Reading Skills: Apple Case Study

Besides reading about great investors or pouring over your finance text books, you should broaden your perspective and read about industries and business founders. This reading–if done critically–will develop a more nuanced analysis of investments. I don’t know if AAPL is a buy or sell, it is in my too hard pile, but I found the two posts below from The Brooklyn Investor very informative. Do not underestimate the power of a genius. This case offers you a way to see how one investor applied his reading for greater understanding. A broad perspective of the world will help your investing. Remember that if you read the same sources, think the same way, then your returns will be at best average.

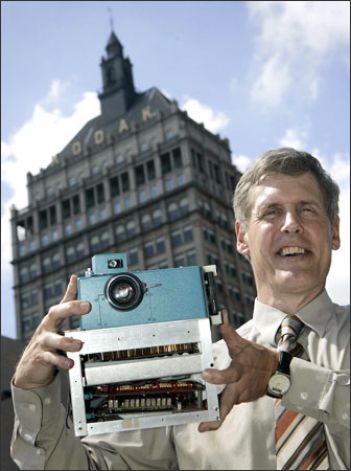

Comparing Apple’s leadership to Polaroid’s Founder

- http://brooklyninvestor.blogspot.com/2012/12/apple-is-no-polarioid-but.html

- http://brooklyninvestor.blogspot.com/2012/12/why-i-left-apple-apple-is-speculation.html

Interview with an Indian Investor

http://www.safalniveshak.com/value-investing-chetan-parikh-way-part-1/

http://www.safalniveshak.com/value-investing-chetan-parikh-way-part-2/

PS: Money Supply Aggregates are humming along at about a 11% clip. Bernanke is on fast cruise control.