The budget should be balanced, the treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed lest Rome become bankrupt.

The budget should be balanced, the treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed lest Rome become bankrupt.

– Cicero, 55 B.C.

As expected, investors who either did not know what they were doing or refuse to acknowledge that they paid too much, seek to absolve themselves of responsibility and blame others: http://www.nypost.com/p/news/business/facebook_claims_

Facebook CEO knew about overpriced IPO and dumped shares, new lawsuit claims

Mark Zuckerberg is losing even more friends.

Another group of disgruntled Facebook investors has reportedly sued the the social media guru, saying he made out like a bandit over the site’s botched IPO.

This latest class-action lawsuit claims Zuckerberg knew Facebook was horribly overpriced at $38 per share when trading began last month, TMZ reported today. He used that inside information to quickly unload shares, in a dirty billion-dollar move, the lawsuit claimed. FB closed at $27.72 a share and was down 27 percent since going public this past Friday.

Editor: Surprise! Insiders were selling on an IPO. Of course, they believe the price is high enough to exchange shares for cash. Investors who do not shoulder their responsibility then lessons are lost and they can’t improve.

Valuation of Facebook’s Growth

Tweedy Browne did a good job placing Facebook’s (FB) valuation in perspective. Go to i-7 of their annual report: TBFundsAnnualReportMarch2012 and an interview of Tweedy’s principals:VIIFundReprint_033112

