I

I am was a serious chocaholic. After robbing a candy store, I tried to gobble down the evidence as the cops closed in. How was I ever going to stop my fixation on dark, rich, creamy chocolate and replace my bad habits with healthier ones?

“Chains of habit are too light to be felt until they are too heavy to be broken.” –Warren Buffett

To learn more about habits:http://charlesduhigg.com/

An excellent 3.5 minute video on the power of habits: http://www.youtube.com/watch?v=a6p3lG9EDXw&feature=related

The author’s words:  What sparked your interest in habits? I first became interested in the science of habits eight years ago, as a newspaper reporter in Baghdad, when I heard about an army major conducting an experiment in a small town named Kufa.

What sparked your interest in habits? I first became interested in the science of habits eight years ago, as a newspaper reporter in Baghdad, when I heard about an army major conducting an experiment in a small town named Kufa.

The major had analyzed videotapes of riots and had found that violence was often preceded by a crowd of Iraqis gathering in a plaza and, over the course of hours, growing in size. Food vendors would show up, as well as spectators. Then, someone would throw a rock or a bottle.

When the major met with Kufa’s mayor, he made an odd request: Could they keep food vendors out of the plazas? Sure, the mayor said. A few weeks later, a small crowd gathered near the Great Mosque of Kufa. It grew in size. Some people started chanting angry slogans. At dusk, the crowd started getting restless and hungry. People looked for the kebab sellers normally filling the plaza, but there were none to be found. The spectators left. The chanters became dispirited. By 8 p.m., everyone was gone.

I asked the major how he had figured out that removing food vendors would change peoples’ behavior.

The U.S. military, he told me, is one of the biggest habit-formation experiments in history. “Understanding habits is the most important thing I’ve learned in the army,” he said. By the time I got back to the U.S., I was hooked on the topic.

