subscription

Categories

Do you want the keys to the Value Vault?

Simply send an email to aldridge56@aol.comTag Cloud

AAPL ABCT Ackman Austrian Economics bitcoin Blogs books Bubbles Buffett business Case Study Competition Demystified Contrarian Cuba Deep Value Economies of Scale economy Federal Reserve Franchises Gold Gold Stocks Graham Greenwald History inflation James Grant Klarman Learning Lectures miners Mises money Munger Politics Risk ROIC Rothbard Strategic Logic Strategy The Fed valuation Value Investing Resources Value Vault Videos WMT-

Recent Posts

Category Archives: Free Courses

Understand Semantics to improve your thinking

Posted in Free Courses, YOU

Tagged Clarity of thought, irving j. lee, precise thought, Semantics

Project Punch Card Investment Event December 7th in NYC–Hurry!

Our goal at Project Punch Card is to foster long-term investment orientation amongst students underrepresented in the investment research and management business.

“We are delighted to announce that Alice Schroeder, the author of The Snowball: Warren Buffett and the Business of Life, the latest addition to the conference, will give a NEW keynote and share her insights on Mr. Buffett’s lesser-known investment secrets — built from thousands of hours spent with him and unique access to decades of Mr. Buffett’s archives.

Buffett_Case Study on Investment Filters Tabulating Company as an example of her work.

The Punch Card Conference has an incredible line-up of speakers and thought leaders including David Abrams (in a rare public appearance), John Rogers, Jonathan Levin, Murray Stahl and more.

We are offering a limited number of super-early-bird tickets for $145 until Nov-9 (TOMORROW-Friday), after which the price increases to $495 for early-bird tickets and $995 for full priced tickets.”

https://www.eventbrite.com/e/project-punch-card-value-investing-conference-tickets-50982639447

Who is it for?

We expect a blend of Portfolio Managers, Investment Advisors, Analysts and Allocators (i.e pension funds, Endowments, insurance, FOF etc). Ideally we would like people from the target communities — women, people of color, or graduates of underprivileged colleges in the investment industry. Marketing and strategic partners such as Smart Women Securities, Forte Foundation and SEO may also be a material component of the audience composition.

What is included?

Breakfast, Full Sit-down Lunch, Coffee Breaks, and Networking Opportunities.

Warren Buffett to students on the choice of a career:

When you go out in the world, look for the job you would take if you didn’t need the money. You really want to think about, what will make you feel good, when you get older, about your life, and you at least generally want to keep going in that direction. Don’t work for money . . . You’ll never be happy. You have to find the intersection of doing something you’re passionate about and at the same time something that is in the service of other people. I would argue that, if you don’t find that intersection, you’re not going to be very happy in life.

Why a punch card? Once again, the Oracle of Omaha said it best:

I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches–representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did and you’d be forced to load up on what you’d really thought about. So you would do so much better.

Learn more about the investment competition: https://projectpunchcard.com/home/

John Chew: This seems like an EXCELLENT opportunity for students and emerging money managers at a CHEAP price. If you net out the lunch/food you are paying $100 to $120 for an incredible conference. I don’t know the other speakers but Murray Stahl is one of the most underrated stars (in my opinion) in the business. See for yourself: Murray Stahl The Skeptics Almanac-third-edition-volume-3

Also, Paul Isaac of Arbiter Partners, is another excellent investor who has been interviewed multiple times by Jim Grant of https://www.grantspub.com/

This New York-based investor has value investing in his blood. His father, Irving, an arbitrageur, was instrumental in finding Max Heine his first job on the Street. Heine went on to run the legendary Mutual Shares Fund, and Irving Isaac sat on its board for three decades. And Paul Isaac’s uncle, Walter Schloss, a student of Benjamin Graham, was praised by Warren Buffett and profiled in Barron’s. At his former position leading a fund of funds, Paul Isaac produced high single-digit returns annually. That fund was sold after the 2008-2009 financial crisis. He continues to manage Arbiter, a hedge fund that has returned 21%..