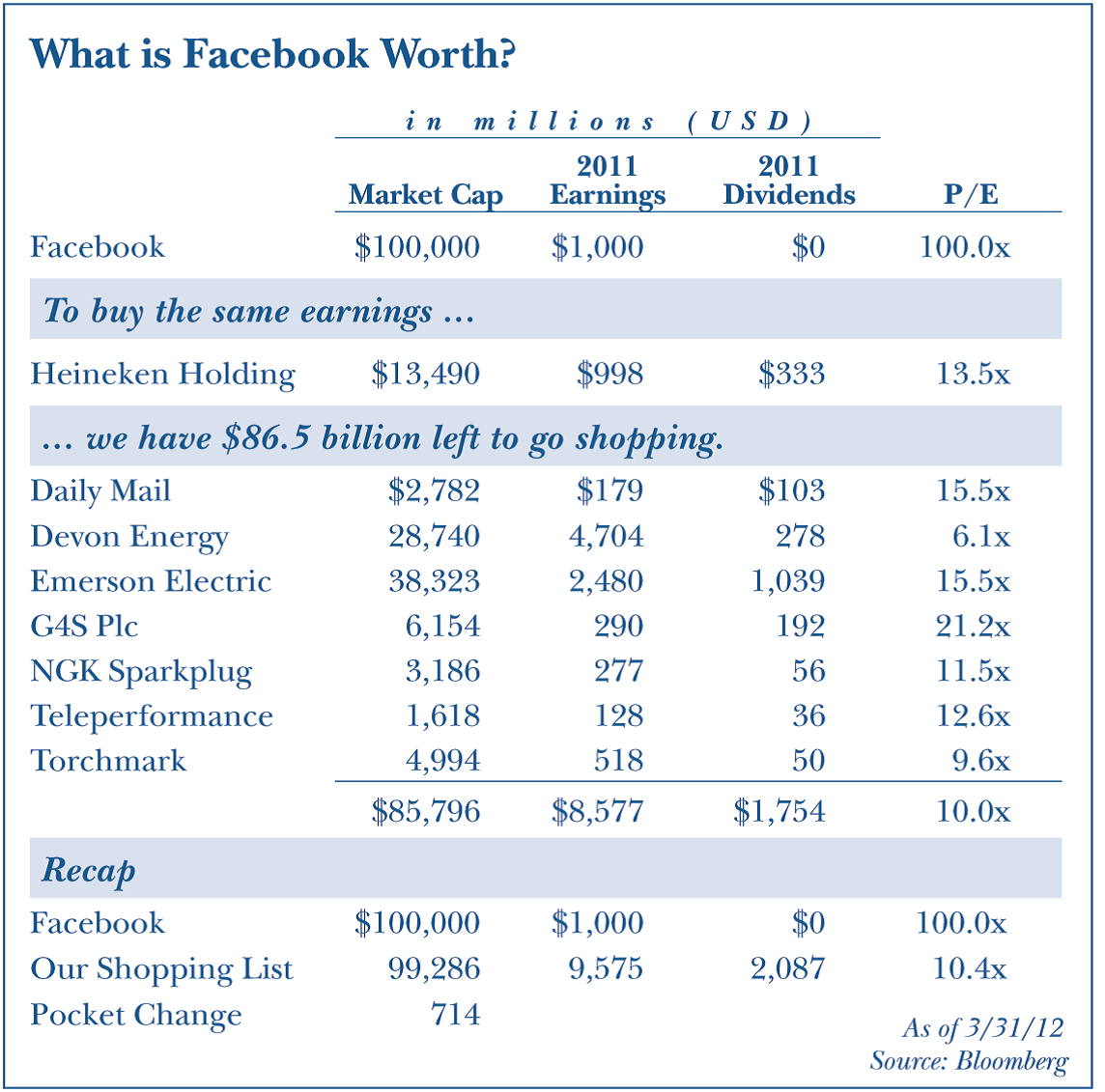

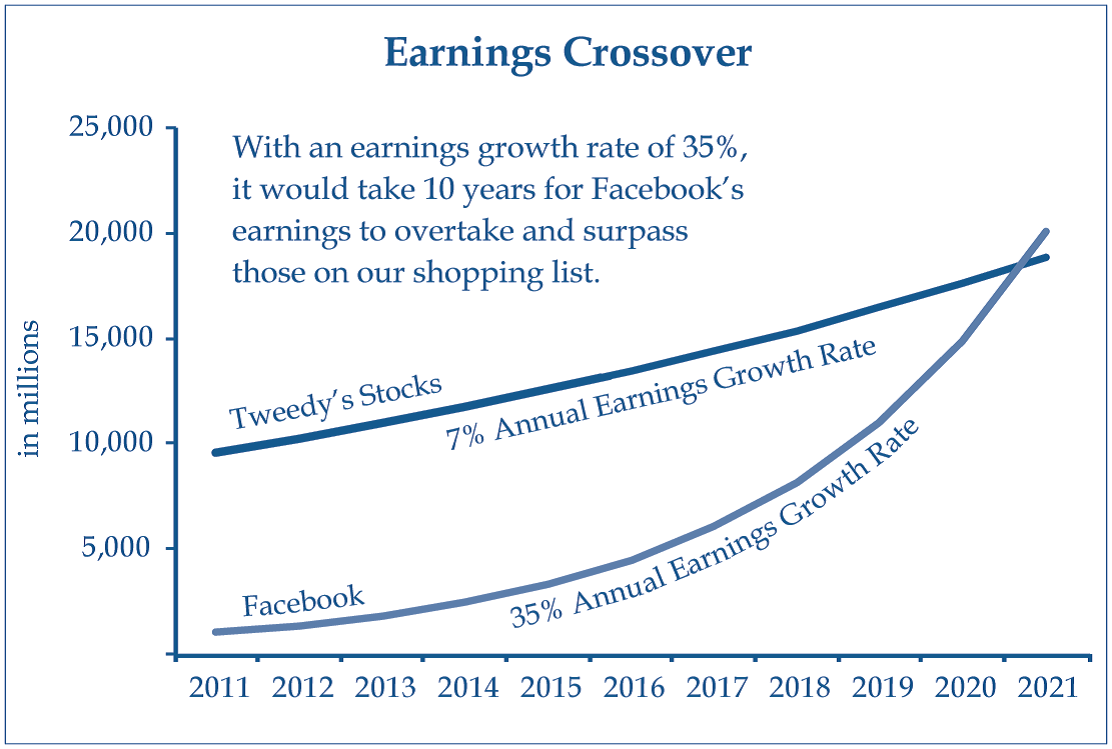

As you can see in the above chart, you could buy roughly the same amount of earnings that Facebook produced in 2011 by simply buying Heineken Holdings for $13.5 billion, and you would then have $86.5 billion left over to go shopping for other companies in our Funds’ portfolios. For the remaining $86.5 billion, you could buy Emerson Electric, Devon Energy, G4S PLC, Torchmark, NGK Sparkplug, Daily Mail, and Teleperformance, and still have roughly $700 million in walking around money. When all is said and done, for Facebook’s IPO price, you could purchase the above group of leading companies in their respective fields at a price/earnings ratio of 10.4 times estimated earnings. As a group, these companies produced nearly ten times the earnings of Facebook in 2011, and paid dividends of over $2 billion. According to our calculations, Facebook would have to compound its current earnings at an annual rate of approximately 35% over the next ten years to catch up to the amount of earnings produced by the selected companies held in the Tweedy, Browne Funds, which are compounding their earnings at a more realistic 7% per year.

Now, it might very well turn out that Facebook performs as expected and compounds at even more attractive rates, producing superior returns when compared to the stocks selected above from the Tweedy, Browne Funds’ portfolios, but the stakes are high given the lofty IPO price. Very high expectations are built into stocks that trade at 100 times earnings. If it disappoints, the results for its investors could be disastrous.

Lest we forget, just six years ago, media and tech savvy News Corp., run by Rupert Murdoch, a rather shrewd investor, acquired MySpace, then the most popular social networking site in the US for $580 million, which valued the company at over 100 times earnings. Last summer, after a string of disappointments and corporate losses, News Corp. sold MySpace for $35 million to a company fronted by Justin Timberlake. At the time of the sale, MySpace had approximately 35 million users, which meant a purchase price of roughly $1 per user. Applying that metric to Facebook would give it a valuation of approximately $1 billion instead of the $100 billion, which is anticipated for the red hot IPO. News Corp. experienced a permanent loss of capital on its MySpace investment of 94%. From all indications, few expect Facebook to be such a flash in the pan. After all, it’s hard to question its efficacy at bringing people together, and in some instances it has even been a catalyst for political revolutions such as the Arab Spring. That said, expectations are extraordinary, and anything less than spectacular growth going forward could lead to disappointing stock market performance.

For us, Facebook serves as a convenient reminder that stock market prices can and do at times become significantly delinked from underlying value.

4 responses to “One More Time on Facebook Investor Psychology and Valuation”