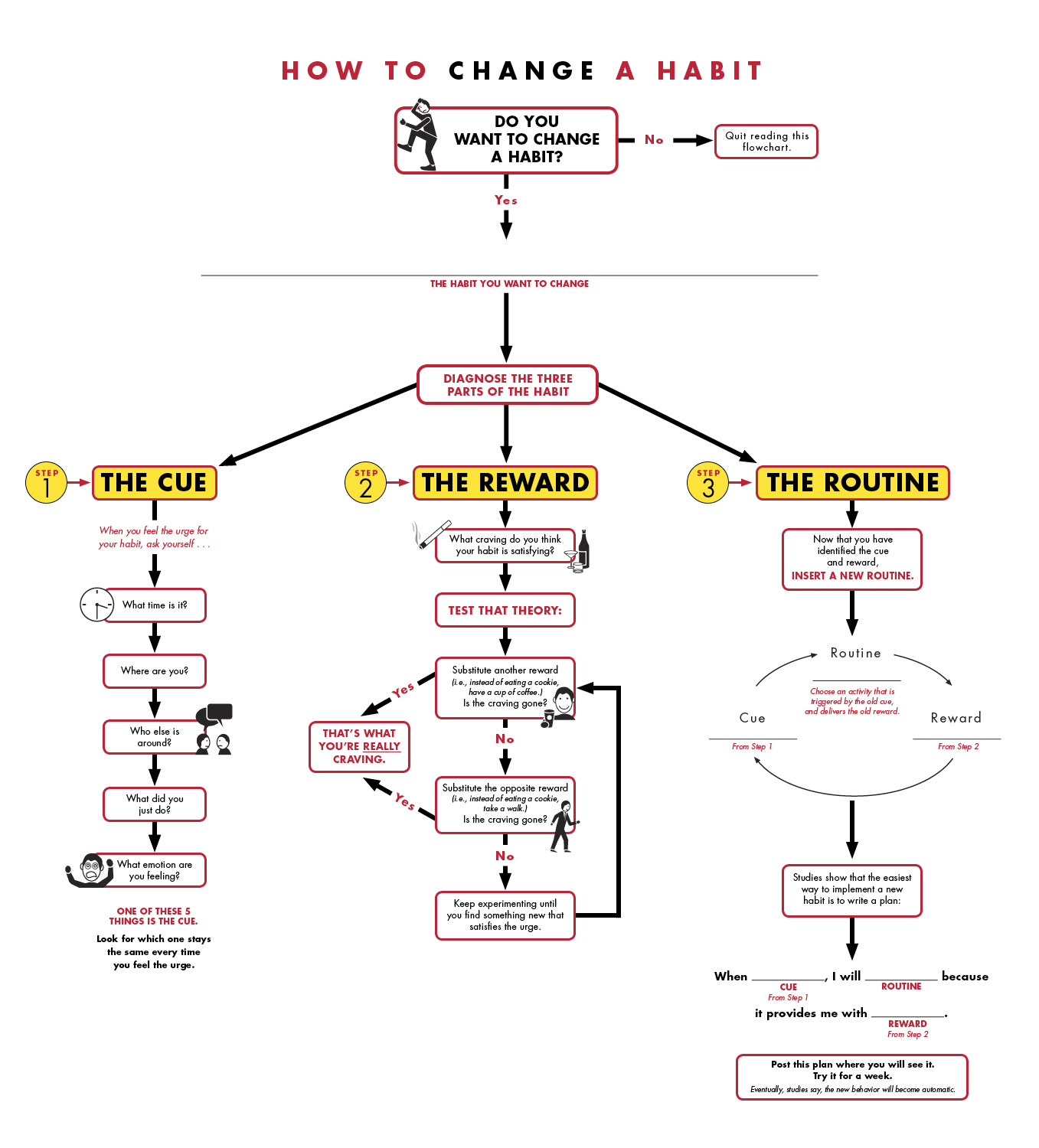

How have your own habits changed as a result of writing this book? Since starting work on this book, I’ve lost about 30 pounds, I run every other morning (I’m training for the NY Marathon later this year), and I’m much more productive. And the reason why is because I’ve learned to diagnose my habits, and how to change them.

Take, for instance, a bad habit I had of eating a cookie every afternoon. By learning how to analyze my habit, I figured out that the reason I walked to the cafeteria each day wasn’t because I was craving a chocolate chip cookie. It was because I was craving socialization, the company of talking to my colleagues while munching. That was the habit’s real reward. And the cue for my behavior – the trigger that caused me to automatically stand up and wander to the cafeteria, was a certain time of day.

So, I reconstructed the habit: now, at about 3:30 each day, I absentmindedly stand up from my desk, look around for someone to talk with, and then gossip for about 10 minutes. I don’t even think about it at this point. It’s automatic. It’s a habit. I haven’t had a cookie in six months.

What was the most surprising use of habits that you uncovered? The most surprising thing I’ve learned is how companies use the science of habit formation to study – and influence – what we buy.

Take, for example, Target, the giant retailer. Target collects all kinds of data on every shopper it can, including whether you’re married and have kids, which part of town you live in, how much money you earn, if you’ve moved recently, the websites you visit. And with that information, it tries to diagnose each consumer’s unique, individual habits.

Why? Because Target knows that there are these certain moments when our habits become flexible. When we buy a new house, for instance, or get married or have a baby, our shopping habits are in flux. A well-timed coupon or advertisement can convince us to buy in a whole new way. But figuring out when someone is buying a house or getting married or having a baby is tough. And if you send the advertisement after the wedding or the baby arrives, it’s usually too late.

So Target studies our habits to see if they can predict major life events. And the company is very, very successful. Oftentimes, they know what is going on in someone’s life better than that person’s parents.

—-

I recommend reading The Power of Habit : Why We Do What We Do in Life and Business by Charles Duhigg: http://www.amazon.com/The-Power-Habit-What-Business/dp/1400069289/ref=sr_1_1?ie=UTF8&qid=1340109798&sr=8-1&keywords=the+power+of+habit

The Mental Habits for Investing

Obviously we seek to learn from other great investors, but how to incorporate their habits as part of our own?

The power of mental habits for investing: http://marktier.com/Excerpts/chap01-01.php