And as investors expect the low inflation environment to continue, they have responded by reducing commodity and emerging market exposure and pumping more money into bonds. A net 29% of global asset allocators are underweight commodities, the BofA Merrill study finds, up from 11% in March and at the lowest level since December 2008. Asset allocators are avoiding energy stocks as well.

https://www.coursera.org/course/accounting

About the Course

Accounting is the language of business. Companies communicate their performance to outsiders and evaluate the performance of their employees using information generated by the accounting system. Learning the language of accounting is essential for anyone that must make decisions based on financial information.

The course is designed to provide an understanding of financial accounting fundamentals for prospective users of corporate financial information, such as investors, creditors, employees, and other stakeholders (e.g., suppliers, customers). The course focuses on understanding how economic events such as operating activities, corporate investments, and financing transactions are recorded in the three main financial statements (i.e., the income statement, balance sheet, and statement of cash flows). Students will develop the technical skills needed to analyze financial statements and disclosures for use in financial analysis. Students will also learn how accounting standards and managerial incentives affect the financial reporting process.

Course Syllabus

The course is broken up into ten weekly modules:

- Introduction and Balance Sheet

- Accrual Accounting and the Income Statement

- Cash flows

- Working capital assets

- Ratio analysis and Mid-course Exam

- Long-lived assets and marketable securities

- Liabilities and long-term debt

- Deferred taxes

- Stockholders’ equity

- How to read an Annual Report and Final Exam

Recommended Background

The course is recommended for students with little or no prior background in financial accounting that want to improve their financial literacy. There are no academic prerequisites for the course. Although we will work with numbers in the course, the only required math knowledge is addition, subtraction, multiplication, and division.

Suggested Readings

The course is designed to be self-contained. Students wanting to expand their knowledge beyond what we can cover in this course or who want more practice problems or more in-depth explanations can consult any Introduction to Financial Accounting textbook that is geared toward MBA students. Because the material in the course has been fairly unchanged for the past few years, any used prior editions of textbooks should be acceptable.

Course Format

The course will combine video of the instructor with Powerpoint slides to the deliver the material. The lectures will be “interactive” in that the instructor will periodically ask students to pause the presentation and guess an answer before proceeding. The videos will also cover “case studies” of real companies to illustrate the course concepts. The course will provide eight short homework assignments and two exams.

FAQ

Will I get a Statement of Accomplishment after completing this class?

Contingent on academic performance, you will get a Statement of Accomplishment stating that you completed this course. However, no certificate will be given from Wharton / Penn and successful completion of this course does not make you a Wharton / Penn alumnus.

What resources will I need for this class?

Everything you need will be provided via the Coursera platform.

What is the coolest thing I’ll learn if I take this class?

You will not only better understand what people in the business media are talking about, you will also be able to notice when they don’t know what they are talking about!

About the Instructor

Brian J Bushee–University of Pennsylvania

Categories:

