Think about the inevitable law of competition and lack of barriers to entry. But understanding this subject will make you a better investor and save you heaps of pain! If an analyst projects an increase in multiples on top of today’s profit margins, then I suggest a mercy kill for that analyst and his boss/clients. We are in the death zone–a climber’s term for high altitude conditions.

Cutting back on growth capex and returning excess capital to shareholders if there are no adequate opportunities to generate excess returns is the right thing to do, but how sustainable is it for large companies like IBM or CSCO? Also, buying stock today may not be below intrinsic value for every company that is doing it.

Go through the last twenty posts of www.hussmanfunds.com and focus on profit margins. Follow his links.

I am studying this subject now. I am certainly not an expert but I do know the subject matter is crucial. I gotta learn it.

There is no excuse for not understanding how distortionary QE is to your companies’ profit margins and for the dangers of mal-investment.

QE is literally gutting our economy. Read Mises/Rothbard.

Posted in Risk Management, Search Strategies, YOU

Tagged Gold, gold miners, Manual of Ideas, report, SPY, videos in investing

“Fighting for Peace is like Screwing for Virginity” — George Carlin.

A Must-See Video on Monetary History:

http://hiddensecretsofmoney.com/blog/140-Years-Of-Monetary-History-In-10-Minutes (Yes, there is the fear sale–buy precious metals since the world will end, but look past that to learn about monetary history in an entertaining video. You can also view Mike Mahoney’s other videos.)

The difference between currency and money: http://hiddensecretsofmoney.com/videos/episode-1 (Hint: Money is a store of value.) www.moneyfornothingthemovie.org

Gold: https://www.valcambigold.com/charts.aspx

Things that make you go Hmmmm… ttmygh_26_aug_2013

Whenever a government puts restrictions or controls on a commodity, you buy!

Gold miners: http://denaliguidesummit.blogspot.ca/2013/08/hurricane-surge-for-gold-miners.html

Pzena_Commentary 2Q13 or Value vs. Growth Investors

Pzena_Commentary 2Q13 or Value vs. Growth Investors

RC&G_Investor_Day_2013 Sequoia’s Investor Day

Meet the New Federal Reserve Chairman

Aristotle on Tyrants

Submitted by Simon Black of Sovereign Man blog,

Nearly 2,400 years ago, Aristotle wrote one of the defining works of political philosophy in a book entitled Politics.

It’s still incredibly relevant today, particularly what he writes about tyranny.

The ancient Greeks used the word ‘turannos’, which referred to an illegitimate ruler who governs without regard for the law or interests of the people, often through violent and coercive means.

Aristotle attacks tyrants mercilessly in his book, and clearly spells out the criteria which make a leader tyrannical. You may recognize a few of them:

“He ought to show himself to his subjects in the light, not of a tyrant, but of a steward and a king.”

and

“He should be moderate, not extravagant in his way of life; he should win the notables by companionship, and the multitude by flattery.”

“A tyrant should also endeavor to know what each of his subjects says or does, and should employ spies . . . and . . . eavesdroppers . . . [T]he fear of informers prevents people from speaking their minds, and if they do, they are more easily found out.”

“Another practice of tyrants is to multiply taxes. . . [and] impoverish his subjects; he thus provides against the maintenance of a guard by the citizen and the people, having to keep hard at work, are prevented from conspiring.”

“It is characteristic of a tyrant to dislike everyone who has dignity or independence; he wants to be alone in his glory, but anyone who claims a like dignity or asserts his independence encroaches upon his prerogative, and is hated by him as an enemy to his power.”

He’s right. And in the past, people had to rise up in the streets to defeat tyranny.

Fortunately, there are many tactics available to freedom-oriented people today that don’t involve violent revolution.

For rational, thinking people who find themselves living in a state that is rapidly sliding into tyranny, one of the most important steps to take is reducing exposure to that government.

If you live, work, bank, invest, own property, run a business, hold your precious metals, store your digital data (email), etc. all in the same place, you are running some serious ‘sovereign risk’.

In many cases, you can move precious metals overseas, set up a foreign bank account, or create an offshore, encrypted email account with a few mouse clicks.

Take a look back at Aristotle’s points. If the majority of them look familiar, it may be time that you look around the world for alternatives.

US planned war on Syria (What a surprise!)