—

I have no association with the organizers of this event. I may be given a free ticket. However, I may not be able to attend. I hope to change my schedule to attend because just being able to meet Murray Stahl would be worth it for me.

Posted in Free Courses, Investing Careers, Investing Gurus

Blockchain Future; Create Your Own Case Studies

Create your Own Case Studies

- Broyhill-TWX-Value-Creation-Case-Study

- Broyhill-Investing-by-Design

- FUN-Thesis-Jun-13

- HSP-Thesis-May-13

- COH-Thesis-Mar-13

Look at the date of the report like Coach, Inc. (“COH”). Do not read the

report. Then download the 10K close to the date of the report and try to

do your own analysis BEFORE you read the author’s thesis. Yes, it is work, but

you will learn more than reading the report and then looking at the financials. Most will simply skim the report.

Great American Rhetoric–Learn How to Convince

Whether you are seeking to convince your neighbors and friends or asking an investor to act, throw out your TV and listen/read the great speeches in the last link below. Learn about persuasive rhetoric. How do you reach and convince people who DISAGREE with you.

http://rhetoric.byu.edu/ The History of rhetoric

Rhetoric_index An Overview

The best 100 speeches in American History

Free Course on America’s Great Depression

One way to become a better investor and informed citizen is to study history. an old pro gives advice:

“Learn history!” Joe Rosenberg (JR), Investment Officer at Loews 2017 L_Letter-to-Shareholders shouts.

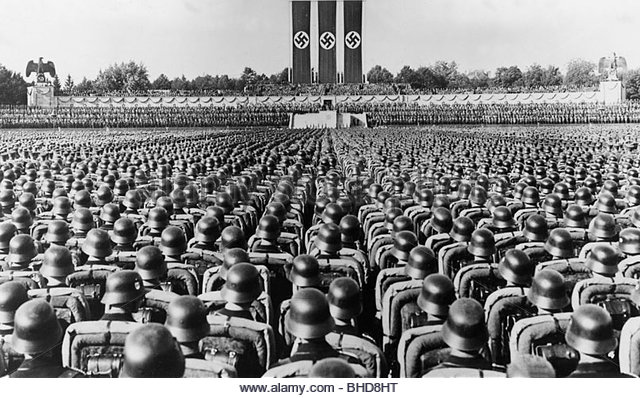

My favorite book to recommend is The True Believer: Thoughts on the Nature of Mass Movements by Eric Hoffer. CSInvesting seconds this recommendation.

Review:

The book provides a concise and astute portrait of the personality type that is drawn to authoritarian institutions, whether political or religious. Hoffer makes an excellent case that the mass movements – the fascists, the communists, and the various brands of religious fundamentalists, that have caused so much death, suffering, and chaos throughout history in their attempts to impose their values and belief systems on others, have all depended on people of basically similar character to fill their ranks.

The true believer, as Hoffer portrays him/her, is someone who yearns for certainty and fears ambiguity; who sees the world in dualistic terms, black and white with no gray areas; who prefers to simply follow orders, letting others make the hard ethical decisions; who revels in belonging to an exclusive group and looking down on outsiders, particularly if they belong to a group the leaders have chosen as scapegoats.

Every voter should read this book and then look at the world today – the politics of fear and division, the growth of fundamentalist religion, the strident bigots on talk radio and TV – and then start working to reduce the danger they all pose to the freedoms in our Constitution, to the separation of church and state, and to our standing in the world.

— Back to Mr. Rosenberg…………

There is no discussion about investing in the book, but in my opinion, it is extremely helpful in understanding markets. It conveys the nature of human behavior in mass–how people act as a group. One of his great examples is explaining why people riot. There is no reason and no logic. People just get caught up in it. Riots don’t end all at once, they end person-by-person—that is markets. People panic in a group, but they come back to their sense one by one. That is why stock move incrementally the way the do.

CSIMA (Columbia Student Investment Management Association): How should they think about investment and time horizon?

