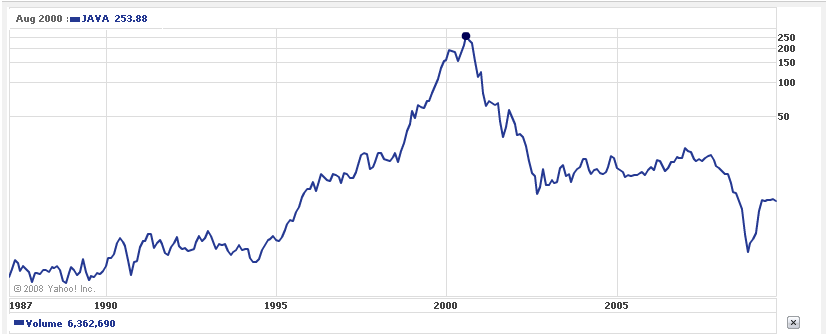

While at all times Wall Street analysts try to justify the valuations, here is a fun quote (via Bloomberg) from 2002 looking back from Scott McNeely, the CEO of Sun Microsystems, one of the darlings of the 2000 tech bubble:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes.

What were you thinking?”

An educational, savagely satirical view of our current market conditions and lessons on valuation. I read about 40 investment letters a quarter and this is about the best I have read in five years. Hilarious! Mark McKinney – Its Like Deja Vu All Over Again – Final and his prior letter: I Dont Get It – Mark McKinney – Final 8292017 New

—

An excellent interview by Tobias Carlisle. CHEAPNESS not quality wins! Yes, I was somewhat shocked. Why?

http://www.valuewalk.com/2018/01/tobias-carlisle-talks-acquirers-multiple-valuetalks/

ACKMAN INTERVIEW

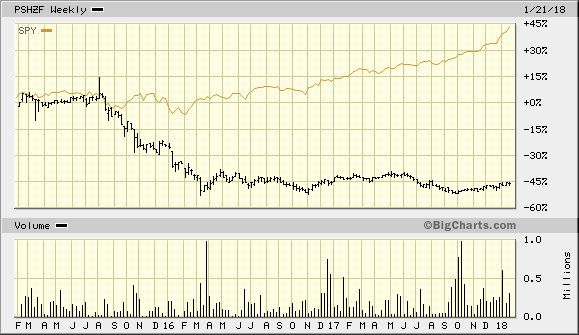

Ackman’s embattled Pershing Square hedge fund laid off 18 percent of its staff on Friday — a total of 10 pink slips that brought head count down to 46.

Investors have suffered in Pershing Square (PSHZF) vs. S&P 500:

He wants to hire an analyst who can THINK INDEPENDENTLY. You walk into his office and he asks you, “Can you think independently as an analyst?”

How do you reply. Be careful…………think for awhile before you reply. What proof can you give?

If you are struggling to answer, then https://www.newyorker.com/magazine/2015/11/23/conversion-via-twitter-westboro-baptist-church-megan-phelps-roper

will provide clues.

9 responses to “Acq. Multiple, Yog Berra and Financial Satire, and Hedge Fund Quiz”