Economics & Finance

Business & Management

—

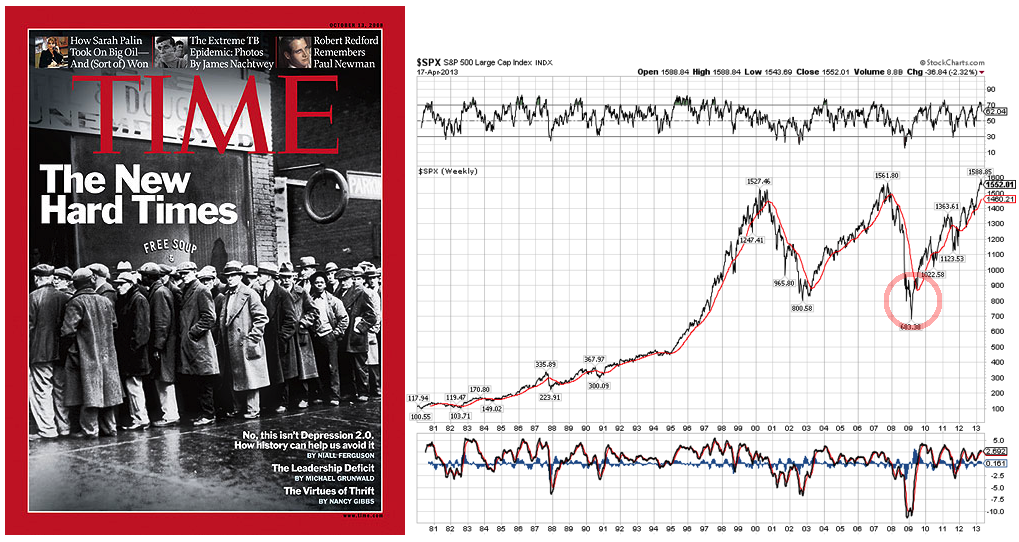

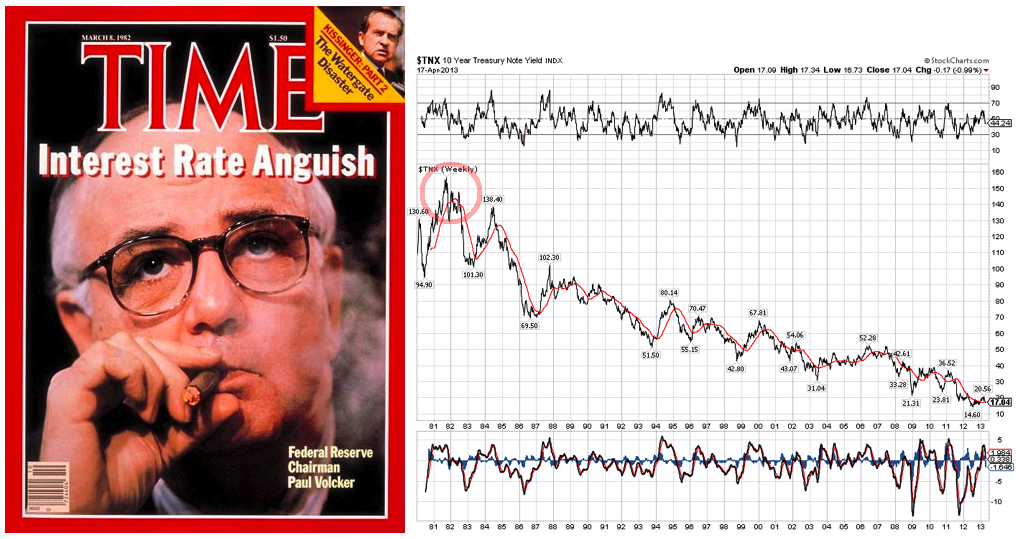

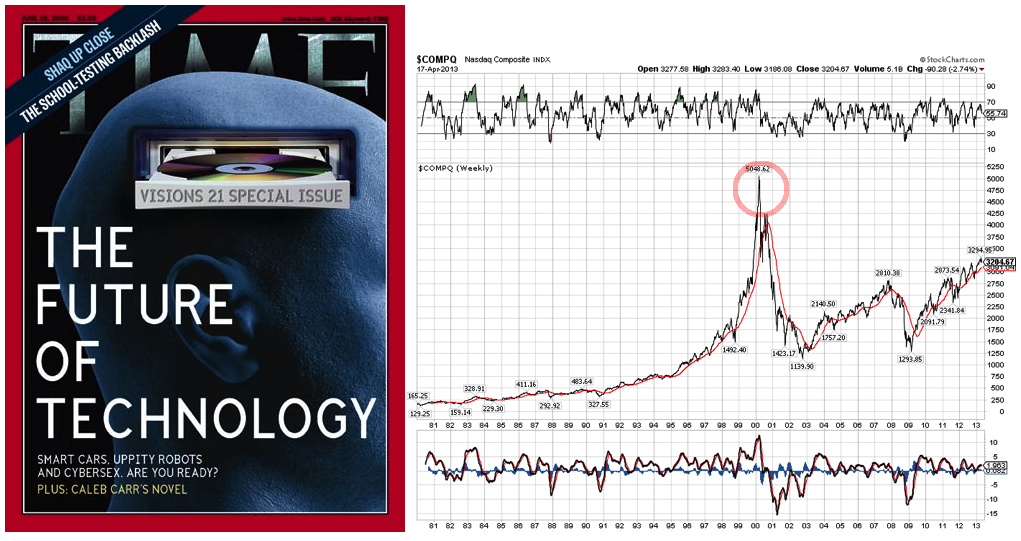

The French Revolution and Speculator Joseph Fouche

Investors have flocked into financial assets while shunning commodity companies because of China slowdown fears and less “inflation.” What if they are wrong?