JR: Young people today in business are much more macro-oriented than micro-oriented. They spend much more time on what is going on in Europe or Federal Reserve policies. They don’t focus much on company specifics. Even when they do they have a very low level of confidence in what they are doing. It’s very unfortunate. I hate that they don’t teach financial history in business schools. If it was up to me, I would make financial history and all history a number one requirement for business schools. Understanding how a spreadsheet works can be learned on the job easily but understanding the continuum of history requires certain intellect. I cannot for the life of me under-stand why business schools are not teaching financial history.

My advice to young people, if they really want to be successful in this business, is to learn financial history. Learn history in general and then dig deeper into financial history and you will not be in such awe of everything that’s going on. I see the same problem in my office. People just don’t know any financial history and they think that everything that is happening is unusual. Everything else can be learned on the job.

—

The Course on The Economics of the Great Depression

In this five-lecture course, Dr. Robert Murphy reviews the causes of the Great Depression, the response of the Hoover administration, and the New Deal. The focus is more on economic analysis rather than historical narratives, contrasting the Keynesian interpretation of various events versus the Austrian explanation in particular. Topics include the operation of the gold standard and the allegation that it inhibited policymakers from implementing the “stimulus,” Herbert Hoover’s supposed austerity program, the Friedman-Schwartz theory that the Fed’s unwillingness to inflate led to the severe downturn in the early 1930s, recent academic research showing the cartelization effects of the New Deal, and the myth of wartime prosperity. Dr. Murphy’s book, The Politically Incorrect Guide to the Great Depression and the New Deal, would be very helpful for students, but it is not required for the course. All necessary reading materials are provided.

Sign up for free: https://mises.org/mises-academy/economics-great-depression

How to Get Rich

Posted in Free Courses, History

Tagged Depression, History, Joe Rosenberg, Loews, mises.org, Robert Mourphy, Robert Murphy

Better than a MBA/CFA–A PhD in Financial History by James Grant

A Fantastic Offer

From: CSInvesting: I have no affiliation with Grants Publication whatsoever, but I am a fan of his work. I post this because if you want access to an incredible library of the past 35 years of financial history, then this is your chance. If you pay $349, ignoring the book and the six future issues, you have access to two issues per month from the past 35 years or about 840 issues at 42 cents per issue. Besides financial data, there are excellent case studies of valuation and financial euphoria/despair.

If you read through those issues (Of course, skimming over articles that don’t interest you.), then you would have the equivalent of an MBA/CFA/PhD in financial history plus a vast course in valuation on certain companies, bonds, and real estate in real-time over more than a third of a century. THIS IS A DEAL! See the offer below

Grant’s versus…

Dear Almost Daily Grant’s reader,

The new edition of Grant’s Interest Rate Observer features a hard look at a zooming stock. The company behind the stock is widely appraised as one of the century’s greatest. Grant’s begs to disagree with that consensus view, as is our wont. Who or what might bring this shooting star down to earth?

Subscribers are also reading about. . .

–the newly crowned holder of the dubious title of America’s most indebted nonfinancial corporation. Would you buy these bonds? Your insurance company probably is.

–one of the few North American industries where value–and bearishness–abounds.

–a pair of struggling foreign debt collectors who may soon be getting a taste of their own bitter corporate medicine.

–a certain Asian behemoth which has managed to spawn a money supply nearly as large as that of America and the eurozone combined.

All this, plus an inspiring Fourth of July quotation by Thomas Jefferson, awaits you.

Sign up today for a trial subscription: six issues, access to the 35-year Grant’s archive and a signed copy of Jim Grant’s latest book, “The Forgotten Depression: 1921, The Crash That Cured Itself,” winner of the 2015 Hayek Prize, all for just $349 ($359 outside U.S. and Canada).

Click Here to begin a six-issue Trial Subscription to GRANT’S. This offer ends MONDAY, July 2, 2018.

– Philip Grant

Cliché Battle

Joel Greenblatt on Valuing Stocks; Is College Worth It?