Posted in Economics & Politics, History

Tagged Aristotle, gold miners, Housing, Monetary History

Some Investors Gettin’ Hammered in Gold Miners

In October, Marcel “Mac” DeGuire became president and chief operating officer of Guyana Goldfields, an exploration-stage company listed on the Toronto Stock Exchange that has been losing money trying to develop gold mines in South America for years. Within a few weeks DeGuire was helping to convince investors to buy into a Guyana Goldfields financing for C$3.40 a share, a significant fund raise for the company of some $100 million that closed in February. Eleven days later, however, DeGuire resigned from Guyana Goldfields, citing “personal reasons.” The stock has plunged by more than 60% in 2013 and is now changing hands for C$1.24.

It might be surprising for some market watchers to learn that Guyana Goldfields’ biggest shareholder is the Baupost Group, the massive Boston hedge fund firm run by Seth Klarman. Baupost owns 19.7% of Guyana Goldfields, a stake recently worth about $30 million. A billionaire hedge fund genius, Klarman is one of the most revered money managers of his generation, a value investor who likes to steer clear of controversy and public attention, keep his head down and concentrate on his investments. His track record and reputation are stellar, which makes it a little strange that Baupost has gotten behind Guyana Goldfields and some other long shot, some might even say iffy, gold mining ventures with penny stocks and high executive pay. These companies often make sure to point out that Baupost is a major investor in their shares in investment presentations.

Shares of gold mining companies have been hammered this year as the price of gold has tumbled. Most gold mining companies are facing a serious cash crunch as the economics of their industry get upended. The fall of gold and gold miners has publicly embarrassed investors who made big bets on the sector, like billionaire John Paulson, who has been so frustrated with the shadow his decimated and relatively small gold hedge fund has cast on the rest of his hedge fund operation that he has stopped sending out his gold fund’s financial returns to investors in his other funds. Klarman’s gold mining investments have also been clobbered, losing between $150 million and $200 million in value in 2013. That’s hardly an insurmountable loss for Klarman since Baupost manages $28 billion and, unlike Paulson, Klarman does not separate out his gold-related investments in a separate fund. Still, Klarman’s gold mining losses, which have not received any public attention this year, are among the biggest to have hit a major U.S. hedge fund this year.

Mr. Klarman must be quite bullish on the future price of gold in U.S. Dollars because his investments in the Junior resource sector require much higher gold prices to be profitable. Note the high capex costs. Remember that it is not the size of a deposit but the cost to bring ozs. into production that matters.

I prefer the royalty/streamer companies like RGLD, SLW, FNV, SAND that are already profitable with low fixed costs and little operational risk. Those firms can make money even if gold goes lower. When you read about “famous” investors losing money in a sector, a lot of bad news is long in the tooth, IMHO.

John Doody on July 10, 2013 discusses the gold mining sector (Audio): fsn2013-071013

A Good Read: The-Leather-Apron-Letter-07-12-2013

The Fed and the Crisis of 1987 (Financial History) 152107746-Fed-1987

Posted in Economics & Politics, Investing Gurus

Tagged 1987 Crash, gold miners, Klarman, Leather Apron, The Fed

The news of poor acquisitions, dilution, rising input costs, poor returns, declining stock prices of miners are becoming baked-into prices. But who knows when the bottom occurs. All we know, is that all markets are cyclical. Hatred of an asset class or industry is what one seeks when searching for bargains.

http://www.gotgoldreport.com/2013/07/chart-of-the-week-mining-share-money-flows-spec-bias.html#more

Historical Perspective

http://www.gold-eagle.com/article/what%E2%80%99s-mining-shares

The Golden Narrative

To market participants in 2013 gold means lack of confidence in money, and their behavior in buying and selling gold similarly reflects this meaning. Buying gold today is a statement that you believe that global economic events may spiral out of the control of Central Bankers. It is insurance against some sort of massive monetary policy mistake that cannot be fixed without re-conceptualizing the global economic regime – hyperinflation in a developed nation, the collapse of the Euro, something like that – not an expression of a commonly shared belief in some inherent value of gold.

The source of gold’s meaning, whether you are a market participant in 1895 or 2013, comes from the Common Knowledge regarding gold. J.P. Morgan said that gold is money, and he was right, but only because at the time he said it everyone believed that everyone believed that gold is money. Today that same statement is wrong, but only because no one believes that everyone believes that gold is money.

Read more: http://www.lemetropolecafe.com/kiki_table.cfm?pid=10861

What the $%^&! wrong with mining shares?

http://www.gold-eagle.com/article/what%E2%80%99s-mining-shares

Sanjay Bakshi’s Way

2012.8_Value-Investing-The-Sanjay-Bakshi-Way-Safal-Niveshak-Special

Posted in Investing Gurus, Search Strategies

Tagged gold miners, Sanjay Bakshi, Value Investor