2Q 2016 Tocqueville Gold Strategy Letter – Final

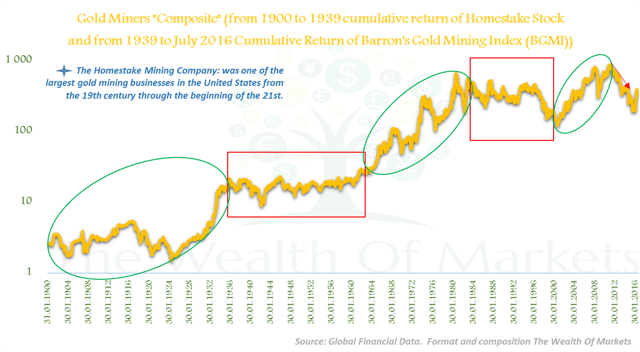

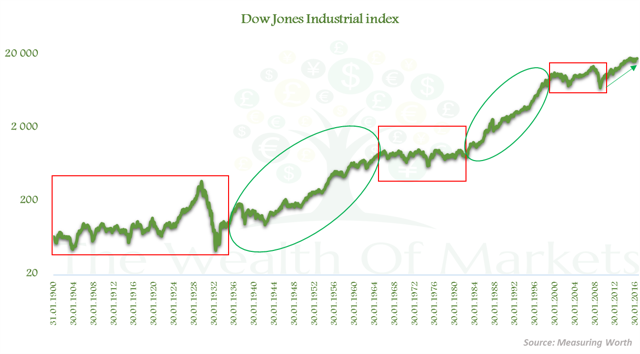

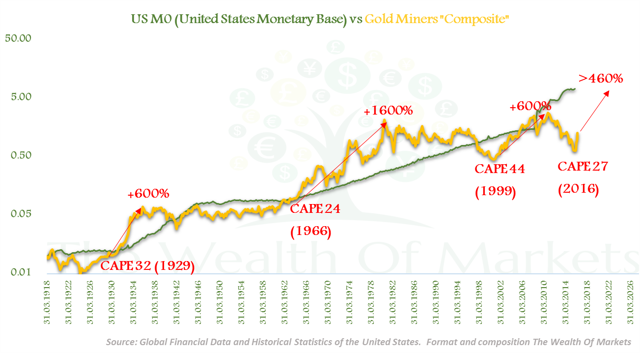

The above charts came from this article. I would ignore the conclusions but focus on the historical perspective.

http://seekingalpha.com/article/4003004-gold-mining-stocks-best-investment-asset-next-decade

—

GOOD MANANGEMENT

Enterprise Product Partners August 2016 Presentation

Note the information they give investors. How management communicates is important. Do they provide sufficient detail for you to assess their capital allocation skills and operational performance. Note page 5.

Celebrate when your stock gets downgraged

2 responses to “Perspective on the Gold Miners; Management”