The Value of College Goldman report (Click)

Alternatives to College

—

Joel Greenblatt on Valuing Stocks

Posted in Free Courses, Valuation Techniques

Tilson/Tongue Hedge Fund Boot Camp

FREE CLASS in New York City

Whitney Tilson through www.kaselearning.com will be teaching value investing and hedge fund entrepreneurship to the next generation of investors. His programs are aimed at experienced investors and are very hands-on, so they aren’t cheap ($1,500-$2,000/day), but for beginners, he is offering a free two-hour seminar, An Introduction to Value Investing, in midtown NYC (57th and 7th) on Wed., April 4th from 5:30-7:30pm, followed by a cocktail hour. If you’d like to come, just email wtilson@kaselearning.com and Whitney will send you details.

Investing and Hedge Fund/Entrepreneurship “Boot Camp” And other Courses.

I attended Whitney Tilson’s and Glenn Tongue’s February 6th – 8th Boot Camp. I was initially skeptical but pleasantly surprised.

Overall, I was impressed with the learning materials, the organization, and most importantly, the participants who attended. Whitney and Glenn were brutally honest and forthright in showing the rise and fall of their business. One can know the lessons of Munger, Buffett, Graham, and behavioral finance but still fall into a pit. Our main enemy is likely to be ourselves. There were many lessons taught, but my promise of confidentiality prevents me from giving details. The course would not be appropriate for a rank beginner, but for an entrepreneur who wishes to launch their own fund.

The main value–besides the lessons taught–would be to cultivate relationships with the participants including Whitney and Glenn. I wouldn’t go to Whitney to help you get a job, but if you do a rigorous analysis of a company, I am sure Whitney or Glenn could give you honest feedback. And if they liked your work, they might suggest how you could reach a larger audience. Also, your classmates could help. The opportunity to build strong relationships with knowledgeable investors and hedge fund managers would be invaluable for someone beginning their fund.

Each day was ten hours long with meals and cocktails afterwards, so you had plenty of opportunity to develop relationships.

60% of the course was how to improve as an investor, 20% life lessons, and 20% how to build your hedge fund.

See details here:

Upcoming dates are April 29th to May 1st

and June 12th through 14th.

There are other courses available as well.

Make sure you receive at least a 10% discount on the course or other courses by using “CSI10“ when you register.

If you want details on my experience of the course and what you might expect, please don’t hesitate to email me at aldridge56@aol.com with BOOT CAMP in the subject line. I will be happy to discuss with you.

Here are my notes of the comments from the other attendees:

“Regarding last week, I was super impressed by the material. I liked the practical nature of the lessons they taught – a lot of courses exist that cover investing philosophy, but this was unique in its applicability to a start-up manager like myself.”

“The main lesson I learned from the course was to keep it simple. Look for the easy investments.”

“I actually really liked the emphasis on short selling, because it tends to be one of the great struggles of hedge funds that need to be long & short to justify the carry but have difficulty executing on compelling short ideas in the midst of a bull market.”

“I would have liked more on portfolio construction because that is what I am struggling with. Ditto for risk management and small funds. Things I loved – the interaction of our group, the LL case, the mea culpas of what Whitney and Glenn did right and wrong.”

All the participants told me that they both enjoyed the boot camp and found it useful in developing their fund.

Future Boot Camps

Whitney solicited feedback each day, therefore, Whitney and Glenn should improve their course offerings.

I give a thumbs-up. To learn more about the boot camp/Kase Learning programs you can go to www.kaselearning.com.

Also, view a video

Update:

I will periodically update information on Kase Capital for interested readers. If you learn anything from reading this post it should be to KNOW THYSELF! The market is an expensive place to find out. John Chew

The hedge fund founder explains why his fund was “sucking the joy” out of his life — and why he’s turning its failure into a teachable moment.

