John Law and the Mississippi Bubble by Richard Condie, National Film Board of Canada A video worth the view.

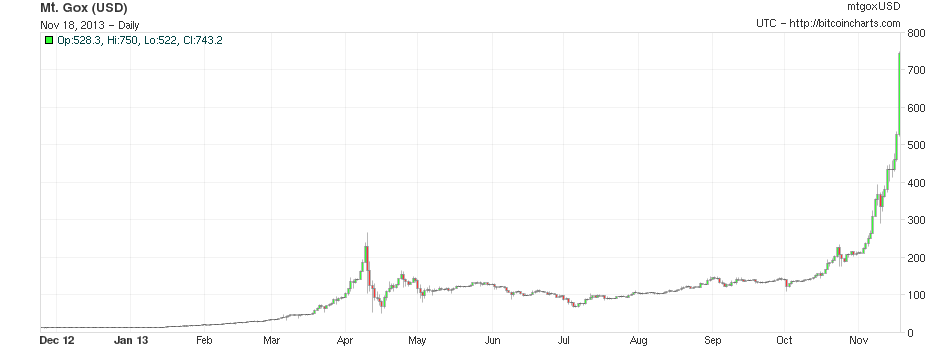

BITCOINS

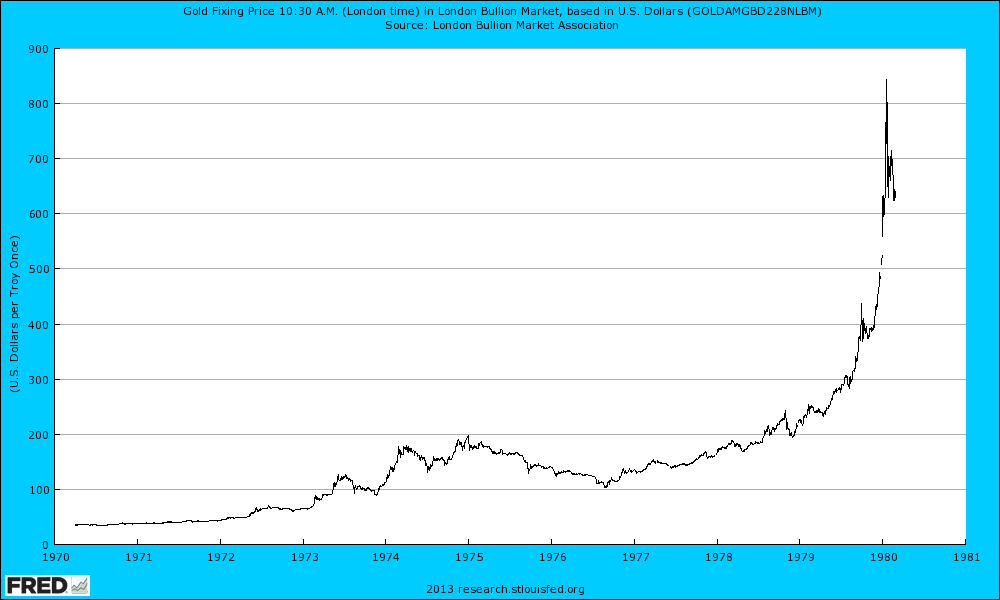

GOLD DURING 1980

Margin Debt

Yes, we must be careful but there are–perhaps–pockets of value?

XOM_Nov 2013 You can see why Buffett recently bought XOM. Note the dotted line on the Value-Line. XOM has “underperformed” the general market for the past five years. But XOM is a better than average company trading far below the market multiple. You won’t get rich quick but you won’t lose it all either. He probably sees XOM as an inflation pass-through.

ESRX_Nov 2013 Note the decline on ROA. Since this is in an oligopolistic industry perhaps a reversion to higher margins can occur. I do not own either one.

Are bitcoins money? Bitcoin-CMRE

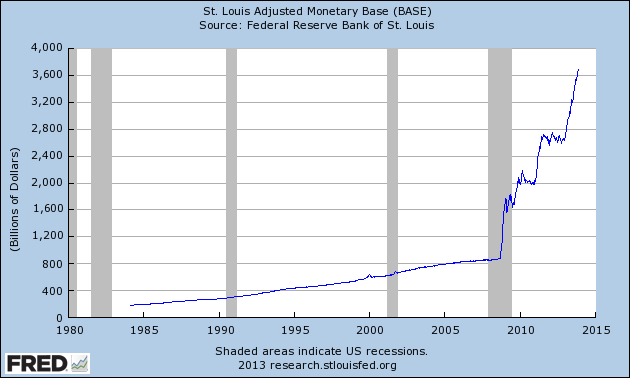

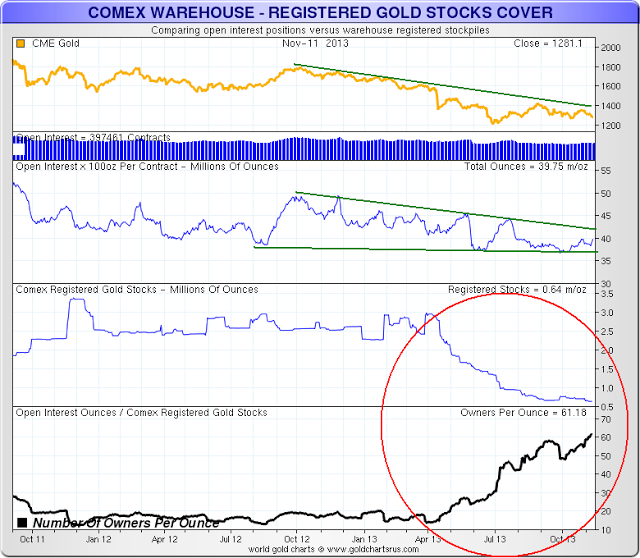

Why, if gold demand from Asia is so high and with inventories draining from GLD and the Comex, are gold prices soft? Stress in the collateral markets?

Gold_Collateral-Thunder-Road-Report-August

Myrmikan_Research_Report_Liquidity

RICHARD RUSSELL:

When the problem presents itself, turn away from it, put it out of your mind completely and think of something that pertains to God, such as God is love or God is truth, but you must keep the problem completely out of mind. This is the simple Golden Key which the great Emmet Fox recommends. It may sound too absurdly simple, it may sound like voodoo, but before you sneer at it and ignore it, first try it. I’ve used it many times and I can tell you that it works. The concept of the Golden Key is probably worth years of subscriptions to Dow Theory Letters. Use the Golden Key.