By Michelle Celarier

March 20, 2018

Whitney Tilson’s Facebook friends surely thought he was on top of the world last summer.Photo after photo posted on the social media site tells the story of a rich, exciting life: There’s Tilson watching whales off the coast of Iceland. Next, he’s on the canals of Amsterdam with his wife and daughter. Just a few days later, he’s checking out Lenin’s tomb in Moscow. Last August he even climbed to the top of the famed Eiger mountain in the Swiss Bernese Alps, photographing every step of the arduous journey.

But to hear Tilson talk today, the reality was grim. After 18 years in the hedge fund business, his firm — Kase Capital Management — was losing money, and Tilson found himself dipping into hissavings to keep it afloat.

“I had lost my passion for the game,” Tilson confided in a two-hour, soul-searching interview about the events that led him to shut down his hedge fund last September. After gaining 184 percent, net — when the broader market was up only 3 percent — during the first 11 and a half years of his hedge fund’s existence, Tilson’s returns had been floundering. Since 2010, Tilson says, he trailed the Standard & Poor’s 500 stock index, and in 2017 he had lost almost 9 percent on the year by the time he shut down his fund. “In an ironic twist, I always built my firm to survive the worst storm, but it was a nine year bull market — complacency and sunshine — that took me out.”

Tilson is one of several veteran hedge fund managers, including Eton Park Capital Management’s Eric Mindich, Hutchin Hill Capital’s Neil Chriss, Eclectica Asset Management’s Hugh Hendry, and Blue Ridge Capital’s John Griffin, who called it quits in 2017. Small hedge funds come and go with great regularity, but the inability of the industry’s stars to profit as the stock market soared to new heights has raised questions about the viability of the model. Tilson was a much smaller player than the others — at his peak he managed only $200 million — but his experiences are a window into the headwinds that have faced these former masters of the universe.

What distinguishes Tilson from many of his peers is his willingness to talk about the long, excruciating road down. “It’s hard, after seven years at sucking at something, to wake up and tap-dance to work. So, I found myself getting distracted. I wasn’t physically getting out of shape; it was the opposite. I was going and climbing mountains. This one part of my life, I was miserable at; I was having no success. It’s hard to have the self-discipline to focus all your attention like a laser, and all your spare time on a particular part of your life in which you’re getting so much negative reinforcement.”

Last year, as his fund’s losses began to mount, Tilson says, “I didn’t feel like I could look my investors in the eye and say, “˜Look, I’m losing you money, but I’m not doing anything else, 18 hours a day that I’m awake, the only thing I am doing is trying to turn performance around.’ ” The vacation photos notwithstanding, Tilson says he even felt guilty attending his daughter’s soccer games. “My hedge fund was sucking all the joy out of my life.”

Tilson’s introspection is uncommon for those in the hedge fund business, where selfconfidence and salesmanship are as important to success as any investing prowess. As Tilson readily admits, managers cannot afford to be frank while they are going through turmoil, lest they further hurt their business — and their investors. “The last thing you want to do is air your dirty laundry. That will further shake the confidence of your investors.”

But there’s another reason for Tilson’s uncommon openness: His experiences, both positive and negative, have led him to create a whole new business, turning Kase Capital into Kase Learning (Kase stands for the first letters of the names of Tilson’s wife and three daughters). From a small conference room at the New York Athletic Club, Tilson has started teaching the perils and profits of investing in general — and running a hedge fund specifically — to aspiring youngsters who don’t come out of big seeding platforms like Julian Robertson’s Tiger Management or a multibillion-dollar hedge fund.

“Unless you are the lucky 1 percent who has the chance of learning in an apprenticeship, how are you supposed to learn how to do this?” Tilson says. “Nobody teaches the next generation. There is not one business school on the planet that teaches anything really usable to starting up your own hedge fund.

“It’s so rare to talk to a manager who is injected with truth serum, isn’t it?” he asks as he details his long bumpy journey through hedge fund land. “But I don’t give a crap anymore.”

Posted in Free Courses

Tagged Boot Camp, Hedge Funds, Investing, Tilson, Tongue, valuation

CFA Seminar on Financial History; Bubble Studies; Advanced Study in Human Action

Seminar of Financial History

In an age when an algorithm is the main competitor for many fund managers, what can we know that they don’t? Algos understand the data trail of history, but this trail provides only limited insight into the key lessons of financial history for investors. In this talk, first provided at the 62nd Annual CFA Institute Financial Analysts Seminar, Russell Napier discusses those 21 most important lessons from financial history that allow human beings to profit at the expense of the machines. 1 Hour on-line seminar Feb. 1, 2018. Register (CSInvesting.org: I believe it is free: https://www.cfainstitute.org/learning/events/Pages/02012018_138012.aspx

Regardless of whether you can attend, read relentlessly about financial, economic, and common history. Note what Jim Grant of Grant’s Interest Rate Observer says:

But our main goal is to tell you the next important event in the markets. And sometimes we succeed.

– As with the tech bubble in 1999

– The 2008 mortgage crash

– The 2009 recovery in financials

– And the 2012-13 rise in house pricesHow have we been so prescient over the years?

We don’t have fancy, financial computer models or a team of MBAs and Ph.D.’s to help us make these predictions. And we don’t have access to any kind of special information.But we have been immersed in the markets for over 30 years. And we’ve studied the financial history of the past 200 years. None of which guarantees clairvoyance—nothing does. What we do claim is the capacity to see the present in the context of the helpful lessons of the past.

Like when we warned about the mortgage debt bubble in September 2006.

From the Sept. 8, 2006 Grant’s:

“Overvalued,” we, in fact, judge trillions of dollars of asset-backed securities and collateralized debt obligations to be, and we are bearish on them. Housing-related stocks may or may not be prospectively cheap; they at least look historically cheap. But housing-related debt is cheap by no standard of value. For institutional investors equipped to deal in credit default swaps, there’s an opportunity to lay down a low-cost bearish bet.

Bubble Studies

368353935-GMOMeltUp J. Grantham says that the current market does not YET show the characteristics of a bubble despite being highly valued.

Referenced study in the article: Bubbles for Fama 2017 and gmo-quarterly-letter

and more of interest: faang-schmaang-don-t-blame-the-over-valuation-of-the-s-p-solely-on-information-technology

Update (1/10/2018) Runaway Train – Dec 2018

—

Advanced Seminar in Human Action

12/06/2017 Mises Institute

Arguably one of the greatest thinkers of the twentieth century, Ludwig von Mises created a framework for all of economic science beginning with the simple axiom that individuals act. In his magnum opus, Human Action, he described economics as a branch of the theory of human action and stressed how broadly it spans, far beyond a discussion of mere money and prices. Mises said, “Economics must not be relegated to classrooms and statistical offices and must not be left to esoteric circles. It is the philosophy of human life and action and concerns everybody and everything. It is the pith of civilization and of man’s human existence.” For Mises, it was imperative that everyone learns economics, calling it “the main and proper study of every citizen.”

Human Action is a challenging read. With over 800 pages of dense material, study tools are very helpful. The course, Advanced Seminar in Human Action, is a useful addition to other materials like the Human Action Study Guide.

In this course, leading Austrian economists walk the student through Human Action a chapter at a time.

If you’ve ever wanted a push to help you get through the book or if you’ve wondered about your own reading of the material, here is your opportunity to study Human Action with David Gordon, Joe Salerno, Jeffery Herbener, Peter Klein, Guido Hülsmann, and Mark Thornton.

Human Action by Ludwig von Mises is available for free on Mises.org and for purchase as a paperback and hardcover in the Mises Bookstore.

Register: https://mises.org/library/advanced-seminar-human-action

The teachers are excellent and Human Action is the Magnum Opus of Ludwig von Mises. The book is a DIFFICULT read but there is a study guide, lecture videos, and lecture slides for all the chapters of the book. You will have a strong grounding in economics and improve your reading and critical thinking skills, but if you are a beginner, I would opt for https://www.mises.org/library/economics-one-lesson

Posted in Free Courses, History, Investing Gurus

Tagged Bubbles, Financial History, Free Course, Human Action